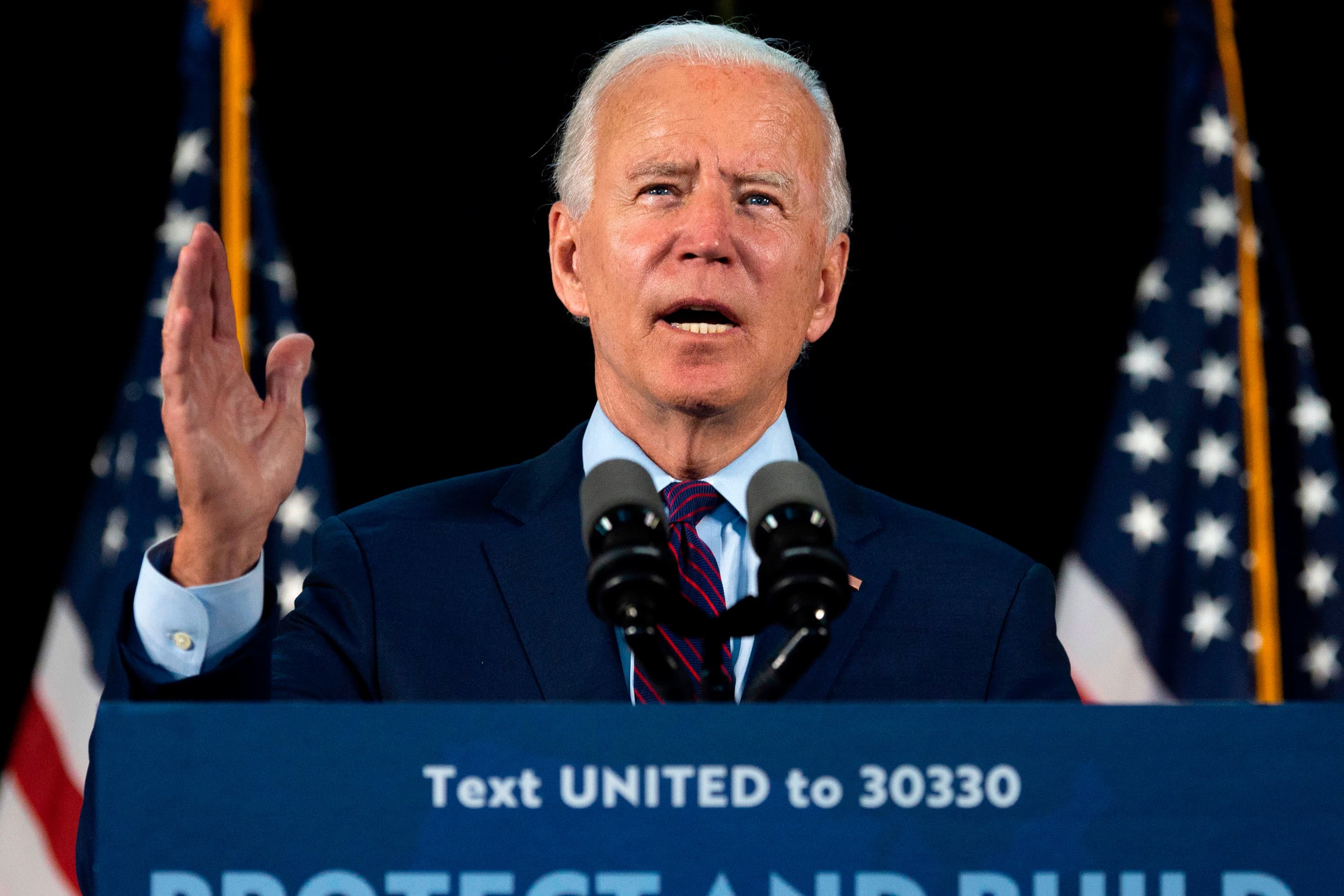

Democratic presidential candidate Joe Biden comments after meeting with Pennsylvania families who have benefited from the Affordable Care Act on June 25, 2020 in Lancaster, Pennsylvania.

Jim Watson | AFP | fake pictures

Finance executives are now preparing for Joe Biden to potentially win the presidency as Donald Trump slips into national and state polls.

Several current and former Wall Street financiers, analysts, lobbyists, lawyers and political advisers with bank clients spoke to CNBC about how the industry is preparing for a possible Biden victory. Some spoke on the record, others decided to discuss on condition of anonymity since they were not authorized to speak publicly on the matter.

Changes in tone and expectations, and, in some cases, preparing for a Biden presidency, represent a radical change for many executives who privately applauded Trump’s cuts in corporate and income taxes, along with his reversal of regulations. Many of them have traditionally projected more moderate inclinations in public settings.

Michael Novogratz, an investor and philanthropist, said he has noticed a change in many of his wealthy finance friends who were convinced that Trump would win because, at the time, the economy was buzzing and the market was constantly on the rise. Since the start of the coronavirus pandemic, millions of people in the United States have been forced to become unemployed, and the market, while recovering from its biggest losses, continues to change.

“Five months ago I had dinner with 10 of the best investors. I was the only one who thought Biden would win. Eight went to Trump, an indecisive and a follower of Biden,” Novogratz said Thursday. “I think if you were to poll that group today it would be a 50 to 50 or 60 to 40 division for Biden.”

Preparing for a Biden presidency ranges from private notices to wealthy clients and friends that their taxes will be up soon, to veteran executives speaking to people linked to Biden in hopes that they can gain access to the White House. Others are donating more to Biden’s campaign.

A Wall Street package with ties to former President Barack Obama and Democratic nominee Hillary Clinton recently noted an increase in calls that uncommitted financial executives answered to now give it to Biden. This person has also presented to donors that if they donate, they may have a better chance of seeing their philanthropic initiatives backed by a Biden administration.

Economic anxiety

A lobbyist told CNBC that he estimates that more than 50% of his Wall Street clients are convinced that Biden is going to beat Trump. A Republican political operative, whose clients include financial investment firms and large technology companies, said that in private meetings, financial executives begin to believe that Biden will outperform Trump. This operation also said they expect Biden not to increase corporate taxes until the economy stabilizes in the wake of Covid-19.

Jonathan Hartley, a former associate at Goldman Sachs, said higher taxes are a predominant concern on Wall Street.

“Taxes in all areas [are] definitely on top of [the] Mind given Biden’s improvements in the polls, “Hartley said.

Signum Global, a financial advisory firm led by former Evercore vice president Charles Myers, has told clients that Biden will not only win, but that the Senate will turn to Democrats. The group has also made clear that it believes taxes in most industries are increasing.

A corporate restructuring attorney, who represents a variety of Wall Street firms, says that in recent conversations with CEOs and leaders of various funds, they believe Biden will win, but Republicans will keep the Senate. The hope is, says this lawyer, that there will be support from the Republican Party to prevent Biden from adopting more left-wing economic policies.

Biden leads Trump by about 10 points in a really clear average of national polls. The former vice president has also opened tracks in changing states like Wisconsin, Pennsylvania, Florida and Michigan, all of which Trump won in 2016.

However, despite a historically catastrophic recession due to the coronavirus, Trump keeps polls on Biden in the economy. A recent Wall Street Journal / NBC News poll showed that 54% of independent voters said they trusted Trump to run the economy, but a plurality of 45% to 35% of independent respondents said they still plan to vote for Biden anyway. The June CNBC poll shows that Trump continues to be favored over Biden in managing the economy.

Biden has said it would raise the corporate tax rate to 28% from 21%, where it is now after Trump’s tax bill lowered the mid-level rate from 30%. Households earning more than $ 400,000 would also see tax increases. The nonpartisan Fiscal Policy Center has said that Biden’s fiscal plan would raise $ 4 trillion in revenue over the next decade.

Some market analysts have pointed out that the recent downturn in the markets could be due to Biden pushing Trump in the polls, possibly leaving investors uneasy about the future of the economy under a potential Biden presidency.

“Joe Biden would be a disaster for the economy and everyone knows it,” said Tim Murtaugh, spokesman for the Trump campaign. “Higher taxes and massive green New Deal regulations would kill any chance of an economic recovery from the coronavirus.”

Biden’s campaign did not respond to a request for comment.

Coronavirus concerns

Some on Wall Street are slowly shifting their bets to Biden, despite his financial successes under the Trump administration, it is the president’s handling of the coronavirus. Trump has come under scrutiny and fierce criticism from lawmakers and activists for being what they consider too slow to react to the pandemic or for not doing enough to help states.

Finance executives have been infuriated to see what they believe the United States is fighting to overcome the pandemic, while its political and business allies in Europe have been more successful in fighting the virus. Data cited by The Hill shows that there are now about 30,000 new cases per day in the United States, while in the European Union there are about 3,000 cases per day.

“It is an article of faith among Wall Streeter to know that the United States is structurally superior to Europe. Seeing ourselves outperforming at Covid-19 burns them,” said an analyst at an asset management company.

Robert Wolf, founder of 32 Advisors, a holding company that includes direct investment arm 32 Ventures, told CNBC that since the coronavirus began to spread across the United States, he has been sending emails to about 175 influencers, including CEOs and politicians, giving their opinion. about the pandemic, the markets, the elections and how he sees Biden standing above Trump.

Wolf is a former CEO of UBS Americas, formerly an adviser to Obama and a current supporter of Biden. He wrote to his email list just after Memorial Day that taxes would be raised under Biden, but he justified the idea because, as he says, fighting the coronavirus is the equivalent of how a government goes to war. Taxing the wealthy, then, is a necessary decision, according to Wolf.

“Everyone must do their part. Our medical professionals, front-line workers, first responders and business owners who were forced to close their stores have certainly done so,” Wolf said in an email titled “War and Taxes.” “We will need the wealthy and high-income to do their part financially, as they have done after previous wars,” the email said.

Money flowing from Wall Street to Biden

The growing confidence in Biden within the industry follows what has been a strong 2020 fundraising election cycle for the Democrat. Money is flowing into his campaign and other efforts from all corners of the business community, including Wall Street financiers.

In May, Biden’s campaign combined with the Democratic National Committee to outrage Trump and the Republican National Committee. Biden and the DNC finished raising $ 80 million, while Trump and the RNC raised $ 74 million.

Biden and groups that support him are outperforming Trump from donors in the securities and investment industry, according to the Nonpartisan Center for Responsive Policy. [CRP]. This is not necessarily a sign that Biden will win. While Obama raised more from the securities industry than his rival, John McCain, in 2008, Mitt Romney in 2012, and Clinton in 2016, they enjoyed similar advantages in their losing campaigns.

The data, which includes all contributions verified through April, shows that Biden and the external committees that support him have raised $ 29 million through those who work at finance companies. Meanwhile, Trump and his outside support organizations have contributed $ 7 million.

Pro-Biden’s financial executives include some at Bain Capital, a company founded by Romney and specialized in private equity, venture capital, and other businesses. In 2016, 17% of that company’s contributions went to Republican candidates for Congress, according to CRP data. This cycle so far, only 4% has gone to the Republican Party.

That strength Biden has with small and big money donors will probably pay even more in June. People familiar with his efforts say the former vice president and the DNC could combine to raise $ 100 million by the end of the month.

.