L-shaped recovery for air lines. Keeping their fate on a vaccine.

By Wolf Richter for Wolf Street.

American Airlines on Friday, and Delta Air Lines on Thursday, once again warned of slow bookings. The very lucrative business air travel segment essentially resides in zombie-states, but leisure travel has grown a bit more in recent months and Thanksgiving will be driven by microscopic quantity. But, even the best travel stays down worse than last year during the best days, and is now moving lower again.

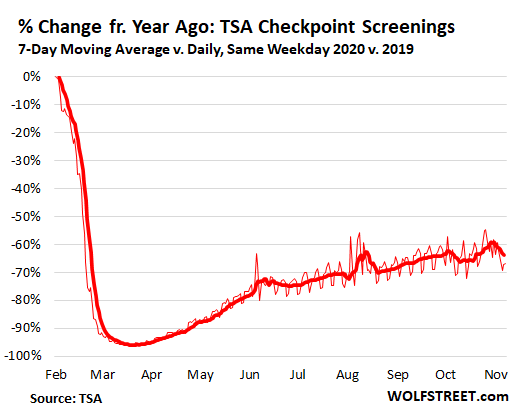

The number of passengers passing through TSA checkpoints to enter safe areas at U.S. airports from Saturday, December to December compared to the same week day of last year, showed a deterioration: -64.2.3% and – 69.2%. And what airlines have warned is this is a drop in bookings from an already low level.

Chart 2020 (red) and 2019 (green) show the total number of TSA checkpoint screenings per day and the seven-day moving average (bold line). Four spikes of more than 1 million screenings per day during the Thanksgiving travel period (Friday November 20; Sunday November 22; Wednesday November 25; and Sunday November 29) were pale imitations of last year’s spikes during that time. Days, November 22, the year-on-year decline narrowed to -54.9%, the lowest since the airline business collapsed in March:

So now, it’s time for an airline confession once again.

On Friday, American Airlines [AAL] “Like others in the industry, it has also seen a decline in demand and forward bookings due to the recent acceleration of the epidemic,” a statement said.

And it added that net booking growth has slowed as a result of increasing COVID-19 case counts and associated travel restrictions in the immediate period leading up to the holiday season, which continues through December. “

And the fourth quarter “daily cash burn,” the industry metric that is born of the epidemic, will come to its previous estimated-25- $ 30 million per day end, above reference and forward booking in terms of above and moderately higher fuel prices. “

The 30 million dollar “daily cash burn” translates into 2.8 billion dollar cash burns per quarter. American Airlines continues to expect a recovery in demand that is difficult to predict volatile and accurate, ”he said.

On Thursday, Delta Air Lines [DAL] Confession was kicking off time. In the midst of a flurry of blah-blah-blah about staff testing and finding voluntary contracts for international travelers, he says, “When we increased the proportion of travel on the Thanksgiving holiday, they were still less than half. What we usually fly during the holidays. “

“Less than half” on the best day during the Thanksgiving period was what the industry as a whole experienced. During the Thanksgiving travel period, TSA checkpoint screenings ranged from -54.9% on the worst day to -64.7% on the worst day compared to the same day of the previous year. Checkpoint screening has deteriorated further since then. And the seven-day moving average, at -65.0%, where it was first on September 4 – three months ago:

“Like everyone else in the industry, we’ve seen a bit of a slowdown in demand and forward bookings as cases of COVID in UVs have increased,” Delta said.

And it expects its Q4 revenue to decline by about 70% from last year. And it expects “daily cash burn” to be about 2 2 million more per day than its previous estimate, which is now between 12 million and 14 million per day in Q4.

U.S. Demand by airlines has reduced the ability to crash, sideline or retire hundreds of aircraft. And they have released thousands. The epidemic began early and airlines have been allowed to reduce daily cash burns. Despite these cuts, they need to significantly increase demand to reach the breakeven.

Like the industry as a whole, Delta is eagerly awaiting vaccinations. His hopes of reaching breakaway point in the spring have been “encouraged by continued positive growth by vaccines,” he said.

While it will take months for the vaccine to be widely distributed, Delta said, but it is a clear indication of the light at the end of the tunnel. “Extensive vaccinations among our customers and our employees will be essential to Delta’s continued recovery and the start of our resume.”

So it is better not to have any kind of hiccups with these vaccines. Now everything depends on them.

And the V-shaped recovery begins to look as dubious as the recovery. See chart above. While vaccines, if and when they become widely available, will ultimately allow leisure travel to recover at least partially, a large profitable area of cost-account business travel is not returning to the old normalcy.

Finding businesses – in fact forced to figure out – how many such meetings can be run online online, and found that this is much more efficient than spending time and money to get there and back. Sure, there will be some business travel, but the old glory days of business travel are over, secondary to corporate cost-cutters, which have now found a functional option. And the airlines themselves have come to accept that.

The business of ancy fees sank the most in the office. In San Francisco, where it was already rock-bottom, it sank into an issue. To read... State of the American Office Fees: Suddenly emptied again under another wave

Have fun reading Wolf Street and want to support it? Using ad blocs – why do I get it perfectly – but want to support the site? You can donate. I really appreciate it. Click on a beer and iced tea mug to find out how:

Would you like to be notified by email when Wolf Street publishes a new article? Sign up here.

![]()