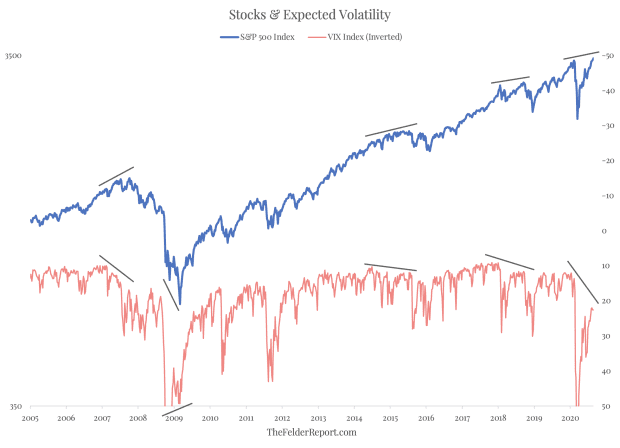

A divergence between the S&P 500 and VIX indices raises a ‘red flag’ for the stock market rally, warned former hedge fund investor Jesse Felder.

Getty Images

It’s a waiting game for investors early on Thursday.

Markets are waiting patiently and somewhat nervously for Federal Reserve President Jerome Powell’s keynote address at the Jackson Hole economic symposium later on Thursday. Powell expects the central bank to adopt a new framework to make inflation hotter than its current target after a period of failure to meet that target. US stock futures ES00,

YM00,

NQ00,

pointed lower, which means a 100-point loss for the Dow Jones Industrial Average DJIA,

at the open. Data on unemployment in the US and data on gross domestic product in the second quarter will also catch the eye.

In us call of the day, Jesse Felder – author of the popular Felder Report financial blog – said the VIX index “raised a red flag” for the stock market rally.

The former hedge fund investor said that typically the stock market and expected volatility – indicated by the VIX index – should move in opposite directions. Any deviation from this, which Felder said appeared now, could signal “an impending reversal.”

The upper body of 2007 and the market bottom of 2009 were both identified by a discrepancy between the S&P 500 SPX,

index and the VIX, he said. “Since then, we have had several bearish non-confirmations warning of major corrections. Today we have another bearish non-confirmation, ‘said alumnus Bear Stearns & Co.

The S&P 500 Index and Reverse VIX Index over the Past 15 Years

The 10-day correlation between the S&P 500 index and the VIX has risen in positive territory, which Felder said could serve as an effective short-term sell signal.

“Right now, this VIX warning signal is flashing again as it did earlier this year and ahead of the corrections in the first and fourth quarters of 2018,” he said.

“In short, the options market is sending a message that forward volatility is likely to be greater than the stock market currently implies. And history shows that the options market is usually the only one [that] wins this kind of argument, ”he added.

The map

If this chart from Goldman Sachs is anything to go by, then the US dollar bear market may have some way to go, Robeco portfolio manager Jeroen Blokland noted. He said there have been only three bull markets in the U.S. dollar and two bear markets since the 1970s.

The brands

U.S. stock futures pointed lower ahead of the open as markets nervously waited for Powell’s speech on inflation strategy. European stocks are also sliding, with the Stoxx 600 SXXP,

down 0.3% and the UK’s FTSE 100 UKX,

falling 0.2% in early trading.

The buzz

TikTok director Kevin Mayer announced his dismissal to employees just three months after he took the job. He said the political environment has “changed dramatically” in recent weeks. President Donald Trump has promised to ban the popular app in the US unless ByteDance based Beijing sells it.

Hurricane Laura made landfall in southwestern Louisiana early Thursday after the National Hurricane Center warned it would bring a “non-survivable storm surge.”

Rolls-Royce RR,

stock tumbled when the aircraft engine manufacturer reported a pre-tax loss of £ 5.4 billion in the first half compared to a loss of £ 791 million the previous year. The company said it had agreed a £ 2bn loan in the second half to help weather the ongoing coronavirus storm.

The Milwaukee Bucks decided to “strike” and not take the floor for their playoff game of the National Basketball Association on Wednesday, in protest at the police shooting of Jacob Blake in Kenosha, Wisconsin.

Vice President Mike Pence said Democratic presidential candidate Joe Biden could not be trusted to rebuild the economy or keep cities safe, during a speech on the third night of the Republican National Convention.

Random reads

Britney Spears’ sister is making a move to control the pop star’s ability.

The ‘selfish waste’ from Tibet which now manages a monastery in Scotland.

Need to Know starts early and is updated until the opening clock, however sign up here to get it delivered once in your inbox. The email version will be sent to Eastern at around 7:30 p.m.

.