Excluding seasonal adjustments, 891,510 people submitted regular claims for benefits in the first instance. In addition, claims for unemployment assistance programs introduced by Congress during the coronavirus pandemic have increased to 542,797. Adding these figures together, unadjusted claims for the first time stood at 1.4 million last week.

But the disappointment of the initial number of claims was offset by a larger-than-expected reduction in persistent unemployment claims, counting people who have submitted regular submissions for at least two weeks in a row. That number dropped to 14.8 million – still very high, but also at its lowest level since the first week of April.

Looking at the figures, “it’s clear that what keeps people unemployed is not too generous benefits, but a lack of job postings,” said Andrew Stettner, a senior fellow at The Century Foundation, a think tank, in emails.

In all, nearly 28.1 million Americans claimed benefits from the various government programs available in the week ending August 1, only about 200,000 less than in the previous week.

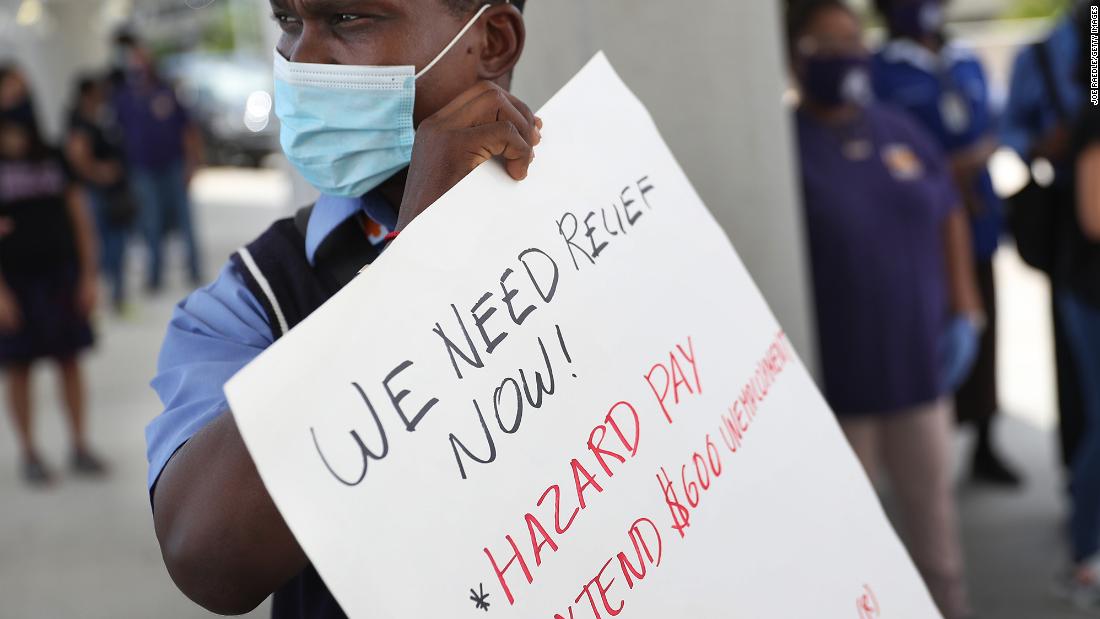

Meanwhile, those who file for benefits will no longer receive the $ 600 weekly incentive Washington is putting in place as part of the CARES Act, which expired at the end of July. Instead, benefits are lost to their regular amount, which is usually less than workers made on their salaries.

“Every day that goes by without an expansion of additional unemployment benefits brings more and greater pain to tens of millions of families,” Stettner said.

Since Congress has so far been unable to approve a new incentive action, President Donald Trump has signed an executive action to increase unemployment benefits by $ 300 per week by separating disaster relief funds from the Federal Emergency Management Agency.

– Katie Lobosco contributed to this story.

.