When it comes to electric vehicle manufacturer Tesla (TSLA), there have always been a number of skeptics. As a result, a part of the bullish case for the stock is that big short-term interest could lead to a big cut in the good news, perhaps something like the company’s Battery Day event that’s slated for this month. of September. However, today I am here to see this important angle because the current situation may not be what most people think it is.

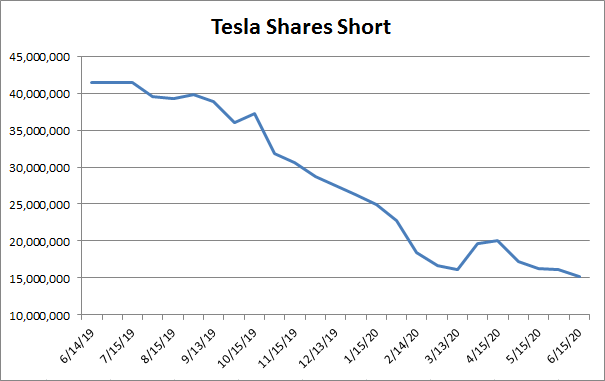

When it comes to short interest, the first thing to consider is the number of short shares. As the chart below shows, short interest in the latest Nasdaq update set a new yearly low. That may not be surprising to some, given that Tesla shares are trading close to their all-time highs. However, we are returning to short interest levels that have not been seen in several years, and that was a time when Tesla was a much smaller company and therefore the number of short shares was much more important. More on that angle in a moment.

(Source: Nasdaq Tesla Short Interest Page)

Due to the rise in Tesla’s stock price, the dollar value at risk for these short sellers rose in early 2020. The mid-April update was comparable to where we are now, because at the time it had more than 20 million short shares and one share in the low $ 700s. Of course, we also don’t know how much of these negative positions are hedges against Tesla convertible bonds. Some of those notes began to mature last year, with more maturities in the coming years. That could explain part of the decline in short-term interest, as hedgers unwind trading in pairs.

The second important element to consider is the days to cover the ratio. This figure measures how long it would take to cover all short positions, based on the average volume over a given time. In late summer 2019, this ratio was above 6.2 for three consecutive bi-monthly updates, meaning it would take just over a full week of trading volume to cover all the shorts. Fast forward to June, where we have not only a short interest below 63% in the last 52 weeks, but also an increase in volume.

Until now in 2020, every day to cover ratio as detailed by Nasdaq the link above has been below 2.0. In fact, all but one update was below 1.4, the only one being the one that included some soft volume around Memorial Day. There were even two updates with days to cover less than 1.0, and the latest figure stood at just over 1.28. With this ratio going down substantially, it makes the chances of a little squeeze decrease dramatically.

The other important element that I generally look at is how the number of short shares compares to the number of shares outstanding, as well as the float of the shares. A stock that has 10 million shares short and says 30 million outstanding is much more likely to have a constraint than one that has 10 million and 100 million, respectively. In this scenario, the assumption is that the floating percentages of outstanding shares are the same. As the chart below shows, and most investors probably already know this, Tesla has diluted investors quite a bit over the years.

(Source: Tesla quarterly documents, seen here)

This large amount of dilution has come about through a combination of several capital increases, a couple of acquisitions (primarily the SolarCity deal), and stock-based compensation. Since Tesla is not buying its own shares, the number of shares outstanding will continue to increase for the infinite future. The data provided by Yahoo Finance details the following floating numbers that I have tracked over time:

- August 2014: 90.87 million.

- September 2015: 98.78 million.

- September 2017: 124.12 million.

- June 2020: 147.63 million.

A year ago, we were analyzing more than 41 million shares outstanding, representing more than 23% of total shares. That would make Tesla one of the shortest names on the street. Now, there are only 15 million shares left, and outstanding shares increased by 11.65 million in the past 12 months. That means that now only about 8.2% of the outstanding shares are now short, which is not terribly outrageous.

What is the key to bring here? Well, if you’re betting on Tesla going much higher due to a little squeeze, the chances of that happening have been greatly reduced. That does not mean that shares may not rise even with good news, as the company may be beating second-quarter delivery estimates. However, there is unlikely to be a slight squeeze on cards with short interest down nearly two-thirds in the past year thanks to a tremendous recovery, along with the days to cover the slightly higher index. one’s. If you’re looking for a stock with a high percentage of short stocks that can be squeezed much more, Tesla really doesn’t fit the bill right now.

Divulge: I / we do not have positions in any mentioned action, and we do not have plans to initiate any position within the next 72 hours. I wrote this article myself and express my own opinions. I am not receiving compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you must do your own due diligence on any name mentioned directly or indirectly in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decision. Any material in this article should be considered general information, and should not be considered as a formal investment recommendation.