[ad_1]

The chairman of the United States Federal Reserve Board, Jeremy Powell, said on Wednesday (13) that he did not consider adopting a negative interest rate, and President Trump again expressed his support for a strong dollar on Thursday (14), Saying this helped by promoting America’s economy during the post-epidemic period, and emphasizing that now is a good time to have a strong dollar, Trump’s statement led the dollar index to rise above 100 points during two consecutive trading days.

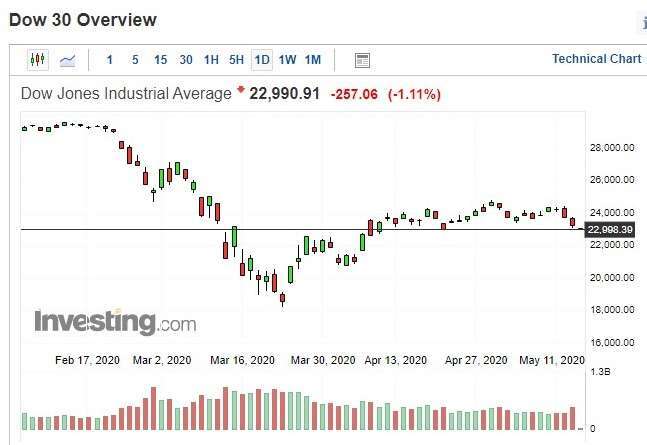

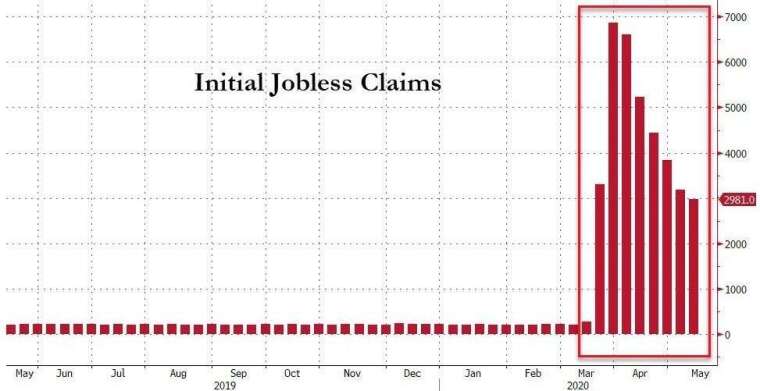

In terms of economic data, the US Department of Labor. USA He announced on Thursday (14) that the number of claims for unemployment benefits as of May 9 was reported at 2,981 million, which was higher than the market estimate of 2.5 million. The increase in the number of unemployed has increased to more than 36 million people, indicating that the labor market is still in recession. On Thursday (14), US stocks continued their decline on Wednesday (13). All four major indices fell, and the Dow Jones index fell more than 200 points. .

Countries plan to lift the blockade and restart the economy

Japanese Prime Minister Abe announced on Thursday (14) that the state of emergency in 39 counties across the country will be officially lifted, and the order will take effect immediately. However, to avoid the second wave of infection, the eight administrative regions of Tokyo, Osaka and Hokkaido have not been unlocked and should be next Thursday (21) After the review by the government and the team of experts, it will be taken the decision.

In response to the US economic restart plan. Although the member of the White House New Coronary Pneumonia (COVID-19) working group, Anthony Fauci, said Tuesday (12) that if the economy and schools reopen too soon, it can give rise to the number of new cases of coronary pneumonia. Wave. In this sense, the President of the United States, Trump, said on Wednesday (13) that he could not accept Fuch’s statement and called for the school to reopen in the fall.

United States Extends Sanctions on China

Following the announcement on Tuesday (12) that President Trump instructed the “Federal Pension Fund” to cancel investment in Chinese stocks, the Federal Retirement Savings and Investment Board (FRTIB) issued a formal statement on Wednesday (13 ) that it would postpone its investment in China indefinitely Business assets.

Starting Thursday, Taipei (14) at 22 o’clock:

- The Dow Jones index fell 257.06 points or -1.11%, temporarily reported 22990.91 points

- Nasdaq fell 64.24 points or -0.72%, temporarily reported 8798.92 points

- S&P 500 fell 24.39 points or -0.86%, temporarily reported 2,795.61 points

- Rates fell by half at 9.14 points or -0.54%, temporarily reported at 1682.43 points

- TSMC ADR fell 0.96% to $ 50.44 per share

- The performance of the US Treasury. USA At 10 years it fell to 0.622%

- New York light crude rose 2.97% to $ 26.04 a barrel

- Brent crude rose 3.01% to $ 30.07 per barrel

- Gold rose 0.42% to $ 1,723.55 per ounce

- The US dollar index rose 0.14% to 100,435 points

Focus actions:

3M (MMM-US)

3M fell 0.93% in the first operations to reach US $ 134.86.

3M said on Thursday (14) that April revenue fell 11% to $ 2.3 billion, although demand for masks continues to rise, it still cannot offset the decline in sales of other product lines.

According to different sectors, income in the transport and electronics sector fell by 20%, income in the consumer products sector fell by 5%, income in the industrial and security products sector fell by 11% , which reduced 3M’s overall revenue performance, while the healthcare sector Revenue increased by 5%.

Master card (MA-US)

Mastercard rose 0.08% in early trading to hit $ 269.39. A

MasterCard said on Wednesday (13) that as the new crown epidemic showed signs of slowing down in some countries, governments gradually began taking steps to lift the blockade, along with the large-scale stimulus package adopted by the government from the United States, which caused credit cards. The amount of use gradually warmed up.

Based on data from two weeks of card slippage as of May 7, the current status of the transaction and credit card usage have begun to recover to the “normalization” stage, and consumer spending is It has gradually recovered from the bottom, although tourism spending power remains weak. However, since last week, the demand for tourism across the country in Europe has shown signs of increasing.

Cisco (CSCO-USA)

Cisco rose 4.41% in early trading to hit $ 43.84.

Cisco announced the third quarter financial report after the close of business on Wednesday (13), both revenue and profit were better than market expectations. Although total third-quarter revenue was better than expected due to the impact of the pneumonia epidemic, revenue decline in this quarter increased from the previous quarter, and the business unit’s “infrastructure platform” more Large, which includes network switches and routers for business data centers, Revenue declined 15% yoy to $ 6.43 billion, less than the market estimate of $ 6.83 billion.

Key data from the third quarter financial report

- EPS: adjusted 79 cents vs. 69 cents (consensus expectation from the Refinitiv survey)

- Revenue: annual decrease of 8% to $ 11.98 billion compared to $ 11.7 billion (consensus expectation of the Refinitiv survey)

Key economic data for today:

- The United States reported unemployment benefits (10,000 people) at 298.1 at the beginning of the week, estimated at 250.0, and the previous value was 316.9

- United States 5/9 Weekly unemployment benefits (ten thousand people) reported the four-week average of 361.65, the previous value of 417.3

- The annual rate of increase of the US import price index. USA In April it was -6.8%, the forecast was -7.3% and the previous value was -4.1%

- The monthly growth rate of the April US import price index. USA Reported -2.6%, estimated -3.1%, previous value -2.3%

- The annual growth rate of the United States export price index for April was -7.0%, the previous value was -3.6%

- April US Export Price Index Monthly Growth Rate USA Reported -3.3%, estimated -2.3%, previous value -1.6%

Wall Street Analysis:

Goldman Sachs estimates that the unemployment rate in the United States may rise to a peak of 25%, but although the overall unemployment rate continues to rise, some industrial sectors are expected to benefit from the economic restart plan and the stimulus plan from the government, which will ease the labor market pressure. Goldman Sachs said the jobs boom in the manufacturing industry will have priority to improve. After the reopening of the economy, the security of manufacturing production sites is easier to control than where consumers gather.

Wilmington Trust economists said the unemployed population in the construction industry was 1 million in April, and it is expected that after the lifting of the blockade and the relaxation of social distance policies, the labor situation of the industry will be stimulated. . In addition, due to the cost of the construction industry, the structure increases the possibility of obtaining the “Payment Protection Loan Program” (PPP) and, therefore, protects the industry workforce.

[ad_2]