[ad_1]

Attention depositors! The Financial Regulation Commission to Prevent the Impairment of Assets, Discusses the Control of Financial Dividends

Reporter Yan Zhenzhen / Taipei Report

2020-12-07 11:52:34

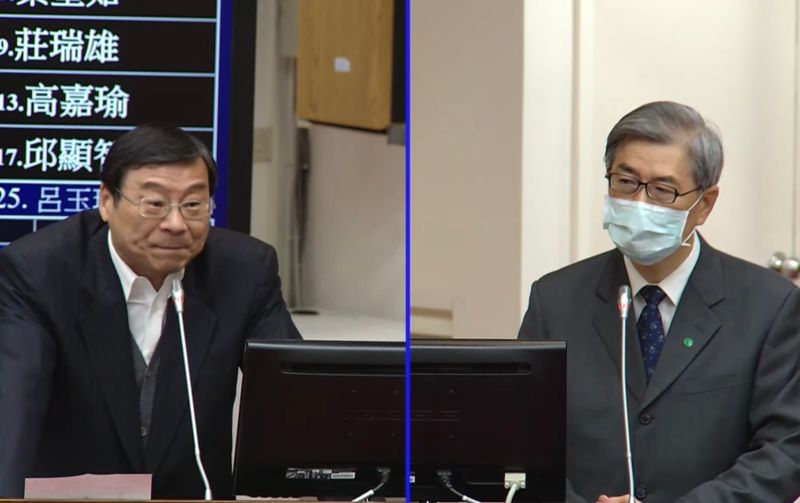

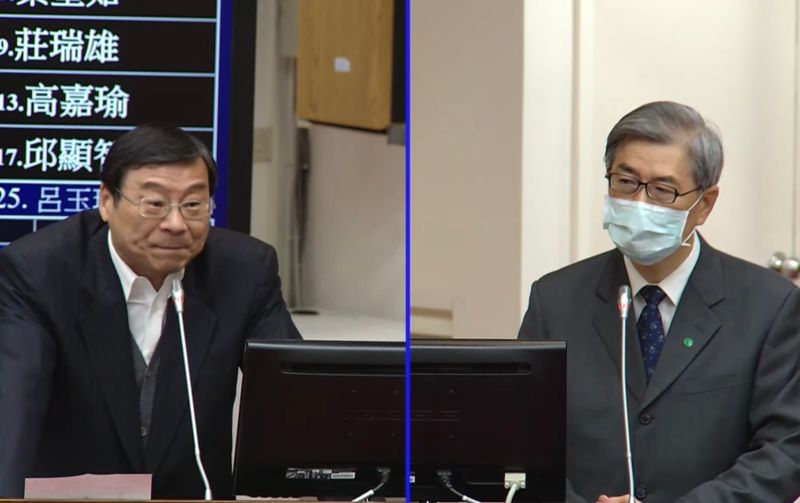

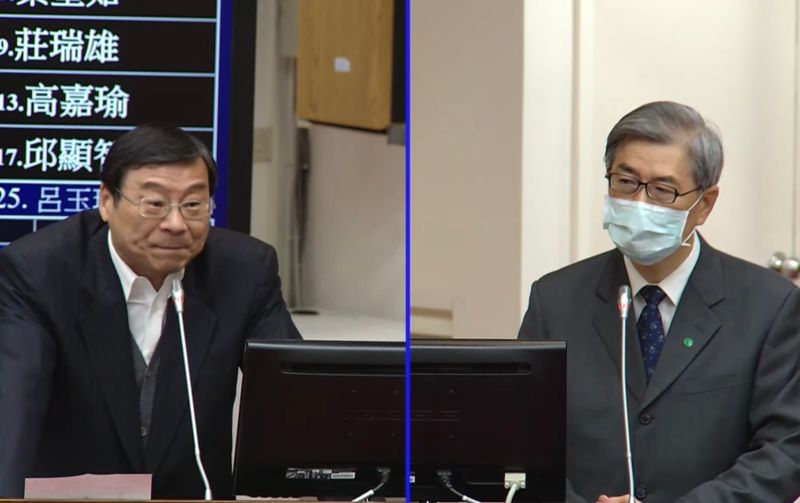

Britain’s financial supervisory authority has asked banks to stop issuing dividends this and next year. The Legislative Yuan Finance Committee caught the attention of lawmakers today (7). If Taiwan’s banking industry raises past-due loans next year, will it also restrict the issuance of dividends from the financial industry? FSC Chairman Huang Tianmu said that depending on asset quality and future prospects, the Office of Banking and the Office of Insurance have been asked to study how to consider dividend policy next year. On the one hand, of course, they need to give back to the shareholders properly, on the other hand, they also need to have advanced implementation concepts to prevent assets.For quality changes, even the insurance industry has to reserve some cash for implementation of the new club system or the capital adequacy index, but there is no conclusion yet.

I’m an ad, keep reading

Huang Tianmu attended the Legislative Yuan Finance Committee today and prepared for a question. KMT lawmaker Zeng Mingzong asked that the epidemic is spreading globally. To avoid further shocks to the financial system, the Bank of England has asked large banks not to issue dividends this year or next. If past-due loans from domestic financial institutions increase significantly next year Under this premise, will FSC also require the Taiwanese financial industry to follow up? Huang Tianmu said that he will comprehensively consider international trends, national practices and asset quality of the domestic financial industry. However, the insurance industry has made good profits this year. Next year will depend on the quality of the bank’s assets and future prospects. The Banking Office and the Insurance Office were asked to study. It’s just that each country’s financial development is different and the FSC will consider it, but it’s not exactly the same as the UK. Huang Tianmu also emphasized how the financial industry should consider dividend policy next year. On the one hand, of course, you need to repay shareholders appropriately, but there should also be some advanced implementation concepts to avoid asset quality changes, and even the insurance industry implements new accounting regulations and coefficient regulations. capital adequacy. Some funds must also be set aside, but this part is still under investigation, “but we have considered this issue”, especially many dividend policies will be determined at the beginning of the year, and we must communicate FMC’s opinion to the financial industry before That date. The answer will be given as soon as possible, possibly by the end of the year or early next.

I’m an ad, keep reading

NOW Survey Center

I’m an ad, keep reading

[ad_2]