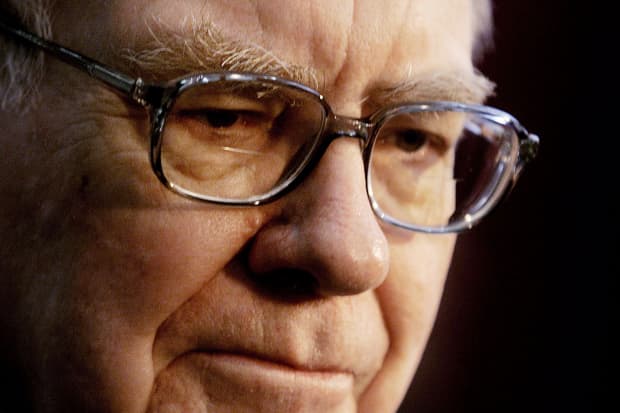

Wern Run Buffett of Berkshire Hathaway

Getty Images

Omaha, Nab. – Warren Buffett’s organization reported a 3% increase in its third-quarter profit as the value of its investment portfolio increased, but Berkshire Hathaway said the coronavirus epidemic damaged a variety of businesses, such as the BNSF railroad.

Berkshire BRKB,

BRKA,

It said on Saturday it had earned .1 30.1 billion or A 18,994 per Class A share during the quarter. That’s up from વર્ગ 16.5 billion or 10 10,119 a year ago. Most of the gains were due to a 24 24.8 billion improvement in the estimated value of Berkshire’s investment, including a large stake in Apple Pay and Bank of America.

Buffett has maintained that Berkshire’s operating operating earnings give excellent quarterly performance as they exclude investments and derivatives, which can change widely. As a result, Berkshire’s operating earnings fell 32% to 49 5.49 billion, or 3, 45,452.45 per Class A share. That’s down from 7 8.07 billion a year ago, or એ 4,943.04 per share.

Four analysts surveyed by Factset expect Berkshire to report operating earnings of 3, 3,587.63 per Class A.

Berkshire said its revenue fell%% to 0 0.02 billion in the quarter. Jim Shanah, an analyst at Edward Jones, said it was impressive to see Berkshire’s earnings close to last year’s levels, given all the challenges facing the economy as a whole.

“I think a lot of you, if any, will struggle to find companies that report only marginal declines in revenue,” Shanah said.

The BNSF said profits fell 8% to 35 1.35 billion, as profits on railroads fell 8% to 1. 1.35 billion as coronavirus fare traffic continued to slow. Berkshire said the railways delivered 8% lower fares during the quarter, which is better than the second quarter, while the height of the virus-related business shutdown saw volumes fall 18%, but significantly lower than last year.

Berkshire’s utility unit was a bright spot in the report, with a profit of 1. 1.395 billion, up 18% from last year. The utilities were assisted in coming online through tax credits for wind energy and other renewable power projects.

Berkshire said its Precision Cast Parts Aircraft Parts Manufacturing Company continued to struggle with the impact of the epidemic on aviation as it cut its pretax earnings by 0%. The retailer, which retained 10 10 billion in the second quarter, said it would reduce its workforce by 40% by the end of the year.

Berkshire said it spent billion 9 billion to repurchase its own shares in the third quarter, nearly double the record double 5.1 billion it spent buying its own shares in the second quarter. But despite Berkshire’s quarterly repurchases and handful of investments, the company still has 5 145.7 billion in cash and short-term investments at the end of the third quarter.

Berkshire continued to hold large amounts of cash over the summer, despite buying about 2. 2.1 billion in shares of Bank of America and agreeing to pay billion 4 billion in Dominion Energy’s natural gas pipeline and storage business. Berkshire did not close on the first part of the Dominion deal until earlier this month.

Berkshire also said in August Gust that it has staked more than 5% on five major Japanese trading houses, but that investments of about billion 1 billion have been slower than last year, so it did not have a major impact on Berkshire’s cash. Third quarter.

Berkshire has more than 90 companies, including Geoco insurance and utilities, furniture, manufacturing and jewelry businesses. The Omaha, Nebraska-based group also has large investments in companies such as American Express, Moody’s and Coca-Cola.

.