[ad_1]

Just a month after this year, investors witnessed an epic crisis in the US stock market. It can be said that this event that was a bloodbath on Wall Street by the uprising of the retail investor Jiegan passed through the eyes of experts from all sides. “Juheng .com” for readers Organize this process of the retail army that forces institutional investors to come out, and possible new battlegrounds that may open in addition to GameStop.

Game distributor GameStop (GME-US) was established in 1984 to sell games and consoles in the form of physical stores. Although it subsequently entered e-commerce, its overall operating performance has not shown significant growth. In addition to the outbreak of the epidemic last year, annual revenue fell to $ 6.466 billion, a decrease of more than 20%.

However, GameStop benefited from the epidemic and peak consumer season at the end of the year. On the 11th of this month, it announced its financial report for the fourth quarter of 2020. Among them, e-commerce sales increased by as much as 309%. , which far exceeded market expectations and sparked a wave of market purchases.

Subsequently, Chewy.com co-founder Ryan Cohen also announced last week that he would join the board of directors and vowed to make GameStop the Amazon of the games industry. Retail investors vigorously promoted the entry and lifted the sedan on the internet, pushing the stock price back to $ 40 after 8 years.

It is worth noting that, in addition to Cohen, the legendary Michael Burry from the movie “Short Sale” is also a shareholder. In the past, you believed that GameStop’s assets and earnings growth were underestimated by the market.

However, just when the future of GameStop was bullish, the well-known short-circuit institution Citron (Citron Research) issued a report on GameStop on Tuesday (19), stating that the company’s share price is only worth $ 20, and that everyone who buys the stock Many of the losers in the game have joined the ranks of institutional investors.

The retail army was outraged by this move, and they entered the market to gain the right to buy, promising to force the short sale institution out. GameStop also merged four times during the day following the retail mobilization. The stock price rose as it rose 663% after Friday’s opening price was the benchmark. This month’s increase was nearly 1800%.

The appeal and drive of retail investors comes from Reddit’s wallstreetbets (WSB) edition, which was founded in 2012 and is based on the spirit of YOLO. Most of them are young generations online who are not interested in the value and investing in index funds. ., The current version has about 6.7 million users.

This wave of retail counter-attacks took these institutional investors by surprise. Citron announced that it would hedge short positions at GameStop’s share price of $ 90, and all of the invested capital evaporated. Point72 and Citadel also ended the same way. The well-known hedge fund Melvin Capital was on the verge of bankruptcy.

This wave of retail counterattacks intensified this week, including Tesla CEO Elon Musk joining the fray, chanting “Gamestonk !!” on Tuesday (26), taking advantage of the trend of pushing this wave to Gao Feng that has attracted the attention of experts and the media, and the United States government has also announced that it will intervene in the investigation.

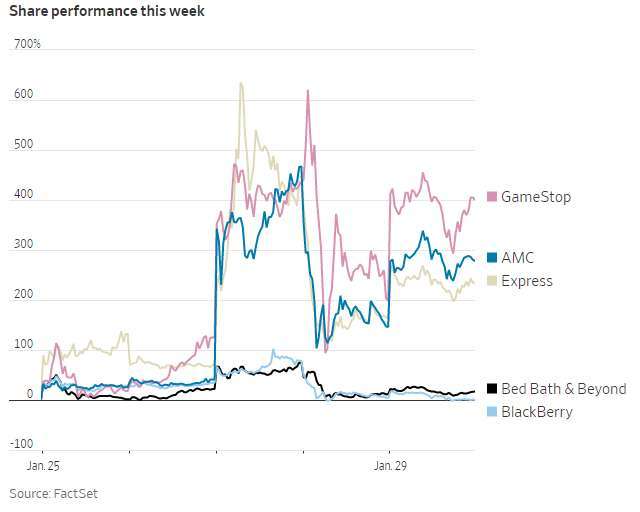

In addition to GameStop, some small stocks have also become long-term targets for retail investors. KOSS-US’s stock price has skyrocketed nearly 18 times this month, and AMC Entertainment (AMC-US) and Express (EXPR-US) also have another 500% gain.

Additionally, this surge has spread to silver and Bitcoin, and even retail investor’s favorite ordering software Robinhood has been forced to suspend or restrict open trading in stocks and assets that have abnormal transactions like GameStop.

Under the retail investor holy war, according to Ortex statistics, American short-selling companies have lost more than $ 70.87 billion so far this year, and GameStop has accounted for nearly $ 20 billion.

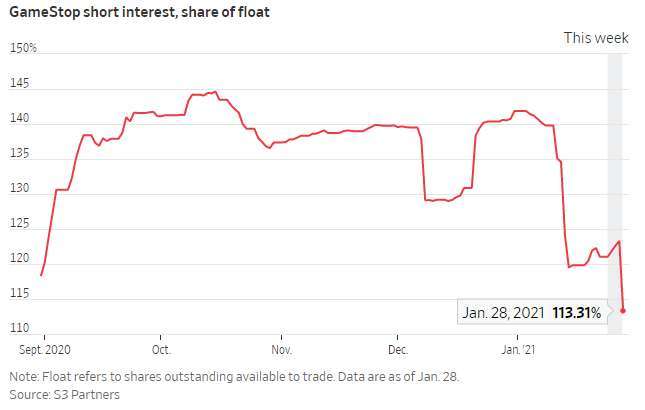

However, GameStop’s short positions have yet to be completely abandoned. According to statistics from S3 Partners, GameStop’s short position on Friday was $ 11.2 billion, behind Tesla (TSLA-US) and Apple (AAPL-US).

Since last week’s short coverage, the empty order balance has only dropped by 8% and as of Friday, GameStop’s empty order balance is still 113.31%.

Ihor Dusaniwsky, executive director of the forecast analysis department at S3 Partners, said that while institutional investors who had been shorting before have fallen short to cover, most of them were borrowed and shorted new shorts after the coverage.

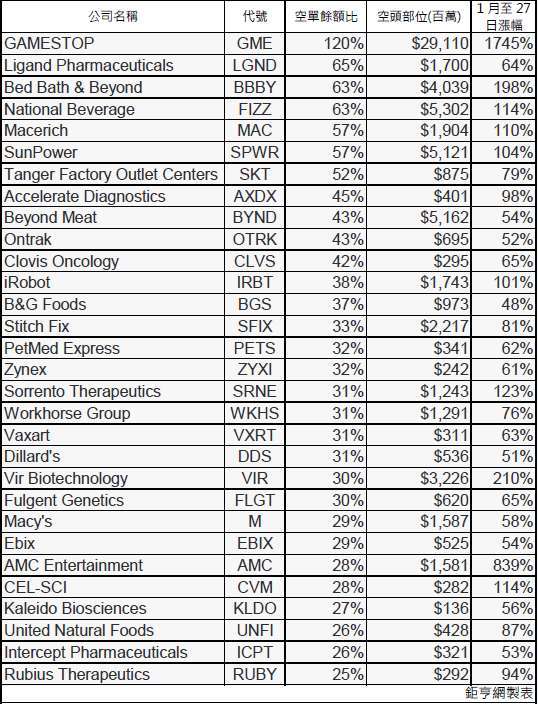

If you look at the single empty balance status of this month’s most recent Russell 3000 component stocks, there are as many as 68 stocks above 25%. The table below ranks the top 30 stocks that have risen through Wednesday (27), which is likely to be the future army of retail investors. New battlefield.

[ad_2]