The Bulls assure the American consumer – and the stock market – will hold a fine, even if politicians fail to allow a second round of financial stimulus before next month’s election.

Some economists, however, are skeptical about how much electricity consumers will be able to buy after the accepted strong third quarter. Worryingly, a recent round of weekly data on unemployment claims shows that first-time applications for benefits have risen unexpectedly to a seven-week high and possibly. Indicates that the spread of Seaweed-19 in several states is again hurting the labor market.

Read: What will put the nail in the coffin of financial-stimulation? The Lander, perhaps

Jeffrey Schulz, investment strategist at Clearbridge Investments, said investors looking for comfort could turn their attention to retailing and reading on consumer confidence.

The Bulls were certainly pleased with the data, which showed a 1.9% increase in September retail sales, exceeding the consensus forecast produced by economists’ Dow Jones Newswire survey by more than 0.7%. On top of that, the University of Michigan’s Consumer Price Index had an initial reading of .21.2 this month, up from .40 in September, the highest since March, even though it is below epidemic levels.

Shares rose following Friday’s data, breaking a three-day losing streak and allowing the Dow Jones Industrial Average to average DJI.

And S&P 500 SPX,

Third direct weekly gain on each log. The Dow rose 0.1% for the week, ending at 28,606.31 on Friday, while the S&P 500 rose 0.2% weekly and closed at 3,483.81. Nasdaq Composite COMP,

The week ended 0.8% higher at 11,671.56.

Expectations of strong sales and rising confidence in the third quarter will be dashed as the લાભ 600 supplementary weekly unemployment benefit expires at the end of July.

“Our concern was that customer spending was declining as the excitement faded and checks closed,” said Richard Grassfeder, senior portfolio manager at Boston Pvt.

Grassfeder said he was surprised by the resilience of American homes, noting that consumer spending in August was only 3% lower than in February.

Meanwhile, rising consumer confidence readings, especially the front-facing component of the gauge, are more common in the mid-to-late stages of economic recovery than in the early part, Schulz said – a development that drives strong home and auto tones. Sale.

What keeps you afloat?

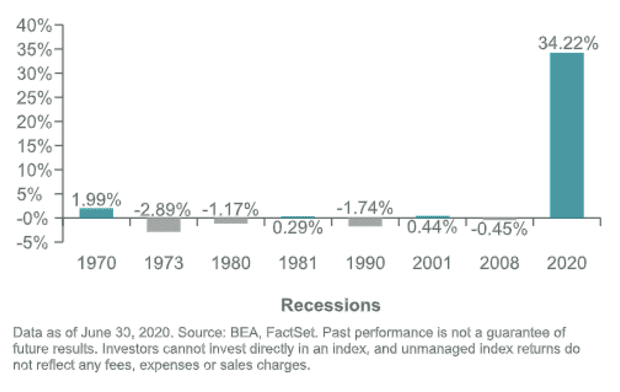

Bulls argues that the best customer, in general, is in good standing. Strong rounds of coronavirus assistance implemented earlier this year during the ths depth of the epidemic lockout helped increase disposable income. Not heard of during the recession, but the scope was particularly impressive, said Schulz, who illustrated the issue in a recent note with the chart below:

Clearbridge investments

Meanwhile, the U.S. rescue rate from the epidemic was high, while shops and services were closed. The rate has come down after reaching the peak of Aking 33 ..% but historically the historical high has been 14.1%.

“Consumers, despite the challenges, are in a reasonable shape to adapt to the 2008 financial crisis. It depends on the personal situation of some people but from a truly broad-based perspective, “Michael Arrow, chief investment strategist at State Street Global Advisors, said in an interview.

Aro introduced an economic stimulus package deployed earlier this year to boost revenue and savings with lower fuel prices, cheaper borrowing costs.

Skeptics claims that the data masks an uneven picture and that second-round coronavirus aid could be the last hurdle until September’s retail data is approved.

Without another stimulus package, “which is now very likely to be finalized this year, disposable revenue will decline rapidly in both Q3 and Q4,” Jefferies warned economists Anita Markowska and Thomas Simmons.

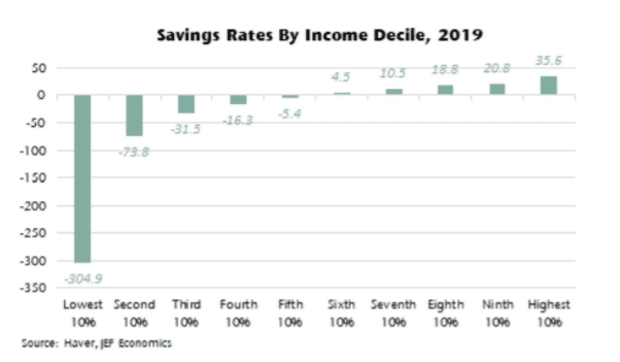

The problem, they said, is that when savings rates are raised, excess savings are largely concentrated in high-income households and will not cushion those who rely on unemployment benefits (see chart below).

Jefferies

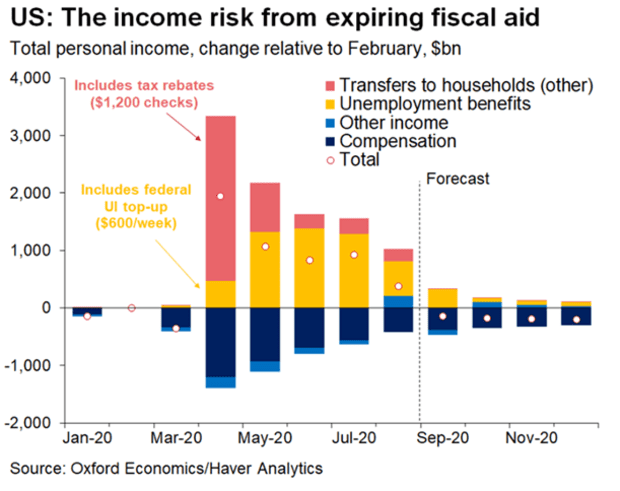

Economists at Oxford Economics were also reporting a significant drop in consumption in the coming quarters, excluding immediate financial relief.

“The forthcoming elections pose a reversal and detrimental risks to the economy, but the failure to support income by 2021 will expose the US consumer to autumn and early winter,” he wrote (see chart below).

Ox Oxford Economics

Weaknesses can be short-lived, he said.

Markowska and Simmons are looking for consumer spending to show zero growth in the fourth quarter, but, they wrote, “the blue-wave season is now with a base case, a more liberal fiscal package is likely to occur in January, which will likely cause spending spending to accelerate.” The “Blue Wave” refers to the growing expectations of investors and analysts that if Democratic challenger Joe Biden wins the November 3 presidential election, his party will retain control of the House and take over the Senate.

Failure by Washington to deliver an aid package in the first quarter would be a potentially damaging “policy error,” Schulz said. But it is a mistake that could potentially be avoided, he said.

Meanwhile, the economic momentum seen in the third quarter is a way to explain the more than 50% increase in the market from the bottom of the March 23 epidemic. And that’s why the Bulls are confident that the pullback that equities had to endure in September will be any near-term hurdle, buying opportunities.

“The gap between the market and the economy has closed and, contrary to expectations, that economy has closed that gap,” Schulz said.

The coming week will give investors a chance to pick up on the economic momentum, as well as more flow into third-quarter earnings. Housing begins in September and building permits are due on Tuesday, while the Federal Reserve’s fictitious economic activity badge book compilation is due to be released on Wednesday.

Thursday will bring a second round of weekly unemployment claims information and will be closely watched after recent figures show unexpected growth.

.