[ad_1]

The US bailout bill has been repeated repeatedly, and the market’s wait-and-see mentality manifests itself in low trading volume. Although Biden has an advantage in the polls, no one can guarantee who the winner will be. Before the uncertainty of the US elections is removed, it is estimated that the Taiwan stock index will maintain a range adjustment, but that does not mean there is no market.

Wang Rongxu, an analyst at Wanbao Investment Consulting, pointed out that the previous column “Why is smart money eager to buy these stocks before the US elections?” 》 Analysis did not wait for the US elections Smart money poured into UMC (2303-TW), Winbond (2344-TW) and other stocks, which really led the market and hit band highs. I said that instead of betting on who is elected Trump or Biden, it is better to bet on the trend that no matter who is elected, it is estimated that there will be “three constants” after the US elections.

The first constant is the technological war between the United States and China.The only consensus between Trump and Biden is to support toughness on China. Even if Biden opposes the punitive tariffs, the tariffs will not be immediately waived. There is a greater likelihood that restrictions on China’s tech industry will continue. This will benefit Huawei and SMIC after the elections. Beneficiaries, such as MediaTek (2454-TW), UMC (2303-TW), and Winbond (2344-TW).

Previous Column Analysis Winbond has a low base period advantage and Apple’s transfer orders are an additional demand, making Winbond a powerful supplemental raise. Since October, it has risen by more than 30%, much more than MediaTek’s 11% and UMC’s 16%. It’s no exaggeration to call it second UMC.

Huadong (8110-TW), which is also a Huaxin Group and a partner in Winbond memory IC packaging and testing company, has a net worth of 21.71 yuan per share. The current share price is only 11-12 yuan, and the price / net worth ratio is only 0.5-0.6 times. With the increase of Winbond, the net cost ratio has increased rapidly from 1 time to 1.2 ~ 1.3 times, and the margin for price comparison has been widened. Huaxin Group shares are lively and often sought after for bottoms at the end of the quarter, and the market outlook is worth following.

The second constant is the economic recovery.Goldman Sachs predicts that GDP will grow 5.8% in 2021 and Citigroup is estimated to grow 5.1%, while those considered conservative like the IMF will also grow 3.1%. Especially in the first half of this year, the global economy has frozen sharply, benefiting from a low base period in the first half of next year, and GDP growth will be large.

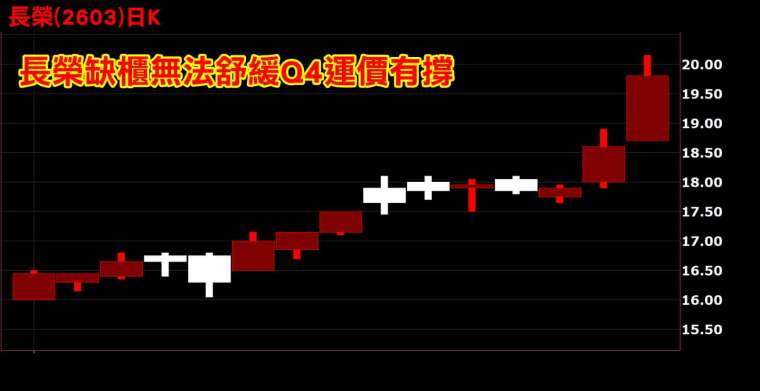

The stock market is the window of the economy and it always reacts early. The shipping index is one of the main indicators of prosperity. Container shipping that should have ended the peak season in October has continued to experience container and warehouse shortages. SCFI’s Comprehensive Container Load Index hit another record this week. new highs. Three-wing containers Evergreen (2603-TW), Yangming (2609-TW) and Wanhai (2615) increased more than 20% in October. It is not easy for the stocks of large defensive bulls to rise by 20-30%.

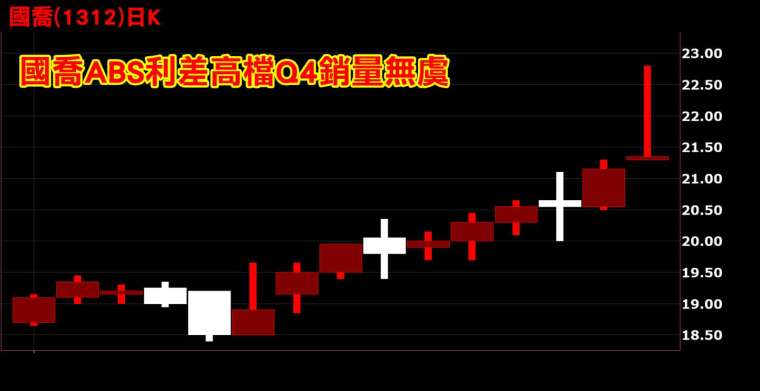

Wang Rongxu, an analyst at Wanbao Investment Consulting, said that during the sharp drop in September, I was optimistic about Evergreen’s P / E ratio in the column, and there was plenty of room for upside. At the time, he was also bullish on raw materials Guoqiao (1312-TW) and Taiwan Dahua (1309-TW) and Huaxia (1305-TW) also rose 13% to 17% in October, and Guoqiao even set a new record.

ABS, the main product of Guoqiao and Delta Chemical, rose again by 5% on Friday 23rd. China’s main PVC product has a constant trend, benefiting from infrastructure and other stimulus policies. China is a large consumer of raw materials. In the long vacation of November, the purchase of recovery stocks has emerged. Related stocks posted good results in the third quarter and the fourth quarter welcomes the peak season.

On the other hand, the prices of rubber materials related to the fight against the epidemic, such as NBR latex, have also increased dramatically. The epidemic will not slow down with the end of the United States general election. This is the third without changes. Furthermore, the recent spread of the epidemic in Europe and the United States as a result of colder temperatures cannot be ruled out. The demand for epidemic prevention has increased and the demand for disposable medical gloves has exploded, taking NBR material and latex from USD 1,100 to USD 1,150 in the third quarter and from USD 1,400 to USD 1,500 in the fourth quarter, an increase 50% from US $ 900 to US $ 1,000 in the first half of the year.

However, the raw material butadiene (BD) fell more than NBR in the first half of the year, and the growth rate of butadiene was lower than that of NBR in the second half, which expanded the spread among latex plants. NBR Nandi (2108-TW) and Shenfeng (6582-TW). Among them, Shenfeng NBR latex accounted for up to 90%, and the profit was the highest. Next year, global latex glove production capacity will increase by 20% to meet explosive demand.

However, Nandi and Shenfeng, which produce latex, have shown a triple jump in profits. In 2019, 2020 and 2021, Nandi’s estimated EPS will be 2.9 yuan, 4.5-5 yuan and 5-5.5 yuan respectively; Shenfeng will be 5.01 yuan and 12. ~ 13 yuan, 15 ~ 16 yuan. Earnings have risen sharply year-over-year, and it is for no reason that the stock price is leading the market. There is more potential stock analysis, to be shared with LINE fan club readers. Welcome to join for free.

Join Wang Rongxu fan group for free now and share more information.

Wang Rongxu, Chief Investor, LINE Fan Group

https://line.me/ti/p/@marbo888

YouTube channel of Wang Rongxu, Chief Investor

https://www.youtube.com/channel/UCi-2okN64tcrY5F09E2pb1Q

Wang Rongxu, Head of Investments Shopmaster FB Fan Group

http://bit.ly/2KGYiSg

Wang Rongxu, Chief Investor, Telegram Fan Group

https://t.me/marbo888

The company and individual values recommended for analysis

No inappropriate financial interest ratio Past performance does not guarantee future benefits

Investors must make independent judgments, prudential assessments and their own investment risks.

[ad_2]