[ad_1]

Under the impact of the new corona pneumonia epidemic, economic growth imbalances have intensified and the market is increasingly concerned that the polarized “K-shaped” recovery of the economy will further widen the gap between the rich. and poor in the United States.

RSM chief economist Joseph Brusuelas believes that “the K-shaped economic recovery is just a phenomenon of economic ramification during the financial crisis, which is related to the growing economic inequality in the 1980s.”

He said, “The upper end of the K-shaped recovery curve is obviously financial markets, and the lower end is the real economy, and the two are separate.”

The easiest way to predict that the current economy will show a “K-shaped” trend is to look at the relationship between the violent rise in the stock market since late March and the real economy.

You can see that even though US equities soared to new highs, US GDP in the second quarter fell by 32.9%, the worst drop in history. Despite falling unemployment, thousands of small businesses closed during the new corona epidemic and low-income families were still mired in the economy. Dilemma.

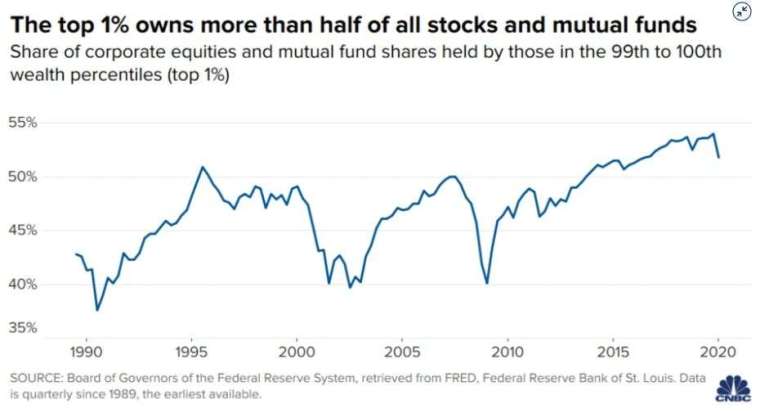

When 52% of stocks and mutual funds on the market are owned by the top 1%, this in itself exacerbates the gap between rich and poor in the economy. However, this is not only related to the ownership of the assets, but also to the nature of these assets.

Given that the vast majority of the rise in US stocks this year is driven by gains in some tech stocks, Microsoft, Apple and Home Depot have contributed much more to the Dow Jones index this year than the other 27 constituent stocks in the index.

Therefore, when the market is discussing whether the economy is a “V-shaped”, “U-shaped” or “W-shaped” recovery, it has also started to include the “K-shaped” recovery as one of the most likely trends.

JPMorgan Chase analyst Marko Kolanovic believes that rapid social transformation and development during the new corona epidemic has also led to greater inequality.

Low-income workers, blue-collar workers, and workers who cannot work remotely are the most affected. By contrast, the share prices of tech companies like Cloud have hit record highs. The market estimates that this is also one of the reasons why the Federal Reserve (Fed) adopted important inflationary policy reforms last week.

BMO Wealth Management analyst Yung-Yu Ma said: “Obviously, the economic recovery in some areas will be slower, but I don’t believe in a K-shaped recovery. I think some areas will take an additional 6 to 9 months. Recovery, but when this happens, things will gradually get back on track. “

US Rep. James Clyburn said economists have warned that the US economy is not welcoming a V-shaped recovery, but is instead facing a more uneven K-shaped recovery, meaning the rich may come back quickly. to their pre-epidemic wealth while low income The family is in a deeper economic dilemma.

As the elections approach, the issue of the gap between rich and poor has repeatedly surfaced. The question of the gap between rich and poor has been repeatedly featured in the House of Representatives’ briefing on the epidemic attended by US Secretary of the Treasury Steven Mnuchin.

[ad_2]