[ad_1]

Wang Rongxu, an analyst at Wanbao Investment Consulting, said the results of the US elections are becoming clearer and the funds are accelerating the return of funds to the stock market. Although the election results remain somewhat controversial, the market seems to have assimilated their doubts. The US Federal Reserve remains unchanged its estimates of monetary easing policy. The weakness of the US dollar will burn the Asian capital market. Stock picks get back to basics. Electronic stocks that have been affected by the weakening of US stocks are expected to

The fourth quarter of this year is different from previous years. Although the traditional off-season for upstream electronics has entered, there is a risk of a second pandemic due to the new corona epidemic this year, and downstream customers are more willing to stock up. Especially when CI design is short on smelter capacity, ordering visibility will be seen from Q4 now to Q1 next year, and you may not even be able to digest orders until Q2 next year. year.

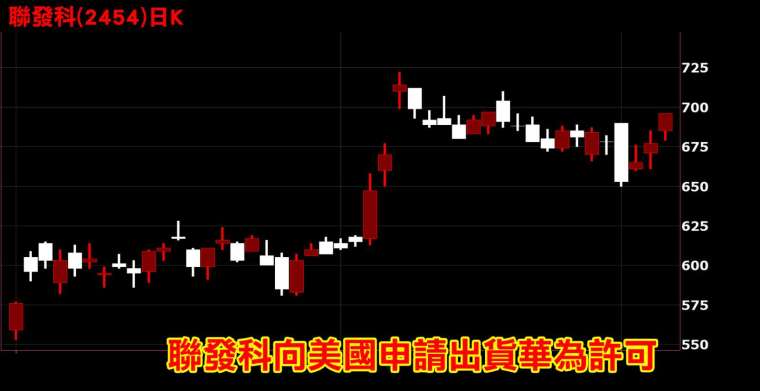

For example, the demand for 5G for power management IC panels and driver ICs has increased dramatically, leading to a severe shortage of 8-inch wafer production capacity. I previously reminded readers in a column that MediaTek (2454-TW) is a major manufacturer of power management ICs and will not only benefit from 5G this year and next. A large number of mobile phone chips are being shipped, and PMICs are also consuming orders. Now, the winner is whoever can get hold of the production capacity.

MediaTek recently announced that it will purchase semiconductor equipment directly and then sublease it to Power Semiconductor Manufacturing Co., Ltd., a subsidiary of Powerchip Group, to ensure hassle-free shipments. And MediaTek’s 5G mobile phone chips are about to welcome a bigger wave of replacement next year.

Global 5G mobile phone shipments are estimated to reach 500 million in 2021, which is double that of 2020.

MediaTek’s beautification removal trend in China remains unchanged, even if the United States relaxes its chip export ban, its market share in China continues to expand. MediaTek’s EPS is estimated to be around RMB 24 this year and RMB 36 next year. The growth rate is close to 50%, which is amazing.

The market has recently fallen below the pink line, and MediaTek’s small line of the month off has risen again. The final position is much higher than the market. If the estimated EPS for next year is compared to the current share price, the PE ratio is less than 20 times.

On November 5, the share price of power management integrated circuits manufacturer Silicon Power-KY (6415-TW), which reached a record 2,130 RMB, each legal entity expects EPS to reach 42 ~ 48 RMB the next year. If calculated at 48 RMB, the P / E ratio is now Up to 40 times, MediaTek’s evaluation is much lower than Silicon Power’s.

On the other hand, if it is determined that Biden is elected president of the United States, the market tends to interpret the relationship between the United States and China more smoothly. Ahead of the US elections, it was reported that if the relevant chips are not used for Huawei’s 5G business, the US will loosen standards. For example, Samsung obtained the right to provide Huawei with OLED panels, and Sony and Howe may also continue to supply Huawei with COMS image sensors. In the future, it is not ruled out that more chipmakers may resupply Huawei.

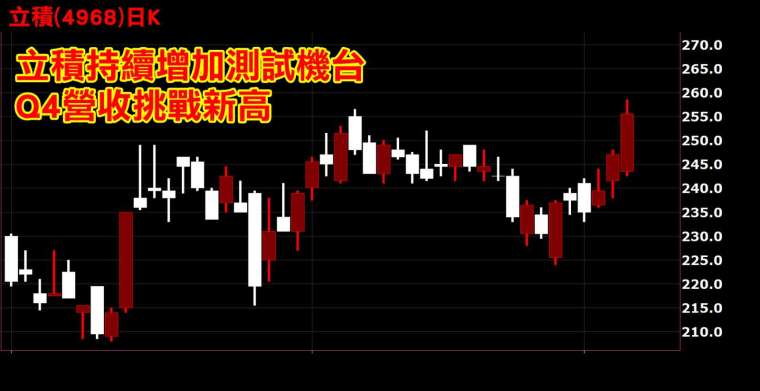

Huawei’s supply chain in Taiwan factories has weathered bad news after the frontal wave ban. For example, Novatek (3034-TW), Duntech (3545-TW) and Liji (4968-TW) are currently in short supply. If they can resupply Huawei in the future, their performance will be even higher.

After deducting Huawei’s order, Liji (4968-TW), a major IC manufacturer, made up for it immediately. Current production capacity is low. Third quarter revenue and earnings have reached a new high. Revenues in the first nine months of this year have increased significantly compared to last year. More than doubled, EPS for the first three quarters was 8.59 yuan, far exceeding 3.13 yuan for the full year last year. It is completely different from the negative impact of this year’s epidemic. Fourth quarter revenue is expected to hit a new record.

After entering 2021, the penetration of 5G mobile phones will accelerate, while the upgrade trend of home and office Wi-Fi routers in the 5G era will remain unchanged. The speed and bandwidth of high-end Wi-Fi 6 have increased. For the consumption of radio frequency front end modules (FEM), from 2 ~ 4 Wi-Fi 5 to 6 ~ 12, the adoption rate of Wi-Fi 6 will increase significantly next year, and the Liji production line will double. Liji’s EPS this year is estimated at 13 yuan. Without Huawei’s order, next year’s EPS will be 18 yuan, which will increase substantially. Based on the current share price, the ratio of PE next year is about 16 times, which is lower than MediaTek’s.

Wang Rongxu, an analyst at Wanbao Investment Consulting, said that with CI Wang Silic’s design stock rising and the share price breaking the 2000 mark, CI’s design group’s price comparison space has expanded one more time, and the market prospects are worth tracking down. There is more potential stock analysis, to be shared with LINE fan club readers. Welcome to join for free.

Join Wang Rongxu fan group for free now and share more information.

Wang Rongxu, Chief Investor, LINE Fan Group

https://line.me/ti/p/@marbo888

YouTube channel of Wang Rongxu, Chief Investor

https://www.youtube.com/channel/UCi-2okN64tcrY5F09E2pb1Q

Wang Rongxu, Chief Investor, FB Fan Group

http://bit.ly/2KGYiSg

Wang Rongxu, Chief Investor, Telegram Fan Group

https://t.me/marbo888

The company and the individual values recommended and analyzed

No undue financial interest ratio Past performance does not guarantee future benefits

Investors must make independent judgments, evaluate wisely and assume investment risks.

[ad_2]