[ad_1]

Not just in Europe, but the number of confirmed cases in the United States in a single day recently hit record highs. As the epidemic continues to hit market sentiment, US stocks opened lower on Monday (26). The Dow Jones industrial average fell more than 300 points or 1.1%. The Nasdaq Index fell 0.7%, the S&P 500 Index fell 0.9%, and rates fell 0.8%.

According to data from Johns Hopkins University, after Friday (23) which set a record for a single day, the number of newly diagnosed cases in the United States on Saturday (24) reached 83,718, a record for the second highest day in a single day, Yesterday there were 60,000 new cases (25). Currently, the cumulative number of confirmed cases has exceeded 8.63 million and the cumulative number of deaths has exceeded 225,000.

In Europe, Spain and Italy they have adopted more stringent epidemic prevention and control measures. The former declared a national emergency on Sunday and imposed a curfew at 11 p.m. every day at 6 a.m., while the latter implemented the strictest restrictions since the last time it was lifted. , Including the mandatory closure of all bars and restaurants at 6pm every day.

As the epidemic worsens, the pace of negotiations on the rescue case appears to be slowing.

House Speaker Nancy Pelosi said Sunday that she had sent a list of questions about the bailout to Treasury Secretary Steven Mnuchin. The White House is expected to respond on Monday, and the two sides are still expected to reach a consensus before this week.

However, White House Chief of Staff Mark Meadows does not appear to be as optimistic and complained that Pelosi had constantly changed targets in the bailout bill and failed to make the necessary compromises, reducing the hope of reaching an agreement.

As of Monday (26) 21 o’clock, Taipei time:

- The Dow Jones index fell 306.86 points or -1.08%, temporarily reporting 28,028.71 points

- Nasdaq fell 78.76 points, or -0.68%, to 11,469.52 points temporarily

- The S&P 500 Index fell 32.61 points or -0.94%, temporarily to 3,432.78

- Commissions and media fell 19.11 points-0.81%, temporarily at 2341.11 points

- TSMC’s ADR fell 0.78% to $ 87.62 per share.

- The 10-year US Treasury yield fell to 0.814%

- New York light crude fell 2.06% to $ 39.03 a barrel

- Brent crude fell 1.87% to $ 40.99 a barrel

- Gold fell 0.09% to $ 1,903.40 an ounce.

- The US dollar index rose 0.30% to 93.04 points

Focus actions:

Dunkin ‘Brands (DNKN-US) rose 17.13% in early trading to $ 104.00.

People familiar with the matter said Dunkin ‘Brands is preparing to sell its own company to the Inspire Brands holding company for $ 8.8 billion. The acquisition transaction is expected to be announced on Monday (26), and he warned that there is still a chance to break the game before the transaction is finalized.

Dunkin ‘Brands owns fast food chains Dunkin’ Donuts and Baskin Robbins, and Inspire Brands is the owner and special needs operator of chain restaurants such as Arby’s, Buffalo Wild Wings, Sonic Drive-In, Jimmy John’s and Rusty Taco .

AstraZeneca (AZN-US) was up 1.54% in early trading to $ 52.80.

The Financial Times reported on Monday (26) that the possible new vaccine against coronary pneumonia (COVID-19) jointly developed by AstraZeneca and the University of Oxford has produced a similar immune response in the elderly and the young, and the first results of Clinical trials showed, that it can produce a strong immune response in the elderly in high-risk groups.

Lockheed Martin (LMT-US) fell 1.44% in early trading to $ 368.95; Boeing (BA-US) fell 2.17% to US $ 163.73; Raytheon (RTX-US) fell 1.52% to $ 61.62.

China said on Monday (26) that it will impose sanctions on US individuals and corporate entities involved in arms sales to Taiwan, including Lockheed Martin, Boeing Defense and Raytheon.

The United States announced on Wednesday (21) that the State Council had approved the sale of three comparison weapons to Taiwan, including long-range land attack missiles (SLAM-ER), long-range precision fire attack system ( HIMARS) and new F-16 reconnaissance module (MS110). ), the total amount reached US $ 1.81 billion.

Daily key economic data:

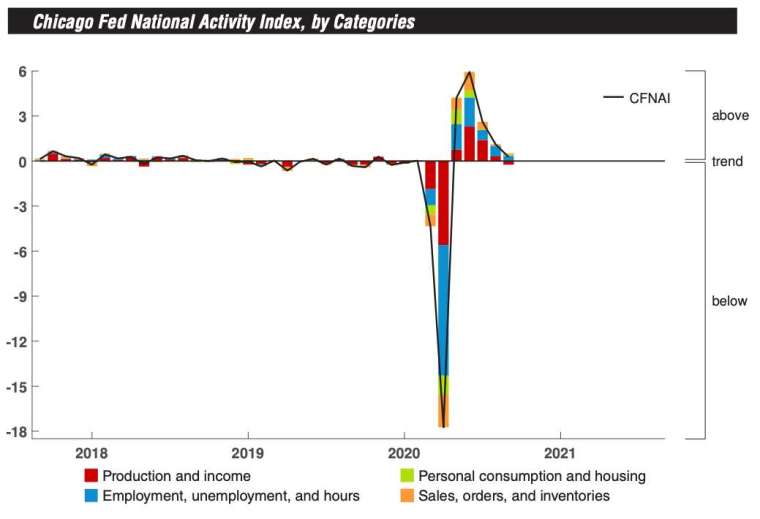

- The Chicago Fed’s September National Activity Index reported 0.27, the previous value increased from 0.79 to 1.11

- At 10:00 p.m. Taipei time, the annualized total number of new home sales for September in the United States will be announced, which is expected to be 1.024 million, and the previous value was 1.011 million.

- At 10:00 p.m. Taipei time, the annualized monthly growth rate of new home sales in the United States will be announced in September, which is expected to be 1.3%, and the old value is 4.8 %.

- The Dallas Fed Manufacturing Activity Index will be announced at 10:30 p.m. Taipei time, it is expected to be 13.5 and the previous value was 13.6

Wall Street Analysis:

In response to the epidemic, David Stubbs, director of investment strategy at JPMorgan, said: “This is absolutely concerning! We may need to consider implementing a circuit breaker before the winter solstice, including tight, short-term closings, but it has always been known that until the medical problem itself is resolved, it will not really enter the main stage of the new cycle. “

Peter Rosenstreich, head of marketing strategy at Swissquote Bank SA, said: “The current market sentiment is fraught with uncertainty. Concerns about the new corona epidemic and US fiscal measures are dominating the market.”

He said: “Everyone is talking about the Blue Wave, but” what will happen if things happen again in 2016? This incident makes investors cautious. “

[ad_2]