[ad_1]

The November “small non-farm” employment report released by ADP was not what was expected. After yesterday’s rise, US stocks fell from their highs at the opening on Wednesday (2). The Dow Jones industrial average fell once more than 200 points and then the downtrend converged. The Nasdaq Index fell 0.9% and the S&P 500 Index and the Free Trade Zone fell 0.4%.

The optimistic progress of the new corona epidemic has recently ignited investors’ expectations of an economic rebound and pushed the major indices to record highs. The three major US stock indices closed at the same record yesterday ( 1st).

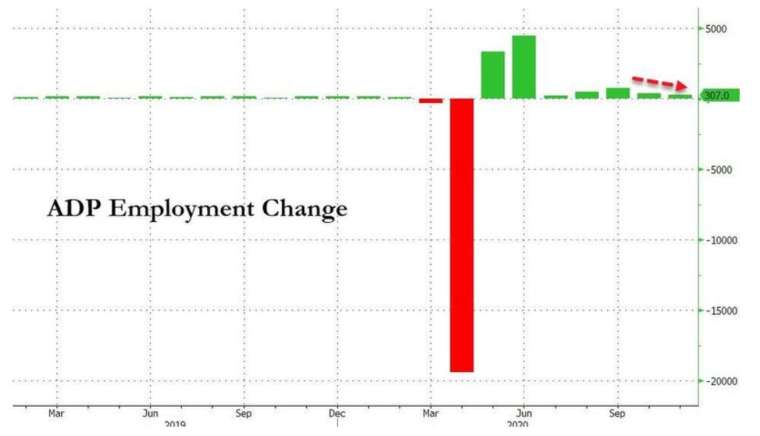

However, ADP announced on Wednesday that the number of new jobs in the private sector in the United States was 307,000, well below expectations. With the number of infections rising in the United States, the pace of job recovery is slowing and the outlook looks bleak. The US Department of Labor is scheduled to release the official non-farm report before the market on Friday (4).

While market sentiment was cautious, the US dollar index rebounded to 91.32 and the price of gold continued yesterday’s gains, climbing to $ 1,821 an ounce, breaking through $ 1,830 at the highest point of the day.

US congressmen resumed negotiations on the coronavirus aid package this week. The Speaker of the House of Representatives, Nancy Pelosi, and the Secretary of the Treasury, Steven Mnuchin, discussed by phone on Tuesday (1). We are at the end of October. For the first time since this conversation, Pelosi stated that she will review the new cross-party proposal with Mnuchin.

After multi-party lawmakers proposed a new roughly $ 900 billion stimulus package, Republican Senate Leader Mitch McConnel voiced his rejection on Tuesday, saying he would propose a smaller plan to Republican senators and I would listen to their opinions. .

On the news of the epidemic, the British government officially approved Pfizer to cooperate with BioNTech to develop a vaccine, which will be available next week as soon as possible. The two were up 2.7% and 5.9% respectively in the first trades.

The Federal Reserve Committee (Fed) will publish the Economic Beige Book at 3 am on Thursday (3) Taipei time.

Starting at 10:00 p.m. on Wednesday (second) Taipei time:

- The Dow Jones Index fell 203.55 points, or -0.68%, temporarily to 29620.37 points.

- Nasdaq fell 111.66 points, or -0.90%, to 12,244.79 points temporarily

- The S&P 500 Index fell 14.68 points or -0.40%, temporarily to 3,647.77 points

- Commissions and averages fell 11.07 points, or 0.41%, to 2,698.65 points temporarily

- TSMC ADR fell 0.12% to $ 100.74 per share

- Yield on 10-year US Treasuries increased to 0.939%

- New York light crude oil fell 0.04% to $ 44.53 a barrel

- Brent crude fell 0.04% to $ 47.40 a barrel

- Gold rose 0.15% to $ 1,821.70 an ounce

- The US dollar index rose 0.03% to 91.32 points

Focus actions:

Salesforce (CRE-US) fell 7.40% in early trading to $ 223.48; Slack (WORK-US) fell 2.08% to $ 42.93.

Salesforce decided to acquire Slack, a business communications software, for $ 27.7 billion in cash and stock exchanges, making it the second-largest acquisition in the history of the software industry, second only to the acquisition. from IBM for $ 34 billion from open source software provider Red Hat in 2018.

Under the acquisition agreement, Slack shareholders will receive $ 25.79 in cash per share, plus 0.0776 Salesforce common shares.

Pfizer (PFE-US) was up 2.56% in early trading to $ 40.42.

The UK announced on Wednesday (2) the approval of the new coronary pneumonia vaccine jointly developed by Pfizer and BioNTech. Vaccination is expected to begin next week, leading the world to become the first country to approve the use of the Pfizer vaccine, and it will be available for vaccination next week.

According to government guidelines, the first batch of vaccination targets are seniors and nursing home employees, people over 80, nurses, and NHS employees.

Palantir Technologies (PLTR-US) fell 16.21% in early trading to $ 21.51.

Morgan Stanley analyst Keith Weiss downgraded Palantir’s stock from “Equal Weight” to “Underweight” with a price target of $ 17.

Weiss issued a report indicating that Palantir is up 155% since its listing and its risk reward is absolutely negative than it is now. There are too many unsolved problems that cannot maintain the current high valuation, even if the reduction in operating expenses this year is a growth prospect Threaten, or if the company can expand its customer base.

Daily key economic data:

- In the United States, ADP’s small nonfarm farmers reported 307,000 in November, with an expectation of 500,000. The previous value rose from 365,000 to 404,000.

- At 11:30 p.m. Taipei time, the rise and fall of crude oil inventories from the EIA will be announced last week, the old value: 754,000 barrels.

Wall Street Analysis:

Forexlive said that the actual data in the ADP report was worse than expected, indicating that the official non-farm data on Friday (4) will face some downside risks.

Naeem Aslam, Avatrade’s chief market analyst, said good vaccines fueled the stock market rally yesterday, but it ended today. Investors are trying to stay cautious.

In response to the British government’s approval to use the new crown vaccine jointly developed by Pfizer and BioNTech, IG Senior Market Analyst Joshua Mahony believes the above news is not helpful in boosting investor sentiment.

Ingo Schachel, Commerzbank’s head of equity research, said it’s good news for Pfizer to get early approval, but getting approval to list in one country won’t have a broad impact on the market. After a recent strong performance, the stock market has shown to be Profit-taking.

[ad_2]