[ad_1]

Wanbao Investment Gu Wang Rongxu said Taiwan stocks are performing like the best market ever. Although there is bad news about the new corona epidemic this year, Taiwan’s shares have not fallen, but have risen more than 4,000 points. Among them, more than 1,100 points have risen this month. You can see that the bull market is booming and the market has repeatedly made new highs. Some people in the market look at 15,000 points, and some claim 20,000 points. Although it is too early to tell, as long as the market can reach a high, it is Long, with no need to preset high points.

Economic recovery will be established next year. At the end of the year, there will be a wave of replenishment of foreign capital. In November, foreign investors bought more than 150 billion Taiwanese shares. Since the beginning of this year, foreign capital has sold more than 540 billion yuan. With the sale of foreign capital, the exchange rate of the new Taiwan dollar can rise to a maximum of nine years. Now foreign capital is hedging it heavily and the exchange rate of the new Taiwan dollar is not going to fall. The capital market remains unchanged and the market has no room for a big drop. The rest is stock selection.

Tech stocks are the most sensitive to the economy. South Korea and Taiwan focus on tech stocks. Since November, Korean stocks have risen 12.4%, and if they rise around 2%, they will hit a record high. Although Taiwan’s shares were up just 9.2% this month, they have already led the way and hit a record high. Philadelphia’s strongest semiconductor index rose 14.4% this month to a record high. Semiconductors are the most advanced in electronics. Who is the main? You can see the price of the shares.

Wanbao Investment Gu Wang Rongxu said that if foreign investors continue to buy TSMC (2330-TW), Taiwan shares are likely to rise but never fall. National investment is likely to be large and small. In addition to equipment stocks, semiconductor-related products include integrated circuit design, silicon wafers, and memory. Power semiconductors, as long as they perform explosively next year, will have a chance to increase.

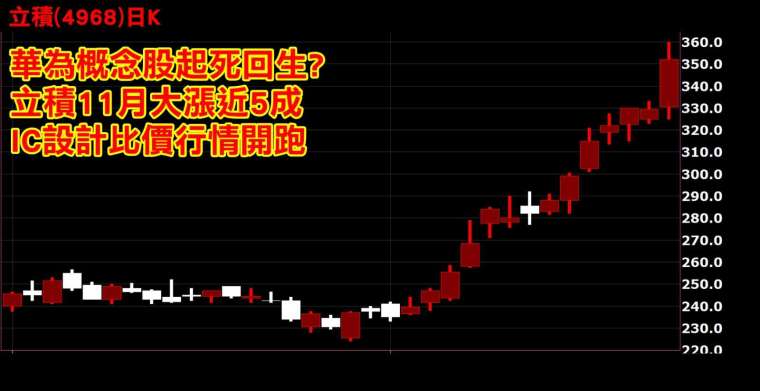

For example, the column analysis in early November is bullish on IC Design Liji (4968-TW). This month it was up 50%. It is one of the stocks that will rise the most in Taiwan in November. The share price at the beginning of the month was only a few yuan, but now it has risen to 360 yuan. In just a few days, the price difference exceeded 100 yuan. At the time, he was optimistic about Biden’s victory, and Huawei’s concept stocks had a chance to come back to life. In the past, Huawei accounted for 20% of Liji’s revenue, but after Huawei’s ban went into effect, the vacant capacity was immediately filled with orders from other customers. The situation is exactly the same as TSMC. This is a demonstration of its superior technological competitiveness.

Wanbao Investment Gu Wang Rongxu said that recently there are some integrated circuit designs more than 100 yuan, such as Andes (6533-TW), Crystal Phase Light (3530-TW), etc., have also increased considerably, and the market has started IC design price comparison. Due to space constraints, next week I will be conducting an in-depth analysis of more IC design stocks with explosive performance next year.

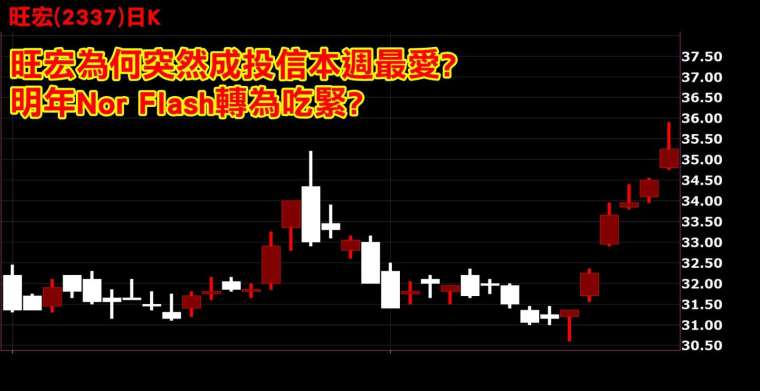

Memory is arguably the semiconductor group that hasn’t risen the most this year, however, as Micron’s share price has skyrocketed, Nanya (2408-TW) and Macronix (2337-TW) have seen the shadow of legal entities these days. Global capital spending on DRAMs has declined for two years in a row. Next year, with the 5G memory upgrade, DRAM prices are estimated to start to rebound, which is beneficial for Nanya. NOR Flash will also benefit from 5G mobile phone upgrades equipped with NOR Flash external OLED panel, and production will also be substantial growing.

In addition, the trend of the technology war between the United States and China has not changed. Zhaoyi Innovation’s global NOR Flash market accounted for 15%. It is about 10% of the total world production produced by SMIC, while Zhaoyi Innovation comes from overseas operations. Revenues go up to 80%, that is, once SMIC is controlled, foreign customers of Zhaoyi Innovation are very likely to transfer orders to Macronix or Winbond (2344-TW).

While Macronix’s technology leadership, tight supply of NOR Flash next year, and potential transfer opportunities, Macronix will benefit the most. Next year’s EPS is estimated to be between 3 and 3.7 yuan, and next year’s P / E ratio will be about 10 times. It is less than 18 times that of Nanya Branch and 25 times that of Winbond, it is worth following the market outlook.

There is more potential stock analysis, I’ll share it with my Line fan club readers, welcome to join.

Join Wang Rongxu fan group for free now and share more information.

Wang Rongxu, Chief Investment Officer Shopmaster FB Fan Group

http://bit.ly/2KGYiSg

Wang Rongxu, Chief Investor, Line Fan Group

https://line.me/ti/p/@marbo888

Wang Rongxu, Chief Investor, Telegram Fan Group

https://t.me/marbo888

The company and the individual values recommended and analyzed

No inappropriate financial interest ratio Past performance does not guarantee future benefits

Investors should make independent judgments, prudential assessments and their own investment risks.

[ad_2]