[ad_1]

Bitsgap platform analyst Dmitry Perepelkin talks about the current market situation.

On April 29, the market confidently broke through the $ 7,800 level, which is a historically significant price barrier. The dynamics of the downward trading volume in the growing market is broken. This is evidenced by the increase in purchases at the pump from $ 7,800 to $ 9,000.

Moving averages EMA 9 and EMA 200 they were quickly drilled, this is clearly seen in the graph below.

The market is very overheated, such a conclusion can be made on the basis of a sharp increase in the interest rate of marginal positions. At Bitfinex, the daily percentage reaches 0.14%, which is 4.2% per month. Such bets are very rare. The last time was in early January and February 2020.

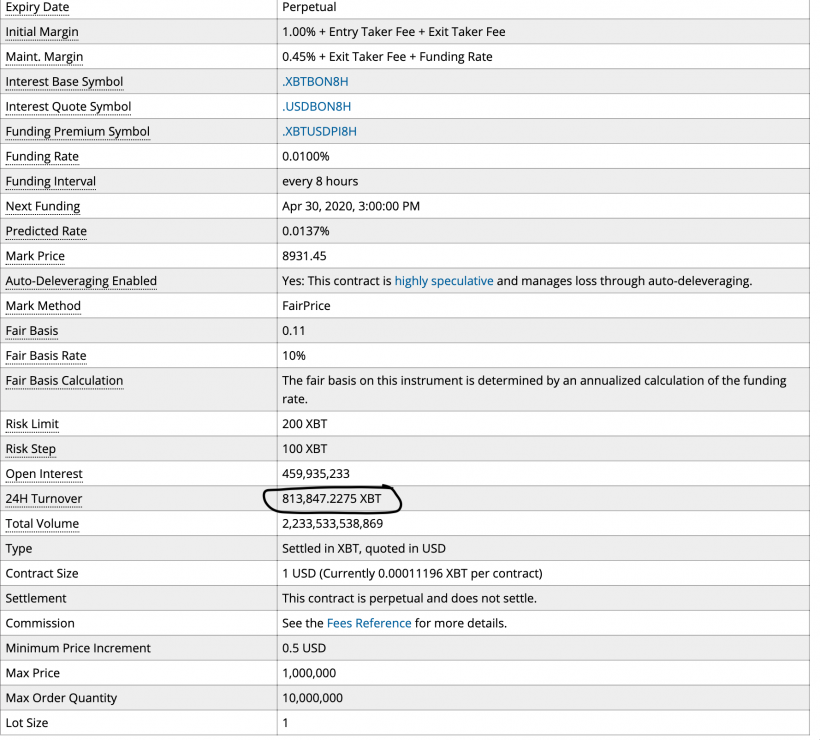

At BitMEX, the trading volume in the last 24 hours has amounted to 813 thousand BTC. These are very high rates for the margin market.

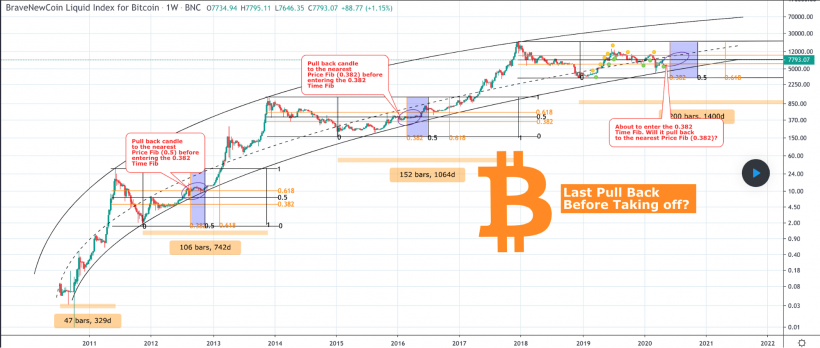

Growth is most likely associated with the next halving, when the block’s reward falls to 6.25 BTC. The growth of BTC supply in the market will slow down, and demand is supposed to remain at the current level or even continue to grow, which mathematically should cause a price increase.

Since 2009, two halves have already been made. As we see, the price continues to rise. You can find a nice chart on TradingView showing parabolic growth.

The second argument, which partially explains the growth, is that some countries are ready in May to lift the quarantine restrictions. Large market players, such as the United States, continue their quantitative easing (QA) program, saving the Covid-19 market.

When the market is very overheated and a lot of people try to get on the outgoing train, a pullback usually occurs.

We see how Bitcoin attempted to break through the $ 9,200 level, after which it returned to $ 8,500. Now the price fluctuates in this range, leaving long shadows on the candles. Volatility is high and can easily shake those who enter with stop-loss orders close to the market opening price.

It is better to wait until the daily candle closes to further determine the trading channel. After such rapid growth, a drop to $ 8100 is also possible. The chart already shows that traders started to take profit, and the price is starting to pull back.

Attention

Financial markets forecasts are the private opinion of their authors. The current analysis is not a guide to trade. ForkLog is not responsible for the results of work that may arise from using business recommendations from submitted reviews.

Subscribe to Forklog’s YouTube channel!

Found an error in the text? Highlight and press CTRL + ENTER

SUBSCRIBE TO THE NEWS Forklog