[ad_1]

Privatbank case: they want to protest Surkis’s victory. Collage

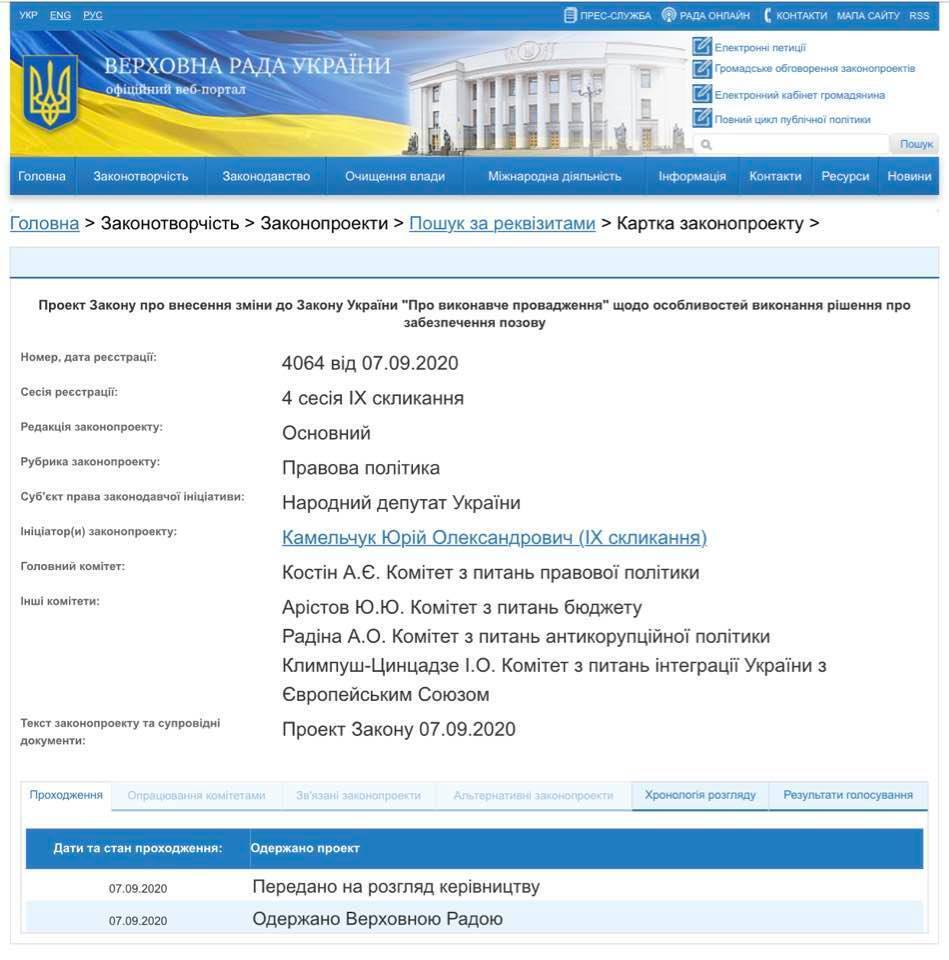

A bill was submitted to the Verkhovna Rada of Ukraine that could block the forced collection of $ 350 million from Privatbank in favor of Surkis companies.

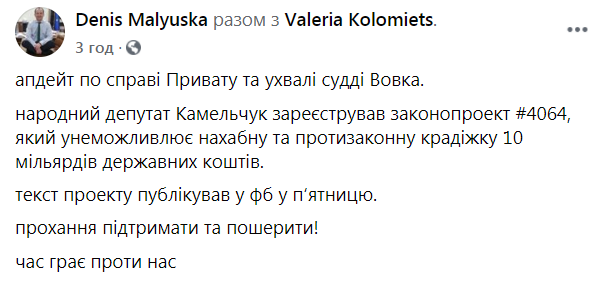

The document was registered in the parliament on September 7 by the people’s deputy of the “Servant of the people” Yuri Kamelchuk. The head of the Ministry of Justice, Denis Malyuska, announced it on his Facebook page.

The status of the document on the parliament’s website says that the draft was received by the Verkhovna Rada and presented for consideration to the leaders.

Let us remind you that on September 2 the Surkis won the court against Privatbank. The Ministry of Finance then announced its intention to challenge the decision of the Kiev Pechersk District Court.

Information about the invoice on the BP website. Facebook / Denis Malyuska

Screenshot

What is the essence of the Surkis lawsuit?

-

Entrepreneurs Grigory and Igor Surkis, members of their families, as well as companies associated with them, were suing Privatbank, where their deposits were kept before nationalization. These were deposits for 250 million dollars and interest for 100 million dollars.

-

During the nationalization of Privatbank, the Surkisovs were recognized by the NBU as inside information (associated with it) by the NBU in 2016. The NBU indicated that Igor Surkis and Kolomoisky are shareholders of the television channel 1 + 1, which shows the connection between Surkis and Privatbank.

-

The funds from the deposit accounts of the Surkis were actually canceled: instead, they received shares from the additional issue of Privatbank, after which they were forcibly sold for 1 UAH to the state (for which they were nationalized).

-

In 2017, the Surkis went through the courts and proved that they are not related persons at Privatbank. The Ministry of Finance through the courts tried to suspend the resolution that obliges Privatbank to pay the deposits of the Surkis family.

As OBOZREVATEL reported:

-

On December 21, 2016, Privatbank became state property. The state received 100% of its capital, the financial institution was capitalized in the amount of UAH 116.8 billion.

-

At the end of June 2017, the Cabinet of Ministers decided to recapitalize the bank by another 38.5 billion UAH on the basis of the proposals of the NBU and the conclusion of an independent auditor – EY.

-

The international detective agency Kroll discovered that Privatbank was the subject of large-scale fraudulent activities, and this led to the imposition of losses on the financial institution of at least $ 5.5 billion.

-

In December 2017, Privatbank filed a lawsuit in London High Court against Igor Kolomoisky, Gennady Bogolyubov, as well as against Teamtrend Ltd., Trade Point Agro Ltd., Collyer Ltd., Rossyan Investing Corp., Milbert Ventures Inc. and ZAO Ukrtransitservice Ltd., allegedly owned by them.

-

During the same period, the High Court in London decided to seize the assets of former Privatbank shareholders around the world. At the same time, the court ordered Kolomoisky to disclose information about all of his assets to a limited number of people directly involved in considering the case. The corresponding decision was made on the basis of the evidence provided regarding the withdrawal of $ 2 billion from the Ukrainian bank.

-

On April 18, the Kiev District Administrative Court declared illegal and canceled the nationalization of Privatbank. Thus, it satisfied the claim of the former owner of the financial institution Igor Kolomoisky against the National Bank and the Cabinet of Ministers.

-

Subsequently, Privatbank appealed the decision of the Kiev District Administrative Court on the illegality of the bank’s nationalization procedure.

-

On May 24, the bank filed an appeal in case No. 826/13813/17 in the claim of the former bank shareholder of the Cypriot company Triantal Investments LTD to cancel the decision of the NBU commission on the determination of the list of persons associated with the bank.

Don’t miss the lightning! Subscribe to us on Telegram