(Bloomberg) – Wells Fargo & Co. plans to cut its dividends, breaking with all of Wall Street’s largest banks, after the Federal Reserve imposed new payment restrictions last week.

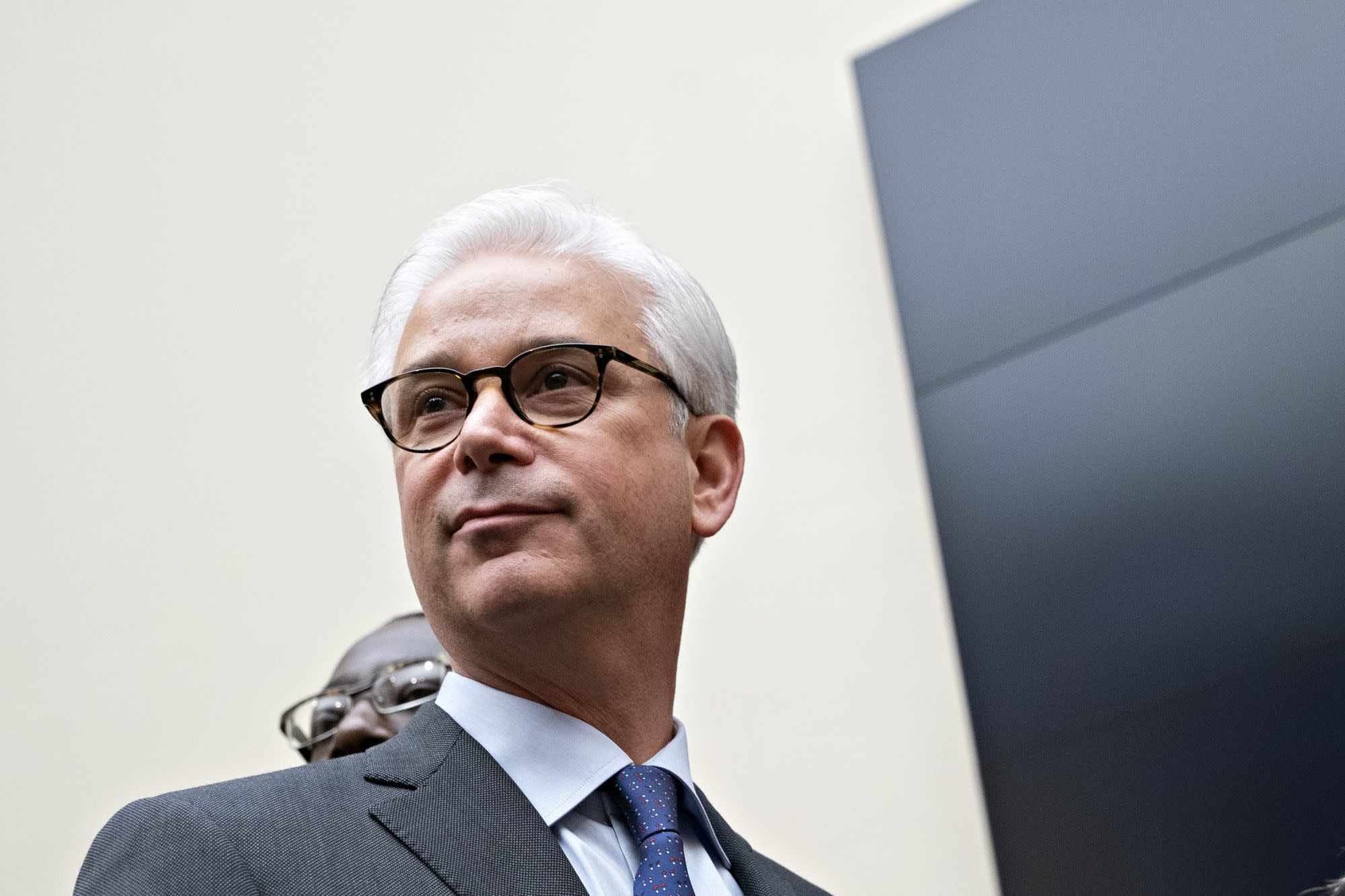

“There remains a great deal of uncertainty on the road to economic recovery, and while the ultimate impact on our credit portfolio is difficult to accurately predict, our economic assumptions have changed significantly since the last quarter,” Chief Executive Charlie Scharf said Monday. it’s a statement.

JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc. and Morgan Stanley left their third-quarter payments unchanged, according to statements from those banks.

A reduction was widely expected from Wells Fargo after the Fed said it would restrict payments using a profit-based formula, which has sunk at the San Francisco-based bank in recent quarters, in part due to legal costs linked to multiple scandals. The bank has spent nearly four years struggling to get out of the missteps, which started with the 2016 revelation that employees opened millions of potentially fake accounts to meet sales targets.

Wells Fargo said it would announce by July 14 how far the current 51-cent payment would drop. It is expected to drop to 20 cents, according to an analysis by the Bloomberg’s Dividend Forecast team.

Wells Fargo shares fell nearly 1% to $ 25.45 in extended trading in New York at 5:29 pm. They are down 52% this year.

By publishing the results of its annual industry stress test last week, the Fed capped dividends on the 33 largest banks at current levels. The central bank said it could carry out another review using a more severe economic scenario later this year, limiting the companies’ ability to assess dividend prospects for the rest of the year.

Coronavirus impact

The Fed added a new “sensitivity analysis” to its review that sought to capture how well companies are prepared to handle the financial pressure caused by the Covid-19 pandemic. Those results were released only in aggregate, showing how all banks that are testing in more severe scenarios would fare.

Policymakers considered three potential scenarios: a fast V-shaped recovery, a slower U-shaped bounce, and a worst case W-shaped bounce, a second wave of coronavirus containment measures. In that review, the industry’s capital levels are expected to drop 4.3 percentage points.

The Fed has also told companies that they cannot resume buybacks, which were suspended in March to preserve capital as the pandemic spread. While the industry did well in the central bank’s annual review, the new limits were intended to restrict the distribution of capital at a time when the economic recovery seems uncertain.

Goldman Sachs was one of the hardest hit in the hypothetical economic scenario of the stress test, leading some analysts to predict that it may have to reduce its balance sheet in the third quarter to continue paying dividends at the current level.

The firm said Monday that it was confident it could raise its capital level to the new central bank requirements. Goldman Sachs said it has already brought its Tier 1 Common Equity Index to 13% in the second quarter, up from 12.3% in the previous three months. Under the new stress capital buffer set by the Fed, it has to be 13.7% by the end of the third quarter.

Capital One Financial Corp., another lender that some analysts predicted would cut its dividend, did not mention the payment in a statement on Monday about stress tests. Credit Suisse Group AG analyst Moshe Orenbuch said that likely meant the company could continue to pay at the current level.

(Updates with actions in the sixth paragraph, Goldman’s comment from the eleventh paragraph).

For more items like this, visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2020 Bloomberg LP