[ad_1]

“We see very limited upside potential for oil prices in the near term due to a smoother balance sheet, full oil inventories and a continued high level of OPEC + reserve production capacity,” DNB Markets writes.

However, for the second half of 2021, the bank expects the market to be clearly below expectations, which is one of the bank’s main arguments for oil prices during the fourth quarter of 2021 to be estimated at around $ 60 a barrel.

“The view of the evolution of the oil price is quite neutral in the short term, but we remain optimistic for the second half of 2021,” emphasizes the bank.

In a comment to Nyhetsbyrån Direkt, DNB oil analyst Helge André Martinsen states that the evolution of the oil price in the short term depends “very” on how the covid-19 vaccination is carried out and the production and vaccine distribution.

The downside risk (for the price of oil; red note) is related to the coronavirus mutations that have been recently noticed, which means that the vaccination process is characterized by increased risk. The same happens with the expected recovery in demand in 2021 ”, says the analyst.

When asked what price triggers are on the cards, Helge André Martinsen states that the focus is on the OPEC meeting, which is expected to take place on January 4 next year, where the outcome will be “important” for the development of the oil market.

“We expect OPEC, with its allies, to agree to a more modest continued reduction of current production restrictions, with a production increase of 0.5 million barrels per day starting on February 1 next year,” he said. the oil analyst.

According to recent statistics, released Tuesday night, US crude oil stocks rose by 2.7 million barrels the previous week.

The announcement initially caused oil prices to trade slightly lower on Wednesday morning, where another factor contributing to the price drop was that US President Donald Trump threatened not to sign the new package. of stimulus that is underway, because it thinks that the sum for direct payments is too much. low.

By around 11.30am on Wednesday, however, oil prices had rebounded and the price of Brent saw slightly above $ 50 a barrel, an increase of 0.9 percent, while US WTI oil cost $ 47, which also reflects a daily increase of 0.8 percent.

According to Kotak Securities, the Brent price support level is around $ 49 a barrel, but if trading falls below that level, it could mean a sharp price drop to $ 46 a barrel, Reuters reports.

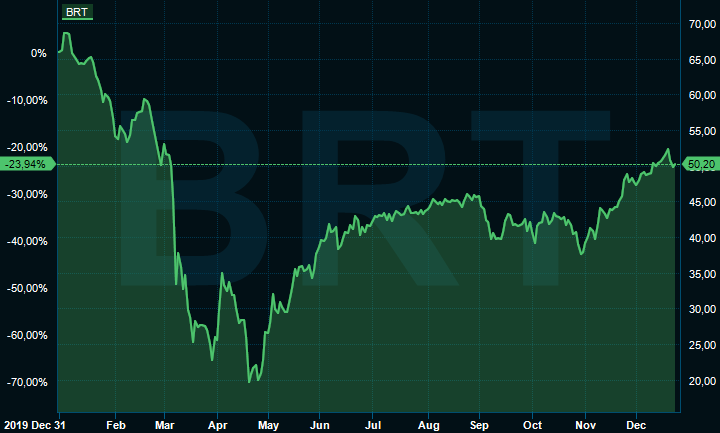

In 2020, movements in oil prices have been strong in the wake of the corona pandemic, and since the turn of the year, the price of Brent has fallen by a total of about 24 percent. In April, the price of Brent was at a low level for the year when a barrel cost 19:66 dollars. Since then, the price has increased by as much as 154 percent.

Graph: Evolution of the price of Brent oil since the turn of the year.

Bildkälla: opposite.