[ad_1]

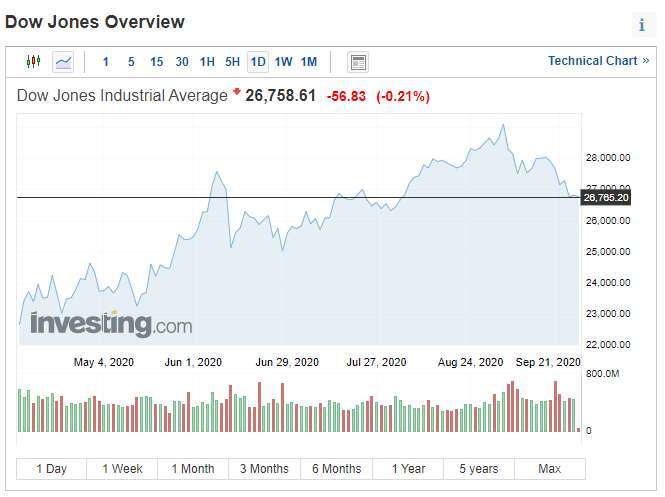

Major US stock indices were generally weak in early trading on Friday 25. The Dow Jones Industrial Average fell 0.45%, the S&P 500 remained close to flat, and the Nasdaq and Fiscal were down 0. , 3% and 0.9% respectively.

Despite the rebound in market risk sentiment, the US equity market overall remains under pressure. Investors weigh the relationship between the prospects for the new US stimulus plan and the global increase in COVID-19 cases. European equity markets are weak, Stoker Europe 600 Bank index even fell to its lowest level since its inception in 1991.

On the trend side of the currency, the US dollar is still strong, the US dollar index once hit 94.56, the euro and the pound were down, and gold also gave up its previous gains.

House Democrats said they are currently crafting a stimulus package of about $ 2.4 trillion to negotiate with the White House and Republican lawmakers, but this amount is still much higher than the White House is willing to accept. At present, the main institutions are not optimistic about the American elections. An agreement is expected earlier.

The weekly capital flow report released today by Bank of America shows that investors withdrew $ 25.8 billion from US equity funds on the trading day of the week ending Wednesday, establishing the third Highest level in the history of US equity funds Exit.

At 21 o’clock on Friday (25) Taipei time:

- The Dow Jones Index fell 120.93 points, or -0.45%, temporarily to 26694.51 points.

- Nasdaq climbed 5.56 points, or 0.05%, to 10,677.82 points temporarily

- The S&P 500 fell 10.31 points, or -0.32%, to 3,236.28 points temporarily.

- Odds and a half fell 19.07 points-0.89%, temporarily to 2,128.35 points

- TSMC ADR fell -1.01% to $ 77.59 per share

- Yield on 10-year US Treasuries fell 1 basis point to 0.66%

- New York light crude fell 0.6% to $ 40.07 a barrel

- Brent crude oil fell 0.3% to US $ 41.82 a barrel

- Gold fell 0.4% to $ 1,860.76 an ounce

- The US dollar index rose 0.2% to 94.61 points

Focus actions:

Apple (AAPL-US) rose 0.5% to $ 108.73

In July this year, Apple won an appeal for illegal tax evasion of 13.1 billion euros in Ireland, but the European Commission decided on Friday to continue the appeal before the Supreme Court. EU officials emphasized that, based on the 2016 survey results, Ireland provided Apple with illegal tax cuts between 2003 and 2014.

Costco (COST-US) fell 1.9% to $ 340.46

Costco’s single-quarter financial report announced EPS reached $ 3.13, beating market expectations of $ 2.86, and revenue increased 12.4% to $ 53.38 billion. , which was also better than analysts’ expectations of $ 52.08 billion.

Costco noted that an additional $ 281 million was used for epidemic prevention the previous quarter, higher than the original estimate of $ 100 million, but less than the $ 283 million in the third quarter.

Despite the excellent earnings report, Costco’s stock price fell after Thursday and continued to decline in early trading on Friday.

Nikola (NKLA-US) rose 4.5% to $ 19.96

After plummeting 37% in the past two days, Nikola’s stock price rebounded and Wall Street gave the stock a sell rating for the first time.

Wedbush lowered his 12-month price target from $ 45 to $ 15 on the grounds that founder Trevor Milton abruptly left the company earlier this week.

Daily key economic data:

- The initial value of durable goods orders in the United States in August increased by 0.4%, which was lower than the expected value of 1.4% and significantly lower than the previous value of 11.4%.

Wall Street Analysis:

BlackRock’s portfolio manager Russ Koesterich said his team had benefited from some rising tech stocks in late August and bought more cyclical stocks during the recent recession. He considers that it is not that technological values are going to collapse, but that from a short-term perspective some technical adjustments are needed, in general, the current economic situation is still satisfactory and some companies can be found that are improving.

Sebastien Galy, senior macroeconomic strategist at Nordea Asset Management, said that recent poor economic data from the US indicates that the US economic slowdown is temporary. However, if Congress fails to move forward, eventually there will be no additional fiscal stimulus plan. It will strengthen.

Newton Advisors’ Mark Newton said the sell-off of US stocks in recent days has been slightly stable, but there is still no sign of a real dip. Therefore, the trend is still bearish and there is not much chance of a rebound.

[ad_2]