[ad_1]

Since the beginning of this year, Apple (AAPL-US) has gained considerable momentum. For retail investors, the stock split plan launched on Monday (31) has made Apple shares more attractive. However, past experience shows that, in the short term, investors seem to have no need to rush.

In early August this year, Apple became the first publicly traded company in the US with a market value of more than $ 2 trillion, with a price of more than $ 500 per share. The increase this year has reached around 70%.

To lower the investment threshold, in late July, Apple announced the fifth share split plan since listing, dividing 1 share into 4 shares. The dates and numbers of the four previous divisions are as follows:

- June 9, 2014: 1 share divided into 7 shares

- February 28, 2005: 1 share divided into 2 shares

- June 21, 2000: 1 share divided into 2 shares

- June 16, 1987: 1 share divided into 2 shares

Although the stock split is intended to lower the nominal price of the stock, after using the analysis tools, it is found that Apple stock is often sold shortly after the split.

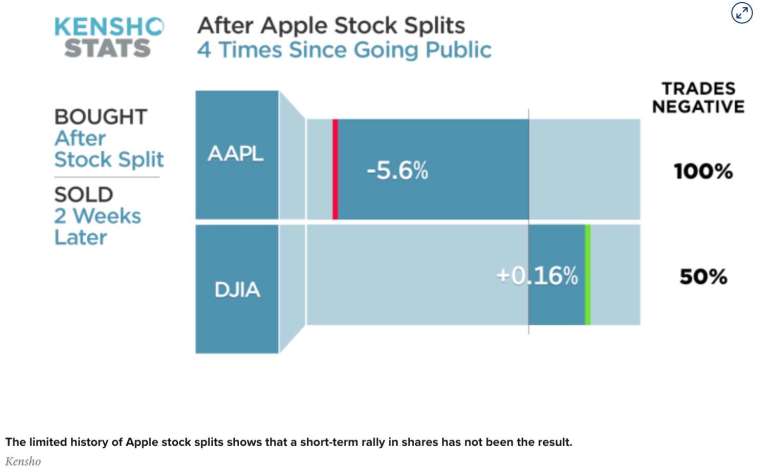

CNBC used hedge fund tool Kensho to analyze and found that from the last 4 experiences, Apple’s share price fell by an average of 5.6% after the implementation of the stock split two weeks after the implementation of the stock split, which is well below the market.

To be clear, the stock split will not change the fundamentals of the company. Although low-priced stocks may attract more small investors, large investors who hold stocks before the split still have a greater influence on stock prices. In addition, the general market environment is also critical After Apple’s previous stock splits, operations have also been affected.

CFRA chief investment strategist Sam Stovall recently stated that after the stock split in 2014, Apple was up 36% the following year, and after the split in 2000, hit by the bursting of the stock bubble technology, Apple fell 60%. Since the announcement of the last targeting plan at the end of July this year, Apple has risen more than 30%.

Stovall truly believes that Apple’s spin-off plan will help keep the share price higher. He told CNBC: “I think we will continue to grow and prosper under the influence of the Fed’s easing policy. Also, Apple’s share price is more important to retail investors. Easy to buy.”

As for Wall Street’s long-term bullish expectations for Apple stocks, they are primarily based on improving the company’s fundamentals.

Wedbush analyst Daniel Ives recently reiterated Apple’s “superior performance” rating. He believes that in the most optimistic scenario, Apple’s stock price is looking at $ 600. With the iPhone 12 supercycle approaching, within the next 12 to 18 months, the Among the 950 million iPhone users, around than 350 million iPhone users will prepare to upgrade.

[ad_2]