[ad_1]

On Monday (21), under a series of negative attacks, with the rapid deterioration of the new corona epidemic in Europe, large-scale bank money laundering scandals sent financial stocks plunging, and stocks Americans were hit by a fierce Air Force attack in the opening.

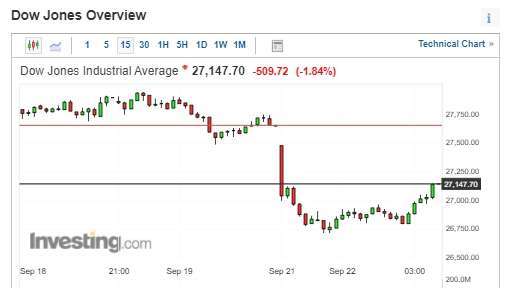

The Dow Jones suffered a massacre during intraday trading, once falling more than 900 points. Fortunately, investors were quick to buy the damaged tech stocks at the end of the trading session. Apple’s counterattack increased by more than 3%, helping the Dow Jones regain some of its lost ground. However, the four major indexes collectively remain Close Black.

The Dow Jones closed more than 500 points lower on Monday, its worst day since Sept. 8. S&P has fallen for 4 consecutive business days since February. Wall Street is expected to usher in a depressed month (September).

As for the bad news, US-China relations remain tense, with China announcing “Untrusted Entity List Regulations” last weekend. Foreign media reported that China is considering whether to publish a blacklist of US companies or announce it after the US elections and clarify the US political situation. Take action against the United States.

On Monday, US President Trump set conditions for cooperation between US companies and TikTok. After TikTok Global went public, Chinese ByteDance should not have any right of control (capital). Then the Chinese official media broke the news that the Chinese government would not approve the TikTok Oracle transaction.

Supreme Court Justice Ginsberg has passed away. President Trump plans to announce the list of candidates for future judges this Friday (25) or Saturday (26), asking the Senate to vote quickly before the general election.

This complicates the already turbulent US electoral landscape and further undermines prospects for the crown’s new stimulus bill.

The global epidemic of new corona pneumonia (COVID-19) continues to spread. Before the deadline, according to real-time statistics from Johns Hopkins University in the United States, the number of confirmed cases worldwide has exceeded 31.16 million and the number of deaths has exceeded 960,000.

The United States has confirmed more than 6.82 million cases and the cumulative number of deaths has reached 199,000. WHO stated that 156 countries have joined the vaccination program.

Monday (21) the performance of the four main stock indices of the United States:

- The US Dow Jones stock index fell 509.72 points, or 1.84%, to close at 27,147.70 points.

- The S&P 500 index fell 38.41 points, or 1.16%, to close at 3,281.06 points.

- The Nasdaq index fell 14.48 points, or 0.13%, to close at 10,778.80 points.

- The Philadelphia Semiconductor Index fell 6.70 points, or 0.31%, to close at 2,154.28 points.

The big five tech giants led earnings with Apple. Apple (AAPL-US) rose 3.03%; Microsoft (MSFT-US) was up 1.07%; Amazon (AMZN-US) rose 0.19%; Alphabet (GOOGL-US) fell 1.44%; Facebook (FB-US) fell 1.73%.

The constituents of the Dow Jones were bloody. American Express (AXP-US) fell 5.09%; Dow Chemical (DOW-US) fell 4.88%; 3M fell 4.83%; (MMM-US) fell 4.83%; Development Heavy Industries (CAT-US) fell 4.63%.

Fei’s semicomponent stocks were mixed. AMD (AMD-US) was up 4.02%; Intel (INTC-US) fell 0.34%; Micron (MU-US) was up 2.08%; NVIDIA (NVDA-US) was up 2.69%; Qualcomm (QCOM-US) was up 1.11%.

The ADR performance of Taiwan stocks has been uneven. TSMC ADR (TSM-US) rose 0.44%; UMC ADR (UMC-US) fell 1.38%; ASE ADR (ASX-US) fell 0.24%; Chunghwa Telecom ADR (CHT-US) was up 0.054%.

Featured Stock News

Several large international banks were suspected of “assisting criminals” in money laundering, transferring more than $ 2 trillion in shady funds, causing financial stocks to crash. JP Morgan Chase (JPM-US) fell 3.09%, Deutsche Bank (DB-US) fell 8.25% and HSBC (HSBC-US) fell 5.52%.

GE-US plans to exit the new coal-fired power generation market, which may include divestitures, site closures and layoffs. This news caused a shock to Qiwei’s share price and it closed down 7.70%.

The founder of electric truck maker Nikola (NKLA-US) announced his resignation and its share price plunged 19.33% to US $ 27.58 per share.

Huawei’s US competitor Cisco (CSCO-US) was revealed as China’s first wave of “untrustworthy entities list” targets, with its share price falling 1.93%.

Tesla CEO Musk tweeted after the market that Battery Day will debut tomorrow. This will affect the long-term production of the company, especially the Semi, Cybertruck, Roadster series, but the products launched will not be able to reach mass production until 2022. Tesla (TSLA-US) closed up 1.64% and fell more than 5% after the market.

Microsoft Lightning announced the acquisition of ZeniMax Media, the parent company of Bethesda, the publisher of The Elder Scrolls. Microsoft closed 1.07% higher at $ 202.54 per share.

ROKU (ROKU-US), a major broadcast equipment manufacturer, soared 17.67% The company added NBC’s OTT services streaming media platform Peacock to its platform.

Wall Street Analysis

Scotiabank’s Department of Economic Research stated that Trump has stated that he will announce the list of candidates for judges on Friday or Saturday and will seek to vote before the U.S. general election on November 3, leading to the possibility that the United States present an economic stimulus bill. Sex is reduced even more

Scotia Bank’s Economic Research Department explained that this measure can take up precious time in Senate administration and pre-election scheduling, at the expense of measures like a new round of economic stimulus bills. Yet even if the issue is resolved quickly, the Democratic Party’s spirit of cooperation may weaken further as the electoral stalemate intensifies.

Brad Kinkelaar, global portfolio manager for Barrow Hanley, said there are healthcare issues. In reality, we have not made any progress. Obviously, there is still no vaccine or cure. We continue to look for ways to deal with the new crown crisis.

[ad_2]