[ad_1]

On Wednesday (16), the Federal Reserve (Fed) concluded its December interest rate decision-making meeting and announced that the interest rate policy would remain unchanged, keeping the benchmark interest rate between 0% and 0.25% and improving GDP forecasts, but did not make any bond purchase adjustments.

The highlights of the latest Fed interest rate statement and President Bauer’s press conference are as follows:

Key point 1: interest rates near zero remain unchanged

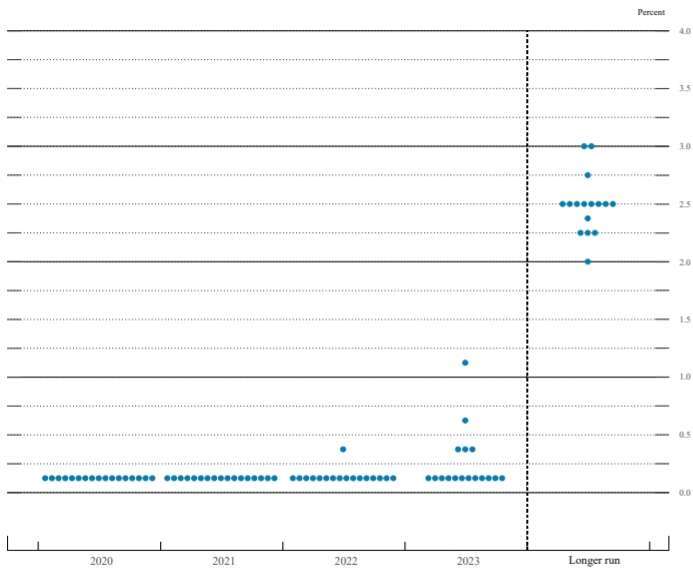

With the introduction of vaccines, interest rates near zero will continue until 2023. Bauer promised to continue using various tools until Fed members are confident that the US economy will fully recover.

Key 2: No adjustments to asset purchases

Outsiders believe the Fed may adjust its bond buying plan to increase 10- and 30-year bond purchases and theoretically depress long-term interest rates. However, there are no adjustments to the Fed’s asset purchases and bonds with longer maturities are not held. Bond purchases will continue like all of 2020.

The Fed stated that it will continue to buy approximately $ 80 billion in US debt, as well as $ 40 billion in agency bonds and mortgage-backed securities each month, until “substantial progress is made toward achieving the stability goal. prices and full employment “.

Key 3: The challenge of the epidemic! The next few months are key

The FOMC agreed that “economic activity and employment continue to recover, but are still well below the level of the beginning of the year. The path of economic development will largely depend on the spread of the new coronavirus.”

Bauer said spending on household items has rebounded, but spending on services remains low. The United States has recovered faster than expected. The next few months can be challenging and the economic outlook is very uncertain, depending on the epidemic. It is still difficult to assess the timing and scope of the vaccine launch.

Key 4: Update the economic data forecast

Bauer said that compared to September, the Federal Reserve will see fewer downside risks.

- Gross domestic product (GDP): contraction of 2.4% in 2020 (before: contraction of 3.7%); increasing by 4.2% in 2021

- Unemployment rate: 6.7% in 2020 (before: 7.6%), 5.0% in 2021 (before: 5.5%), 4.2% in 2022

- PCE inflation rate: 1.2% in 2020, 1.8% in 2021 (before: 1.7%) and 1.9% in 2022

- Long-term federal funds rate: 2.5%, the same as the previous forecast of 2.5%

Key 5: Forward-looking policy guidelines are results-based

President Bauer said that if the economy slows down, the Federal Reserve will increase its balance sheet expansion and implement loose monetary policy generally.

Bauer explained, “Our forward-looking orientation is results-based and closely related to progress in meeting employment and inflation targets. Therefore, if progress toward our goals is slow, forward-looking orientation will be achieved by reducing the expected path of the federal benchmark interest rate and increasing The expected path of the balance sheet to expand the easing policy ”.

Focus 6: tool changes

The Fed extends the liquidity swap lines and the Interim US Treasury Buyback Measures (FIMA) for liquidity in US dollars abroad from March 31, 2021 to September 2021, to guarantee supply global US dollar and US bond market smooth running.

The Fed mentioned that the greater extension of these instruments will serve as an important liquidity support and help to maintain and improve the recent global market for financing in dollars.

Key 7: Joining hands with Ye Lun

President-elect Biden appointed Janet Yellen, former chair of the Federal Reserve Committee (Fed), as Finance Minister.

Ball said he has personally congratulated Yellen on being nominated for Finance Minister. If confirmed by the Senate, he will work closely with Yellen, but will not discuss politics with Yellen before that.

Key Eight: Considering the High Valuation of the Low Interest Rate Stock Market Isn’t a Big Deal

Currently, the S&P index of US stocks has soared 65% since the end of March. The S&P 500 PE index exceeds 22 times, which is much higher than the 10-year average (15.6 times), but the 10-year US Treasury yield is still at an all-time low of 0.92%.

Bauer said it is undeniable that the stock market is overvalued, but considering that the 10-year US Treasury yield is lower than historical levels, the equity premium is in fact the return on taking risks of Actions. A high rating may not be that important. Too many danger signs.

Bauer also mentioned that the overall financial stability situation is a bit complicated. The situation is mixed. Low interest rates reduce the cost of borrowing. Otherwise, businesses will run into trouble, but it also makes the economy more susceptible to a heavy debt burden.

Wall Street Analysis:

Peter Boockvar, chief executive of Bleakley Advisory Group, said that for the market, the Fed’s interest rate meeting is largely not an event because the Fed hasn’t adjusted its bonds as many investors expected. Purchase plan.

Peter Boockvar mentioned that the Federal Reserve will continue to advance at an extraordinary speed and said that the current speed of 120 billion US dollars will not limit what they can finally do.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said no one mentioned the deterioration in real-time data, which is surprising. Although the start of vaccination makes the outlook for 2021 brighter, in the short term, the economics needs all possible explanations.

Dennis DeBusschere, a strategist at Evercore ISI, noted that for long interest rates and the US dollar, the most important thing is the speed of normalization of the US economy. The current position of the Federal Reserve is that it is either super moderate, or the law is as flexible as possible.

[ad_2]