[ad_1]

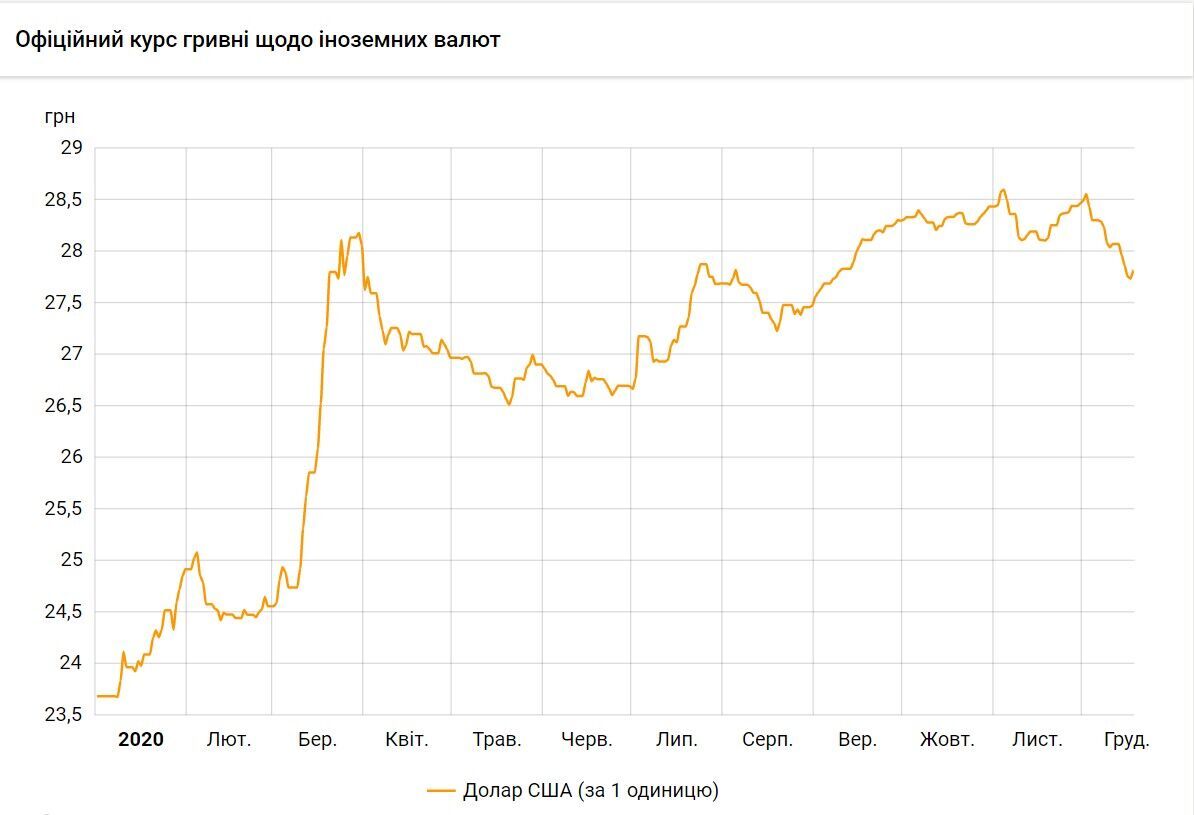

In Ukraine, due to the “Christmas recovery” and the record sale of government bonds, the dollar exchange rate will fluctuate around 28 UAH / $. Foreigners, despite the risks, decided to buy Ukrainian securities.

Read about how and why the exchange rate will fluctuate in the near future on the OBOZREVATEL material.

The Finance Ministry went into enormous debt: the hryvnia received a powerful boost

On December 15, the Ministry of Finance took on a record debt: the department sold state bonds for a total amount of UAH 51.4 billion. To make up for the “hole” in the budget, new values had to be printed. Of the total amount, 42.1 billion UAH, was attracted in hryvnia by 10-11.9%. Foreigners consider Ukrainian government bonds dangerous, but for the sake of that income they are willing to take a chance.

How many borrowed:

-

3.06 billion UAH – at 12.18% (until February 26, 2025);

-

277 billion UAH – at 11.98%, (until 01.11.2023);

-

3.83 billion UAH – at 11.70%, (until 05/11/2022);

-

6,730 million UAH – at 11.56% (until October 27, 2021);

-

UAH 11.35 billion – at 10.75%, (until July 21, 2021);

-

10.1 billion UAH: at 10.50% (until June 16, 2021);

-

4.23 billion UAH – at 10.00%, (until 03/03/2021).

“Investors are more willing to engage in transactions with risky instruments of developing countries, including Ukrainian government bonds. On December 15, the Ministry of Finance raised 51.44 billion UAH in the budget, a record amount for the entire syndicate, whose volume surpassed $ 1 billion last week, “said Sergei Rodler, analyst at TeleTrade.

All of this led to a currency surplus. There are more dollars on the market, and the demand for them practically did not change, as a result, the value of the hryvnia began to grow.

It should not be ruled out and the fact of the “Christmas rally”. At the end of the year, greater activity is observed in international markets associated with the need to change the investment portfolios of the main players. Such actions traditionally lead to higher volatility and an increase in the cost of financial instruments. “We expect the hryvnia exchange rate to approach UAH 27.8 per dollar,” predicts Rodler.

The Christmas rally is a traditional rally in stocks and financial instruments in December of each year. During this period, the shares of Apple, McDonalds, Starbucks rise in price annually. About 70% of all trades during this period are profitable.

“The hryvnia continues to strengthen amid growing positive market sentiment. Participants are optimistic about the start of mass vaccinations, while macroeconomic statistics from Europe indicate an acceleration of the recovery processes in the economy. In particular, it is see improvements in the industrial and service sectors in Germany and the UK. ” All of this creates a surplus of currency supply over demand and has an extremely positive effect on the exchange rate.“, – summed up Rodler.

Alpari analyst Maxim Parkhomenko also predicts a stable dollar rate in the near future. Like, foreigners, buying hryvnia, it will not allow the dollar to rise in price above the 28 UAH / $ mark.

“Over the next week, the price of the dollar will moderately recover to the level of 28.00 hryvnia per dollar. At the same time, non-residents who are actively buying hryvnia may slow down the growth rate of the dollar. a significant increase in the dollar rate above 28.00 is worth waiting for, “says Parkhomenko.

Why the dollar gets cheaper at the end of the year

-

Ministry of Finance, to find money to cover all expenses, sell government bonds at high rates. The papers can be bought for hryvnias, so foreigners and wealthy Ukrainians sell their dollars and buy government bonds.

-

Ukrainians buy less currency and sell more– Obtain the hryvnia and spend it to celebrate the New Year holidays.

-

At the end of 2020, investor confidence improved: the world began to launch coronavirus vaccines, the European Union economy shows recovery statistics.

In the near future, the dollar exchange rate will fluctuate around the psychological mark of 28 UAH / $. Sudden fluctuations in either direction should not be expected.