Flashing job warning lights

Signs that the economic recovery is over are already mounting.

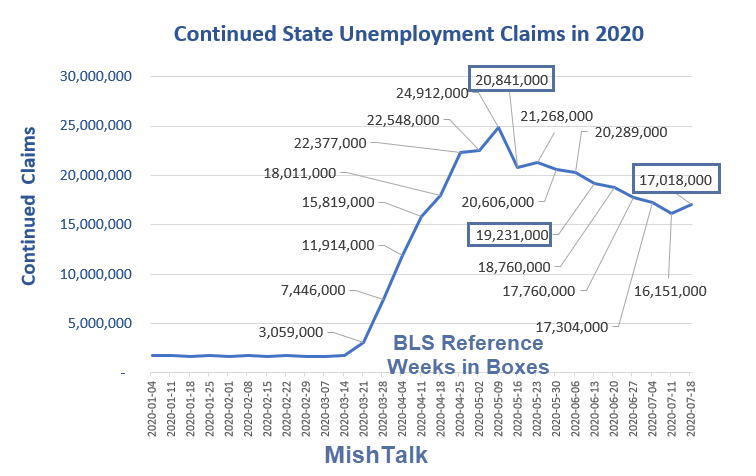

Ongoing claims increased from 16,151,000 to 17,018,000 for the week ending July 18.

Initial claims increased for the second week.

Initial state unemployment claims

After a 16-week downward trend, initial claims increased last week and increased again this week.

Note: My initial claims and continuous claims charts are seasonally adjusted. The following AUP and totals are NOT seasonally adjusted.

Four Continuing Claim Factors

- Continuing claims delay initial claims by one week.

- People can find work and leave unemployment lists.

- People can expire their benefits and leave the scrolls.

- People can withdraw and leave the scrolls.

Basic concepts of unemployment compensation

This is week 19 of the pandemic.

Workers in most states get 26 weeks of unemployment benefits according to the Center for Budget and Policy Priorities.

- Workers in most states are eligible to receive up to 26 weeks of benefits from the regular state-funded unemployment compensation program,

- Six states provide fewer weeks and one provides more.

- Under the CARES Act Responding to Pandemic COVID-19, all states provide an additional 13 weeks of federally funded Emergency Pandemic Emergency Assistance (PEUC) benefits to individuals who exhaust their regular state benefits.

- There are additional weeks of federally funded EB in high unemployment states (up to 13 or 20 weeks depending on state law).

- The maximum number of weeks of Pandemic Unemployment Assistance (PUA) for the exhausted is equal to 39 minus the number of weeks of regular UI and Extended Benefits (EB) received.

- There are no PEUC or PUA available after December 31, 2020.

State exceptions

- Massachusetts provides up to 30 weeks of UI, except when there is a federal extended benefit program (as it is now) or in periods of low unemployment (as was the case until February), when the maximum is reduced to 26 weeks.

- Montana provides up to 28 weeks of UI.

- Michigan typically provides up to 20 weeks of IU, but in the COVID-19 emergency it has risen to 26 weeks.

- South Carolina and Missouri provide up to 20 weeks of IU.

- Arkansas offers up to 16 weeks of regular benefits.

- Kansas was providing 16 weeks of IU before COVID-19, but that was extended to 26 weeks until April 2021;

- Alabama currently provides up to 14 weeks of UI for new enrollees, with an additional five-week extension for those enrolled in a state-approved training program;

- Georgia was providing 14 weeks of UI, but in the COVID-19 emergency it has risen to 26 weeks;

- Florida currently provides up to 12 weeks of UI; and

- North Carolina currently provides up to 12 weeks of IU.

Expired state benefits

- Alabama

- Florida

- North Carolina

South Carolina and Missouri benefits expire after an additional week for those initially affected.

State claims provide incomplete picture

State claims do not provide a complete picture because many people are not eligible for unemployment insurance.

For example, freelancers are not eligible for state unemployment insurance even though they pay in the system.

Self-employed workers and small businesses were eligible for loans that, under some conditions, will not have to be repaid. Freelancers are also eligible for 13 weeks of Emergency Pandemic Emergency Assistance (PEUC), but that may have expired.

Primary PUA claims

The primary PUA covers those who are not eligible to make state claims. The report delays initial claims by 2 weeks and continuing claims by 1 week.

Based on initial state claims and reverse state reopens, I expect this number to increase in the coming weeks, but seasonality may skew the numbers otherwise.

All claims continuous

All continuous claims are the sum of state continuous claims plus PUA claims and all other federal programs.

More than 30 million people collect some form of unemployment insurance.

Does it count double?

Some suggest that the “all continuous claims” report counts twice. It does not. Individuals are eligible for benefits at the state or federal level, but not both.

However, all continuous claims are a poor measure of the unemployment rate because it includes part-time workers, as well as other workers who do not meet the official category of unemployed.

Reference unemployment week

The BLS measures unemployment by survey in the week that includes the 13th of the month.

For July, that is the week ending July 18. The continuing claims are 17,018,000. This compares to 19,231,000 for June.

More than 30 million people on unemployment benefits

As noted Sunday, the watch ran out with $ 600 in weekly unemployment benefits.

Approximately 130 million people are receiving some form of pandemic aid.

Cutting details

- The Republican Party proposes to reduce the improved unemployment benefit from $ 600 to $ 200 per week through September. This is in addition to what states’ unemployment insurance recipients receive.

- The Republican Party also proposes to set maximum attendance at 70% of a worker’s previous wages, with a limit of $ 500 per week.

Those without pay or low pay will be beaten this week.

“So far in a Covid deal we don’t really care”

These are huge numbers, especially those who did not receive any payment.

However, Trump says “We are so far off on a Covid deal that we don’t really care.”

Philosophically speaking

Philosophically, people should not be unemployed more than employed.

Politically speaking, Republicans simply stepped on a land mine.

“We don’t really care” – That says everything.

More than 62 million people failed to pay last week

Yesterday, I commented on more than 62 million people who had no salary last week

Those are not retired people who reported not paying last week.

87,333 million people expect a loss of income in the next four weeks. Loss of income is per household, not individually.

The data comes from household pulse surveys of the Census Bureau.

Click on the link above for five related charts.

Mish