[ad_1]

Photo: Correspondent.net

The bad debt share in PrivatBank decreased to 76.7%

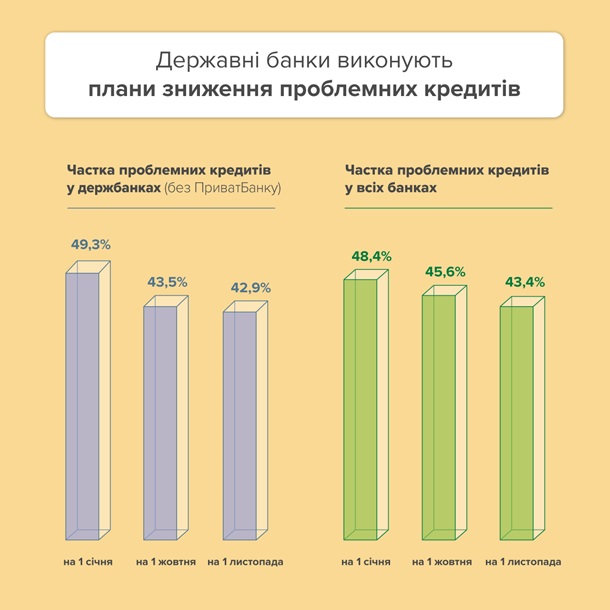

The proportion of bad assets in the banking sector continues to decline for the second month in a row. As of November 1, its stake fell to 43.4%.

In October, the state-owned PrivatBank wrote off UAH 38 billion of non-performing loans (NPL) from the balance sheet, for which 100% of the reserves had previously been formed. As a result, the proportion of bad assets in PrivatBank decreased from 79.2% to 76.7%, reports the National Bank of Ukraine on Thursday, December 4.

Other state-owned banks are also reported to continue working to improve the quality of their portfolios. In October, the share of non-performing loans in their portfolios fell from 43.5% to 42.9%.

According to the NBU, the proportion of bad assets in the banking sector continues to decline significantly for the second month in a row. In October, the share of non-performing loans fell from 45.6% to 43.4% as of November 1. In July 2017, this indicator reached its highest value in the world: 58%.

Infographic: NBU

The regulator noted that canceling does not mean forgiving debts; banks will continue working to collect them. In addition, it is planned to carry out the restructuring of viable loans, the seizure of guarantees with the subsequent sale, as well as the sale or assignment of claims on problem portfolios.

Earnings from state banks were previously reported to have decreased by 19% in the third quarter to 25 billion hryvnia. Most of the profits belong to PrivatBank. At the same time, Ukreximbank suffered billions of dollars in losses.

News of Correspondent.net on Telegram. Subscribe to our channel https://t.me/korrespondentnet