[ad_1]

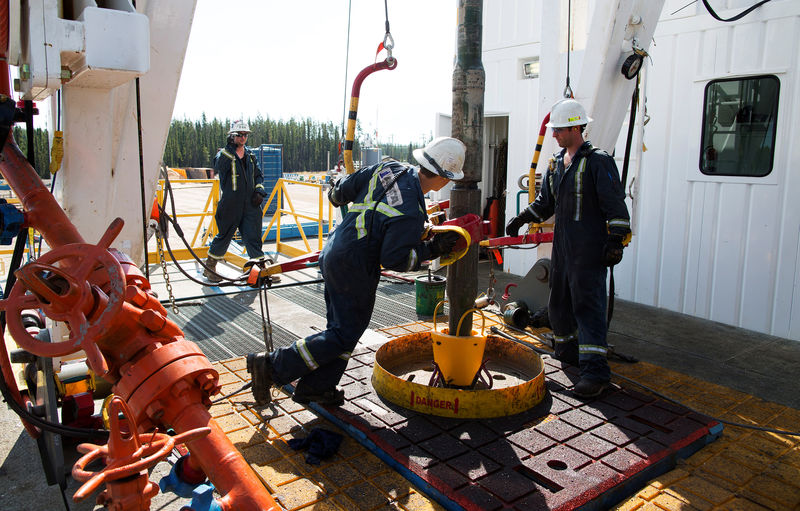

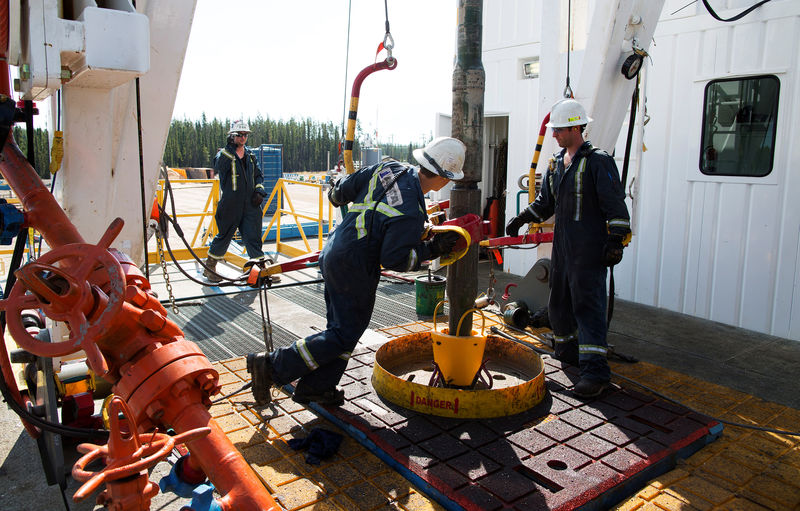

© Reuters. Oil

© Reuters. OilInvesting.com – Oil in Asia rose on Tuesday morning, adding gains from the previous session.

Crude oil futures rose 1.40% to $ 28.23 at 21:43 Eastern Time (02:43 GMT), while futures futures jumped 6.38% to $ 21.69.

Demand for “black gold” continues to grow cautiously. This happens when some countries resume their economic activity after weeks of restrictive measures to stop the spread of the coronavirus.

Production cuts agreed by OPEC + members in early April, in addition to cuts by some US producers, played a role in reducing production volumes, while this level is expected to reach a minimum of 17 years in the second quarter.

The overall picture, while not remarkable, seems more constructive as countries around the world lift quarantine restrictions and at the same time this will lead to increased demand for oil. “OPEC + is reducing production, production is falling worldwide due to economic problems,” Andy Lipow of Lipow Oil Associates said in an interview with CNBC.

But given that global demand for fuel in April fell about 30% due to quarantine, we can expect demand for crude oil to decline for a few more months. “

Investors will also continue to closely monitor the growing tensions between the United States and China, as both countries dispute the origin of Covid-19.

“The growth in demand in China is now favorable for the energy market.” Even a verbal battle with President Trump is not good for rising demand for oil in China, given the fragile circumstances the market is currently in, “said Bob Yauger, director of energy futures at Mizuho, in an interview with CNBC.

Author of Gene Lee

Fusion media or anyone involved with Fusion Media will accept no responsibility for loss or damage as a result of reliance on information, including data, quotes, charts, and buy / sell signals contained on this website. Having full information about the risks and costs associated with trading the financial markets is one of the riskiest forms of investment possible.

[ad_2]