U.S. A very ominous journey is going to enter hyperinflation with a record amount of money and deficit.

The latest Q22020 budget deficit numbers for the United States have been released, and they don’t look pretty.

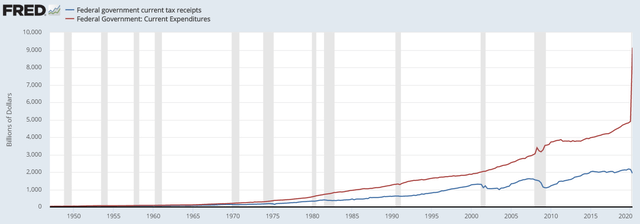

Federal government spending (annual rate) has reached $ 9 trillion while federal government revenue (annual rate) has dropped to tr. tr trillion dollars.

This has resulted in an annual adjusted budget deficit of Rs 5.5 trillion, as shown in the chart below. This is absolutely unprecedented, and it doesn’t look like costs will go down as many businesses (airlines, event sector, hospitality industry) are still struggling with the epidemic.

This has resulted in an annual adjusted budget deficit of Rs 5.5 trillion, as shown in the chart below. This is absolutely unprecedented, and it doesn’t look like costs will go down as many businesses (airlines, event sector, hospitality industry) are still struggling with the epidemic.

If we calculate the deficit in the outlet ratio, we get 60%, which is 40% higher than the hyperinflationary threshold.

If we calculate the deficit in the outlet ratio, we get 60%, which is 40% higher than the hyperinflationary threshold.

The latest Q2 GDP data was just as baseless. The U.S. economy fell 71.7% as the U.S. stock market continued to rise. This has led to an increase of 183% in the total market cap of GDP (Buffett indicator), which clearly indicates that stocks are highly valued here. Q32020 GDP is expected to grow 26%, according to the Atlanta Fed, so this ratio could come down further.

The latest Q2 GDP data was just as baseless. The U.S. economy fell 71.7% as the U.S. stock market continued to rise. This has led to an increase of 183% in the total market cap of GDP (Buffett indicator), which clearly indicates that stocks are highly valued here. Q32020 GDP is expected to grow 26%, according to the Atlanta Fed, so this ratio could come down further.

Ultra-low interest rate policies have created a stock market and bond market bubble in valuation multiples, but the underlying economy is not improving. For example, small businesses do not reopen opportunities insights as witnessed on the chart below.

Ultra-low interest rate policies have created a stock market and bond market bubble in valuation multiples, but the underlying economy is not improving. For example, small businesses do not reopen opportunities insights as witnessed on the chart below.

The Federal Reserve has managed to plunge U.S. businesses into more debt as criminals rise to the level of developed corporate business debt.

The Federal Reserve has managed to plunge U.S. businesses into more debt as criminals rise to the level of developed corporate business debt.

In fact, the Federal Reserve has not yet done so. On August 27, Chairman Powell announced that he would allow inflation to heat up more than usual and keep interest rates at 0% for an extended period (years 5 years). To achieve this, the Federal Reserve will have to greatly increase its balance sheet by purchasing more assets and sending money directly to businesses. The current bubbles will only get bigger and bigger. Shares will rise as the Federal Reserve pulls money into the sector.

In fact, the Federal Reserve has not yet done so. On August 27, Chairman Powell announced that he would allow inflation to heat up more than usual and keep interest rates at 0% for an extended period (years 5 years). To achieve this, the Federal Reserve will have to greatly increase its balance sheet by purchasing more assets and sending money directly to businesses. The current bubbles will only get bigger and bigger. Shares will rise as the Federal Reserve pulls money into the sector.

However, money does not grow on trees. As the Federal Reserve prints more money to buy assets, the US dollar will plummet and inflation will rise.

The US dollar is related to the amount of the deficit. As the trade deficit and budget deficit widen, the US dollar will need to be reduced.

As small and medium-sized businesses remain closed, real output will decline. Without real output, efficiency in the economy will deteriorate and inflation will rise. I expect inflation to rise more than %% in the coming months based on the current Q22020 actual output numbers.

As small and medium-sized businesses remain closed, real output will decline. Without real output, efficiency in the economy will deteriorate and inflation will rise. I expect inflation to rise more than %% in the coming months based on the current Q22020 actual output numbers.

Investors should now prepare themselves against these waves of inflation. A good example of this is War Run Buffett, who bought an early stake in Barrick Gold (NYSE: Gold) In the last quarter. I suggest we follow the great oracle and stock up on gold and gold miners.

Investors should now prepare themselves against these waves of inflation. A good example of this is War Run Buffett, who bought an early stake in Barrick Gold (NYSE: Gold) In the last quarter. I suggest we follow the great oracle and stock up on gold and gold miners.

Advertisement: I / We have no place in any of the stocks mentioned, and have no plans to start any position in the next 72 hours. I have written this article myself, and it expresses my own opinions. I don’t get paid for it (except for finding Alpha). I have no business relationship with the stock mentioned in this article.