[ad_1]

As the vote count continues for the presidential election, Trump turned to legal battles and the outcome is still unclear. Wall Street is awaiting the October employment report. Futures of US stocks fell before the market on Friday (6).

1. Post-election rally suspended and index futures fell before the market

After tech stocks took the lead in Thursday’s rally, with the general election situation still indecisive, futures for US stocks declined.

At around 7:00 pm Taipei time, US Dow Jones stock futures fell 150 points, and S&P 500 and Nasdaq 100 index futures fell, down nearly 1%.

Wall Street strategists believe that the GOP victory in several major Senate elections reduced the possibility of a “blue wave” and contributed to the sharp rise in US stocks on Thursday. However, after the increase, there is no more price chasing at the moment.

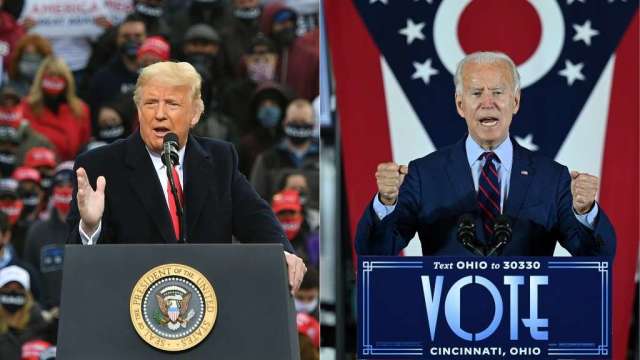

With the vote count, Trump’s lead in many states dwindled, and he was even surpassed in Georgia. At the same time, the Republican Party initiated legal proceedings against the main Biden states, accusing the Democratic Party of stealing the election results.

2. The United States is expected to add 580,000 jobs in October

Economists surveyed by FactSet predict that employment in the United States will rise by 580,000 last month, up from 661,000 in September. The unemployment rate is expected to fall from 7.9% to 7.7%.

Before the data was released, the US dollar was trying to rally and the exchange rate against all major currencies rebounded, but was still near the March low against the yen.

3. Moody’s warns that the US economy will not continue to recover

Mark Zandi, chief economist at Moody’s Analytics, said on Friday (6) that the United States, which has shown signs of recovery due to the intensification of the spread of the new corona pneumonia epidemic (COVID-19) and the lack of other additional support policies The economy, its future prospects may change.

The International Monetary Fund (IMF) said last month that it expects the US economy to contract 4.3% this year, which is better than the originally expected 8% contraction because the world economy shows a faster rate of recovery. .

However, Zandi believes that the current development situation has a very high risk of economic recession, especially when the epidemic has turned into a severe form. There are about 100,000 new cases every day and they are beginning to cause some degree of damage.

4. Peloton said there may be supply problems, share price drop

Peloton Interactive posted a profit loss in the first quarter, but because the company said that during the epidemic, demand for its products increased, but there may be supply problems, causing the share price to fall.

Peloton fell 6.36% to $ 118.58 in pre-market trading on Friday.

Peloton’s EPS was 20 cents, a loss of $ 1.29 over the same period last year, and revenue increased from $ 228 million to $ 757.9 million, far exceeding analyst expectations. .

5. People’s Bank of China: monetary policy remains strict and considers the exit of stimuli moderately

As the momentum of China’s economic recovery has strengthened, the People’s Bank of China has begun to discuss measures to withdraw from a loose monetary policy, which contrasts with Europe and the United States. Repeated epidemics have forced European and US governments to consider offering more stimulus.

Liu Guoqiang, deputy governor of the People’s Bank of China, said on Friday that the question of the withdrawal of future response measures has been discussed internationally during this time period. The unanimous opinion is that withdrawal is necessary sooner or later, but the timing and method of withdrawal must be carefully evaluated, primarily based on the state of economic recovery.

He also stated that China’s monetary policy will continue to “maintain an appropriate degree of rigidity.” Monetary policy will be adjusted according to the flexibility of economic conditions, and the effect of financial services on the real economy cannot be accelerated or weakened.

[ad_2]