Those eligible are due by September 30 to enter their information online. They can expect the payments to be issued by mid-October, the IRS said Friday.

Many Social Security beneficiaries, as well as recipients of railway pensions and veterans, are not required to file tax returns because their income is below the employment threshold. While these people received their $ 1,200 incentive payment automatically, they may have missed the extra $ 500 per dependent because the IRS did not have that information on file.

It puts the families of an estimated 600,000 child dependents at risk of missing the payment, according to an estimate by the Center for Budget and Policy Priorities.

Those who missed the April deadline but used the non-file tool until May 5 need not take any further action and can also expect to receive the extra cash in October, the IRS said.

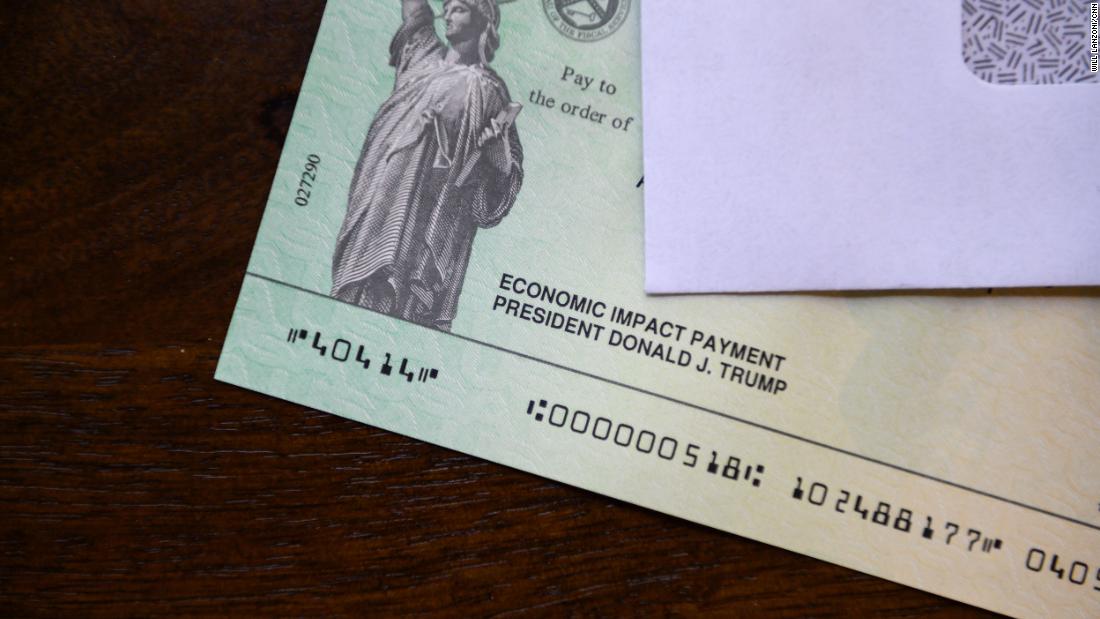

Those who received their original payment via direct deposit will deposit the extra money into the same account. Others will receive a check.

Any beneficiary who misses the September 30 deadline will have to wait until next year and claim it as a credit on their 2020 federal income tax return.

.