[ad_1]

Wang Rongxu, an analyst at Wanbao Investment Consulting, said that foreign investors have been taking annual leave one after another, and the market trading volume has shrunk, but the Taiwan stock exchange has been transferred to domestic capital control it has become more dynamic. 2020 is about to pass, and now the funds are speculating on new topics in 2021.

The hottest topic for next year is not just 5G. Apple has accelerated the launch of Apple’s autonomous electric car and Tesla’s “rolling car.” No one can guarantee that the last king of electric vehicles is, but it can be guaranteed that the relevant issue is already in the share price. Fermentation.

It has been 13 years since Apple’s iPhone went on sale. The number of active iPhone users is estimated to have exceeded 1 billion. Because the interface and operating system used by Apple products are very different from those of non-Apple products, the powder has a strong adhesion. The proportion of iPhone users who buy peripheral products from Apple is very high. If fruit fans want to buy electric cars in the future, they will choose the Apple or Tesla car. I think many fruit fans have the answer.

Wang Rongxu, an analyst at Wanbao Investment Consulting, pointed out that as long as 1% of the billion iPhone users buy Apple cars, that’s the spectrum in the tens of millions. Whoever can get into Apple’s auto supply chain will swallow the performance boost. . Like who was able to get into the iPhone supply chain back then, he immediately became the funding target.

First, Hon Hai (2317-TW), with its global logistics resources and strong production and assembly capabilities, must play a very important role in Apple’s future electric vehicle development. In recent years, Hon Hai formed an alliance with Yulon (2201-TW) and Yageo (2327-TW), and established the MIH Electric Vehicle Open Platform Alliance. Its ambition to move from mobile phones to electric vehicles is very clear.

Compared with traditional cars, autonomous electric cars use more high-tech electronic products. It is no exaggeration to say that it is a computer that works on the road. The second wave of the electric vehicle market will take the electronics industry to its peak. Hon Hai and TSMC (2330-TW) are Apple’s most important partners and beneficiaries of Apple cars.

TSMC is up 54% this year, but Hon Hai’s current share price is still lower than last year’s closing price of 90.8 yuan, so I wouldn’t be surprised if Hon Hai’s price rose. next year. If the Hon Hai elephant’s stock price can dance in the future, what will happen to the smaller stocks?

Taiwan and a half (5425-TW) and Qiangmao (2481-TW) automotive diode manufacturers have already entered the world’s top ten automotive component supply chains. They are also manufacturers of the MIH alliance established by Hon Hai this time, and the price of its shares has risen considerably. And Yisheng-KY (5243-TW), which produces automotive components at Hon Hai Group and has entered Tesla’s supply chain, has become one of the popular stocks of Apple’s concept car with rich dad’s resources. by Hon Hai.

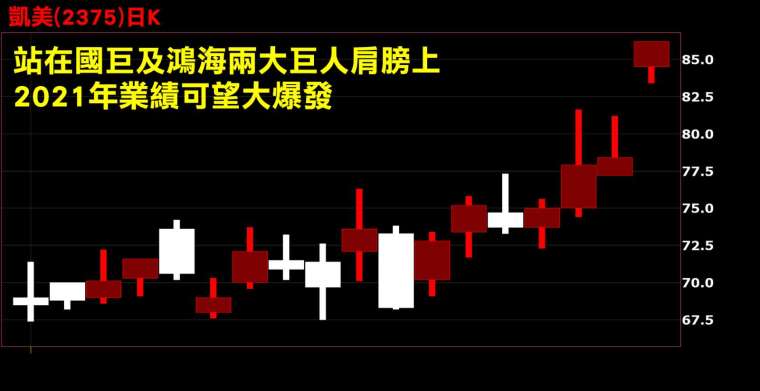

Wang Rongxu, an analyst at Wanbao Investment Consulting, said that Kaimei (2375-TW), which I have been optimistic about in the column many times in the past, is also a beneficiary stock of the twin giants Yageo and Hon Hai Group. Hon Hai launched a large-scale supply of Yageo. Hon Hai internally issued a notice to almost 10 subgroups. In the future, Yageo will be the main supplier of passive components, and Yageo’s subsidiary, Kaimei, has been listed as the first choice.

Yageo Group also launched an internal merger. Wang Chuan will join Kaimei. Next year’s revenue is estimated to increase by 20%. The strategic cooperation between Kaimei and Yageo’s Kemei will help Kaimei enter the automotive market. Big explosion.

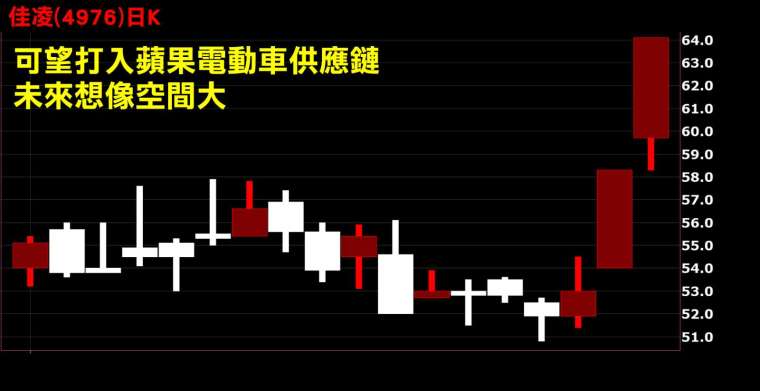

Apple’s car has an autonomous driving function and requires the use of a host of key components, such as optical radar sensors. Apple is reported to be in contact with two major US LiDAR providers, one of which, Velodyne-US, is up 30% this week. Jialing (4976-TW) is the largest supplier of lens for Powerboard.

Wang Rongxu, an analyst at Wanbao Investment Consulting, thinks the benefits of Jialing’s cut in automotive lenses are becoming more and more obvious. It is estimated that next year’s revenue will represent 40%. With strong customer orders, one-month revenue has set a record for 5 consecutive months. In this year’s new record, Jialing has a chance to enter Apple’s auto supply chain. There is much room for imagination in the future. Therefore, the number of large households and the share of participation have increased in the last two months, and the future is promising. There is more potential stock analysis, to be shared with LINE fan club readers. Welcome to join for free.

Join Wang Rongxu fan group for free now and share more information.

Wang Rongxu, Chief Investor, LINE Fan Group

https://line.me/ti/p/@marbo888

YouTube channel of Wang Rongxu, Chief Investor

https://www.youtube.com/channel/UCi-2okN64tcrY5F09E2pb1Q

Wang Rongxu, Chief Investor, FB Fan Group

http://bit.ly/2KGYiSg

Wang Rongxu, Chief Investor, Telegram Fan Group

https://t.me/marbo888

The company and individual values recommended and analyzed

No undue financial interest ratio Past performance does not guarantee future benefits

Investors must make independent judgments, prudential assessments and their own investment risks.

[ad_2]