[ad_1]

Last week’s unemployment data showed that as the epidemic intensifies, the road to recovery in the labor market remains difficult. US stocks collectively opened lower on Thursday (10). The Dow Jones Industrial Average fell more than 100 points or 0.5% at the open, the S&P 500 fell 0.7%, the Nasdaq index and the fiscal index fell 0.9%, and the four major indices fell. Then the momentum converges.

The US Department of Labor announced that it received 853,000 unemployment benefits early last week, which was significantly higher than market expectations and previous values. The recovery of the labor market has clearly stalled.

According to data from Johns Hopkins University, the number of newly diagnosed cases in the United States on Wednesday (9) reached 221,000, and the number of new deaths exceeded 3,000, a one-day high, raising the average number of deaths in one day to 2,230. The job recovery has stalled and the number of infections has risen, and the market will continue to pay attention to the bailout bargaining.

Senate Majority Leader Mitch McConnell (Mitch McConnell) proposed on Wednesday protecting companies from liability in exchange for Democrats abandoning state and local government assistance measures, and even called for disagreement on the first two points hang and focus first. In areas agreed to by both parties, including assistance to small businesses, expansion of unemployment insurance, and financial assistance for vaccine distribution and other epidemic prevention operations, this is expected to break the deadlock in negotiations.

In addition, the US House of Representatives passed a week-long expedited spending bill with 343 votes in favor and 67 votes against on Wednesday (9), helping lawmakers reach a agreement on a new round of rescue plans and a comprehensive spending bill to avoid a government shutdown. All four votes are sent to the president for signature to avoid a government shutdown.

Starting at 10:00 p.m. on Thursday (10) Taipei time:

- The Dow Jones index fell 155.96 points or -0.52%, temporarily reporting 29,912.85 points.

- Nasdaq fell 104.89 points, or -0.85%, to 12,234.07 points temporarily

- The S&P 500 Index fell 23.79 points, or -0.65%, to 3649.03 points temporarily.

- Commissions and a half fell 24.96 points, or -0.91%, to 2709.81 points temporarily

- TSMC ADR fell 1.43% to $ 102.93 per share

- Yield on 10-year US Treasuries fell to 0.933%

- New York light crude oil rose 2.04% to $ 46.45 a barrel

- Brent crude rose 2.05% to $ 49.86 a barrel

- Gold rose 0.38% to $ 1,845.50 an ounce

- The US dollar index fell 0.12% to 90.905 points

Focus actions:

Moderna (MRNA-US) fell 3% in the first operations to US $ 151.90.

Moderna announced on Thursday (10) that it will launch a vaccine trial (mRNA-1273) for adolescents between 12 and 17 years old. The goal is to get data by spring 2021 and hope to deliver mRNA-1273 to teens before classes start in 2021.

DoorDash (DASH-US) fell 6.6% in early trading to $ 177.

US food delivery service DoorDash was listed on the New York Stock Exchange at $ 102 per share on Wednesday (9). It soared more than 85% on the first day of trading and closed at $ 189.51 per share. The market is closely following the recent trend in stocks.

Facebook (FB-US) fell 1.1% in early trading to $ 274.87.

The US Federal Trade Commission (FTC) and 48 state attorneys general filed an antitrust lawsuit on Facebook on Wednesday (9), trying to force the company to sell its two main assets, Instagram and WhatsApp.

Daily key economic data:

- The United States reported 853,000 initial unemployment benefits last week (December 5) and an expected 725,000. The previous value rose from 712,000 to 716,000.

- The United States reported last week (11/28) 5.757 million unemployment benefits, which are expected to be 5.21 million. The previous value rose from 5.52 million to 5.527 million

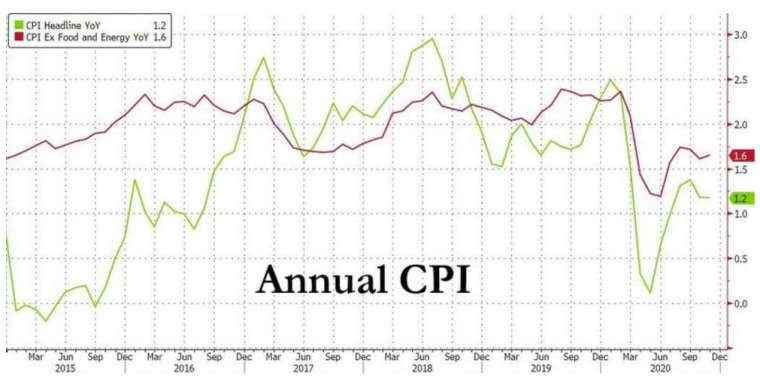

- The annual growth rate of the US CPI in November reported 1.2%, the previous value was 1.2%

- The monthly growth rate of the CPI in the United States in November reported 0.2%, which is expected to be 0.1%.

- The annual growth rate of the US core CPI in November was 1.6%, 1.5% expected, 1.6% earlier

- The monthly growth rate of the US core CPI in November registered 0.2%, which is expected to be 0.2%, and the previous value rose from 0% to 0.2%.

Wall Street Analysis:

Art Hogan, chief market strategist at National Securities, said the trend in the number of jobless claims is not good. We can learn this from the way the virus spreads and the recent increase in the number of cases and hospitalization rates.

Jefferies money market economist Thomas Simons said: “Considering the recent trend in unemployment benefits, it is possible that the number of claims will continue to rise in the future. There are increasing signs that the skyrocketing rise in The infections caused the number of unemployment benefits to reach a tipping point in early November and force a new round of restrictive measures taken by various places has hurt the service industry. “

[ad_2]