The forgiveness portal of the Paycheck Protection Program has debuted, leaving bankers and their lenders a big decision.

Those who have participated in the $ 659 billion program must determine if they are currently ready to navigate the complex system of lending, or if it makes sense to wait and see if Congress intervenes in the process and simplifies. That decision was complicated over the weekend when talks about a new round of incentives collapsed, and doubts about when – or when – PPP will get an overview.

A number of banks, including JPMorgan Chase, the largest participant in the program with $ 29.2 billion in PPP origins, plan to discontinue processing applications. The $ 3.2 trillion asset banking giant will begin the forgiveness process next month, said Kimberly Hooks, vice president at Chase Business Banking.

JPMorgan Chase supports pressure for automatic forgiveness “because it would help thousands of small business owners get back on their feet,” Hooks added.

Holtmeyer & Monson in Memphis, Tenn., Takes a similar wait-and-see approach with the 12,000 PPP loans it serves to 450 banks.

“We were hoping to start active applications today, but we decided to quit,” said Arne Monson, the company’s president and co-founder. ‘We hope that as hell we automatically get forgiveness for loans of $ 150,000 and less, and maybe a streamline [process] for those up to $ 2 million. ”

An SBA spokeswoman confirmed Monday that the agency’s platform began accepting forgiveness applications on schedule, although it did not provide statistics on the opening’s activities.

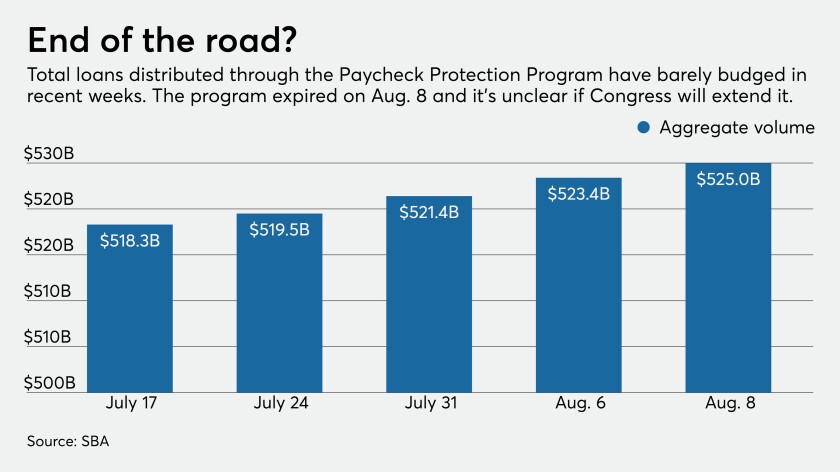

The SBA stopped accepting applications for new Paycheck Protection loans on Saturday, after Congress failed to extend the program’s governing authority. Legislators are considering a number of proposals for a revitalized PPP, including increased funding and letting the hardest hit small businesses get a second loan.

The willingness of lenders to procrastinate, even if it means delaying billions of dollars in lending, comes as a bit of a surprise to many sector observers.

The SBA approved about 5.2 million PPP loans for more than $ 525 billion before closing the portal. The program offers low-interest loans to small businesses affected by the coronavirus pandemic. Funds spent on basic operating costs are eligible for forgiveness, making the program even more attractive to struggling entrepreneurs, but the process has been rocky, characterized by delays and unclear guidance.

The forgiveness process has been stressful for lenders and lenders.

The SBA did not release a forgiveness application until mid-May, almost six weeks after it began approving loans. One month later, after criticism that the original 11-page application was too long and complex, the agency released a streamlined form for self-employed lenders and those who did not reduce employee pay by more than 25%.

Prior to July 23, when the news of the forgiveness platform was published, the SBA had never indicated where lenders could submit their applications.

Confidence in the process prompted groups of bankers to lobby for blankets as automatic forgiveness for smaller loans. Lawmakers are considering various bills on this.

At the same time, a growing number of lenders have chosen to circumvent the problem by selling their PPP portfolios.

Others, such as Holtmeyer & Monson and the $ 19.8 billion asset Atlantic Union Bankshares in Richmond, Va., Have chosen to outsource the forgiveness process in large part. Monson said his firm turned to a team of certified public accountants in Boston for help answering clients’ questions; the contract with Summit Technology Consulting Group in Mechanicsburg, Pa., to package applications for submission.

The scheme “offers our customers a Cadillac solution,” Monson said.

Not every bank waits for Congress to act on forgiveness.

The $ Choice billion-dollar asset First Choice Bancorp in San Diego opened its online lender forgiveness portal on July 2 and plans to start uploading applications to SBA “in the near future,” said Lorraine Lee, its chief strategy officer.

First Choice, which approved nearly 1,900 loans totaling $ 400 million, has “submitted applications for forgiveness immediately,” added President and CEO Robert Franko. “We want to provide peace of mind to our clients who are ready to submit their information.”

For another community bank, the $ 1.7 billion asset Greene County Bancorp in Catskill, NY, there are no one-size-fits-all forgiveness solutions. The company is ready to share the difference between submitting and retaining its Paycheck Protection loans.

Greene County, which made more than 1,260 PPP loans for $ 100 million, believes many of those deals are immediately ready for forgiveness. In some cases, however, “it may make more sense for some of our customers to wait for further announcements,” said Sean DuBois, vice president of commercial lending and business development.

.