While Disney + (DIS) and Netflix (NFLX) are getting more of the splash because of their size, ViacomCBS (VIAC, VIACA) is quietly and consistently transforming into a strong company and competitor. With its # 1 ranked demographic content for all demographics, this content producer / provider is making money on its stand-alone services, as well as leveraging its capabilities by delivering content to Netflix, Amazon (AMZN), Comcast / NBCUniversal (CMCSA), and other companies.

Q2 Earnings Recap

Earnings results from Q2 in 2020 were very good, surprisingly the most in the market. Golf, boxing, EUFA and some unwritten shows have returned to TV, while production of expensive shows is likely to continue to increase virus effects – saving for a quarter. The big news, however, is that the majority of profits came from adding subscribers and selling ads.

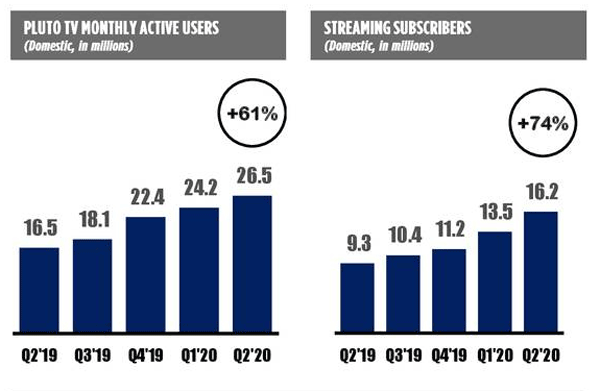

Q2 of 2020 saw a 61% Year over Year increase, and 9% Quarter over Quarter increase, in PlutoTV (the free service) active users. Subscribers streaming on CBS All Access and Showtime (the payment services) show an even better increase of 74% YOY with in 20% QOQ. This led to an increase in digital video / streaming revenue of roughly 25% YOY and paid streaming increase of 52% YOY!

(Source: Income Presentation Slides)

Although technical Q2 revenues of $ 6,275B were 12% YOY down, due to mostly lacking theatrical releases and ad losses due to COVID19, FCF was up 275% YOY based on savings, likely from lower out of production spending and lower debt. The ad losses are likely to be rebound again already, as several other companies are talking about seeing more recent increases.

During the quarter, ViacomCBS announced an expanded distribution deal with YouTube (GOOG, GOOGL), as well as relationship agreements with Cox Media and Sinclair Broadcast Group, including terms that increased profit margins and reach. While some people wonder why they would rent content to others, this adds to current revenue, and remains a long-term control at ViacomCBS, giving them more money to continue producing hit movies and shows. Although a much smaller competitor to Disney and Netlix, ViacomCBS has the flexibility to produce content with the big boys based on their pre-COVID expectations to spend $ 16B on content.

Growth and value

Netflix is the only major streaming service that operates as a stand-alone company and is valued at $ 220B (give or take brand conversions) with an EPS of $ 6.15 per $ 500 + dollar share. Netflix also has an advanced PE of 81+. ViacomCBS has a smaller number of subscribers, but more content PLUS a studio to produce more. (Which, by the way, Netflix, Amazon, and others pay ViacomCBS for.) VIAC has a current EPS of $ 3.84 per roughly $ 27 dollar share and a forward PE of 6.77. This shows that Viacom has more than 1/2 the profit per share of Netflix, but at 1/18 the price! This places ViacomCBS as a very underrated company, although this is in relation to the gorilla of the streaming market.

CEO Bob Bakish has wisely reduced the debt, and some convinced good terms, to the point that there is no debt by 2022. Continuing on this path of debt reduction and extension should be relatively easy in this low interest rate environment. A possible future sale of Simon & Schuster should help with the damages, as it is expected to raise between $ 1-2B. (A sale of this size would knock out almost any debt to the company.)

The Q2 announcement also included an estimated $ 50M bull in synergy from the merger, an increase to $ 300M from the previous $ 250M, adding to the bottom line if it can be realized.

New business & income

- The three cross-company deal innovations from Verizon, Dish, and YouTube TV – all at increased rates / values - add future revenue for Viacom.

- Viacom recently announced ViacomCBS EyeQ, a newly connected video advertising platform to serve as a single entry point for digital content entry. (This gives advertisers a vertically-aligned, simplified way to target broad demographics that Viacom aims to bring with its content.) The EyeQ service is expected to the fall of 2020.

- ViacomCBS is planning a premium streaming service for international markets.

- Simon & Schuster are still for sale in the future. (expected price of 1-2BB.)

The launch in late July of some 3,500 episodes of content, as well as an “improved” user interface (now includes personalization) should help get more traction and stickiness than subscribers. This should lead to more users, leading to more revenue.

ViacomCBS, and CEO Bob Bakish, did not rest on their laurels – do what they can to add more content to the service in hopes of gaining more subscribers. The add-ons will include content from MTV, BET, Nickelodeon (for kids / families), Comedy Central and more. The library of content now has 20,000 episodes and movies – put it, at least in the league and in some cases higher – with players more than ten times their size. Moreover, markets expect Video-on-Demand usage to increase by 9.5% annually by 2025. (VOD user penetration is currently assumed at 11.9%, and moved to 25.5% by 2025.)

Risks involved

Of course, all investments are risky … however, Viacom has a few to be on the lookout for. The debt tax at Viacom stands at 3.3x adjusted OIBDA, as of June 30, 2020.

If streamers do not find the content of their services worth the cost and cut subscriptions, Viacom has the money to last a year or so based on current figures. But if you include a ramp-up in production – which I would expect from any media or content creation company like COVID stay-at-home orders – the debt burden could start to scale a bit like income do not increase as expected.

Should a long and protracted recession occur, Viacom could suffer a loss of subscribers. Of course, this may apply to any business … but it is still a possibility. Fortunately, there is no debt on the books that are currently due until 2022. Just in case, Viacom has a $ 3.5B in revolving credit facility that is undrawn and 1.7B in cash on balance. They could also be forced to slow down production to save money, which can increase churn. I do not consider these risks so high for a company that is experiencing this level of growth.

The future and Outlook …

While I believe that renaming to “All Access” and inserting all content (such as Showtime) into the same service would simplify the structure and generate some interest for subscribers – continued implementation of recent trends should be all that ViacomCBS revenue does in the future. Rolling in Paramount was, in my opinion, a key to show Viacom’s direction.

With Paramount, Viacom gained access rights to many things, but none were more important than the Star Trek franchise. The entire Star Trek franchise is now under the control of ViacomCBS, no longer having to look for contracts for merchandise and access to the original Star Trek movies – which were regulated by Paramount. (Previously, both companies produced Star Trek products, CBS had Star Trek: Discovery and Picard rights, while Paramount could produce any original series of Kirk, Spock, or other images and materials on production.)

The full Star Trek rights allow for increased marketing, products, as well as control over characters and storyline – which is why CEO Bakish flaunted that they will use this model with the entire portfolio of brands. Soon there was an announcement of Star Trek: Lower Decks (a Star Trek-themed comic book theme that brilliantly used social distance employees), Star Trek: Strange New Worlds (featuring the popular Captain Pike, Spock and Number One introduced in Star Trek: Discovery Season 2), a new season of Star Trek: Picard as more Star Trek series (including Star Trek: Prodigy – which seems to be a CG-animated series for kids for Nickelodeon) and feature films . Using iconic shows like The Twilight Zone, Mission Impossible and much more … it probably looks like a business model that could be replicated for quite some time.

ViacomCBS believes it can use this mold to expand streaming subscriptions to 25 million or more within two years. Although not Netflix or Disney numbers, this would be an almost 65% increase within two years and prove some resilience.

The size of ViacomCBS also gives a potential for a larger company to get its content. (Though the Redstone’s massive percentage ownership makes it a bit more difficult.) Still – AT&T, Comcast, Netflix, Amazon, Disney, and a few others are all able to make a purchase this size and would probably take a dominant position with a purchase.

As an opportunity for acquisitions, ViacomCBS has a bright future ahead – and the merger of the two companies and direction provided by CEO Bakish appears to have this undervalued company turning the corner and moving into the future.

Announcement: I am / we are long VIAC. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.

Additional disclosure: I’ve been ViacomCBS for a long time, and will be getting heavier in the name in the coming days