[ad_1]

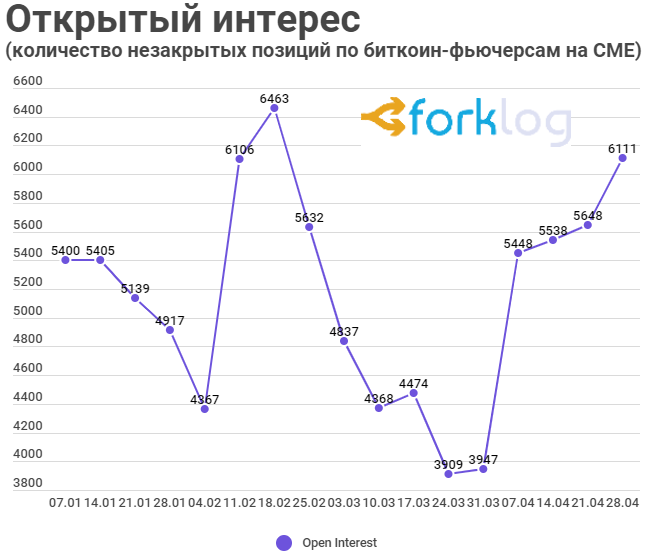

According to the latest CFTC report, the Open Interest (OI) indicator for bitcoin futures on the regulated CME is showing a sharp rise.

As you can see from the chart, the OI indicator reached the February mark. Prior to this, equally high values were observed in the middle of last year, when Bitcoin was trading above $ 10,000. According to analysts Arcane Research, the current situation may indicate a resurgence of interest in BTC by professional traders.

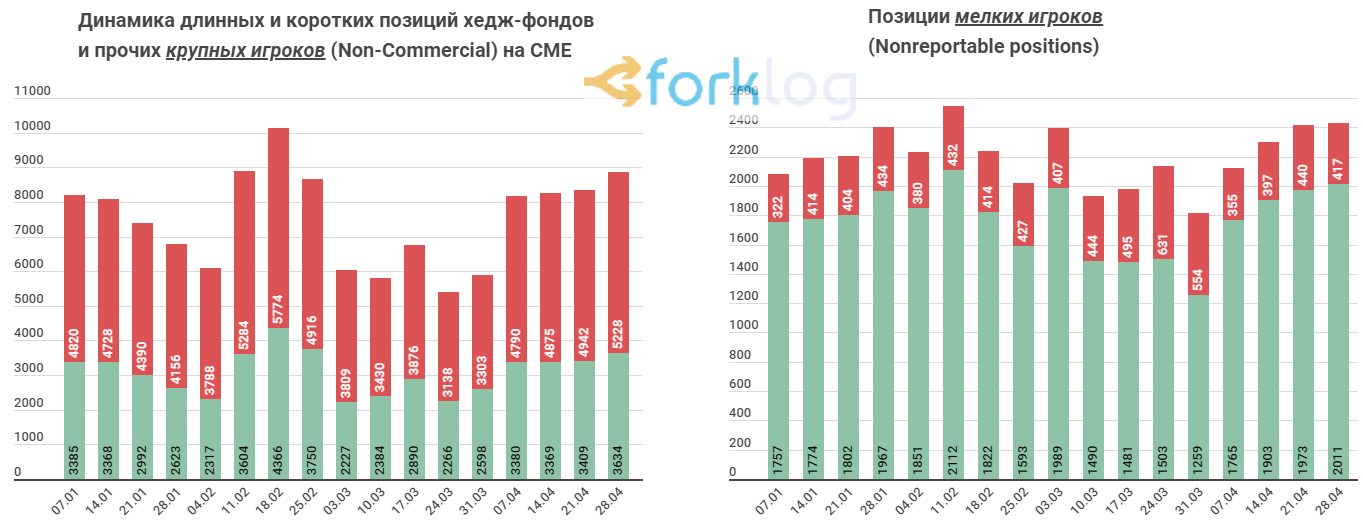

The following image shows that wide margin retail investors hold long positions. At the same time, the main (non-commercial) players are still in no rush to actively increase their lengths.

However, based on the asymmetry, investment funds (leveraged funds) still slightly reduced shorts.

Leveraged Funds Cut Shorts on CME After March 12 Bulk Sale pic.twitter.com/NIQ10FsQD1

– bias (@skewdotcom) May 4, 2020

The Unfolded chart shows that retail investor activity (green line) is often correlated with bitcoin’s price.

28 – April CME $ BTC Merchant Commitment Report

Open interest: 6,111 (up to 8.19%) pic.twitter.com/c3gSrBWqqu

– Deployed (@cryptounfolded) May 4, 2020

The current activation of the investors may indicate that they have a positive perception of Bitcoin’s halving, which will take place on May 12. Halving miners’ rewards for the mined block will reduce already low inflation from the first cryptocurrency, making it an even more scarce asset. This means that the price of the latter will inevitably increase with a constant or increasing demand.

ForkLog previously reported a decline in institutional activity at CME amid widespread market collapse in early March.

Subscribe to ForkLog news on Telegram: ForkLog Live – all news service, ForkLog – top news and polls.

Found an error in the text? Highlight and press CTRL + ENTER

SUBSCRIBE TO THE NEWS Forklog

[ad_2]