[ad_1]

The high price of shares of Tesla (TSLA-US) will not fall, which brings new problems to index funds.

Tesla has risen for 3 consecutive days, and this is the sixth time it has risen in the last 7 trading days. All because Tesla will soon join the S&P 500 Index on December 21. After the announcement, Tesla has risen. 41%, the current value of the stock market is approximately 543 billion US dollars, only slightly lower than Buffett’s Berkshire Hathaway (BRK.A-US), which has a market value of 547 billion US dollars. American dollars.

This means that Tesla will join the index as the fifth or sixth largest company in the S&P 500. The higher the value it receives, the more shares the index fund must buy and the more shares the index fund must buy. If there are more, more traders will buy Tesla shares in anticipation of the next wave of large-scale purchases, thus forming an upward spiral.

The S&P 500 is a market capitalization-weighted index. Market capitalization is adjusted by the number of shares outstanding (the number of shares that can be traded). When the Tesla Index was announced, its weight on the S&P 500 was about 1%. With the recent increase, the peso is close to 1.3%.

The index will buy $ 70 billion of Tesla stock on December 21. More importantly, because Tesla shares have risen much more than the S&P 500, they must now buy about 2 million Tesla shares.

This is a positive feedback loop. The potential risk is the price drop after being included in the index, but Tesla shares have no sign this year that they will fall in the long term. So far this year, Tesla shares are up roughly 585%.

However, indexation isn’t the only driving force behind Tesla’s stock price. Morgan Stanley analysts raised the rating on Tesla shares to “Buy” last week; On Wednesday, CFRA analyst Garrett Nelson raised Tesla’s stock price target from $ 550 to $ 650, a new high on Wall Street. .

Nelson said: “We believe the positive momentum from Tesla may continue in the near term thanks to strong tailwinds in the acquisition of index funds. Importantly, this continued growth means that the cost of Tesla’s capital advantage in comparison with their peers will continue. ” Expansion, because Tesla continues to build new factories, so this is crucial. “

He believes this may be another positive feedback loop for Tesla. The higher the share price, the fewer new shares Tesla must issue to build a factory, which in turn makes the cost of growth lower. After all, current shareholders don’t like any new share issue.

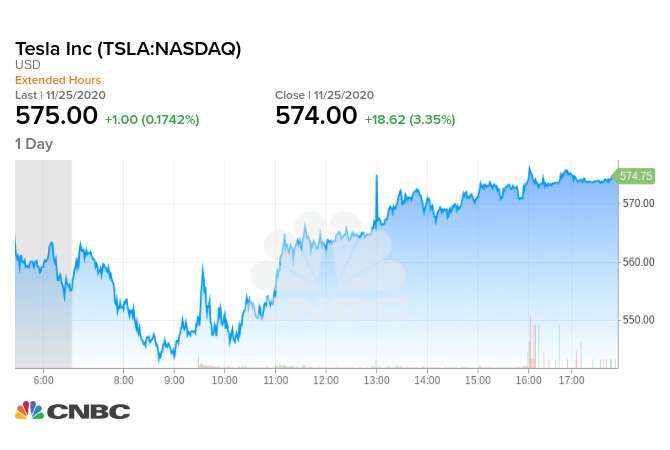

Tesla rose $ 18.62 or 3.35% on Wednesday to close at $ 574, setting a new 52-week high.

[ad_2]