Welcome to the US edition of oil production from Oil Markets Daily!

United States oil production is starting to rebound, but this should come as no surprise to anyone as WTI has now rebounded to $ 40 / bbl. Anything over $ 35 / bbl over an extended period will allow US shale producers to regain closed production. Fixed cost erosion makes it impractical to keep barrels closed to save for higher prices later.

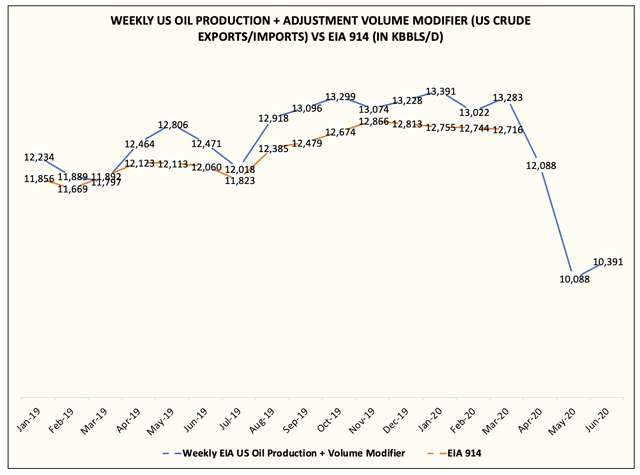

Source: EIA, HFI Research

After hitting a low of ~ 10 mb / d, US oil production recovered to ~ 10.75 mb / d from last week’s data.

This is in line with our assumption that US oil production will recover from 11-11.5 mb / d by July.

The key figure to keep in mind for now is where the total level of US oil production is today, even after considering the return of closed barrels. We can go back to our main indicator as a guide for this and the figure is ~ 11.8 mb / d.

Source: EIA, HFI Research

Right now, based on the return of gas production associated with the shutdown along with pipeline flows, we are seeing ~ 11.8 mb / d as the absolute level for US oil production even after the return of the closed barrels.

This would mark a decrease of ~ 1.3 mb / d from the level of ~ 13.1 mb / d that we observed in March. This makes sense intuitively as given the absolute low level of well completion in the past 3 months, the decline in the US oil production basin has eroded ~ 325k b / d per month.

Going forward, we believe US oil production for August will be around ~ 11.6 mb / d. This is likely to represent a short-term cap on US oil production.

Source: EIA, HFI Research

Once US oil production recovers to that level, we expect the decline to resume and push US oil production to ~ 11.1 mb / d.

Please note that our figure for oil production in the United States now encompasses the adjustment factor, which we believe is missing production. Either way, the figure turns into supplies and storage, so we must track the absolute level of supply.

This represents a rather optimistic outlook for oil prices in the future, provided that the recovery in demand continues.

And right now, demand recovery is on the way. The question for the broader market and oil will be how governments respond to spikes in coronavirus cases that occur in some states.

Source: EIA, HFI Research

Source: EIA, HFI Research

To carry out

Given all of the above, if the refinery’s performance returns to ~ 15 mb / d in August, we should start to see sharp declines in US crude storage. Lower oil rates have also contributed to improve the economy of United States crude oil exports. As a result, the combination of lower imports, higher crude oil exports, and lower production should equal, if not exceed, the crude draws we saw in 2017.

Three weeks ago, we noticed that energy reserves were due to a pullback. With many names now forming a healthy consolidation, we will look to re-enter in the coming weeks.

For readers seeking guidance on the energy market and energy reserves, we are currently offering a 2 week free trial. Come see for yourself why we are the largest energy subscription service at Seeking Alpha.

Divulge: I / we have no positions in any mentioned action, and we have no plans to initiate any positions within the next 72 hours. I wrote this article myself and express my own opinions. I am not receiving compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.