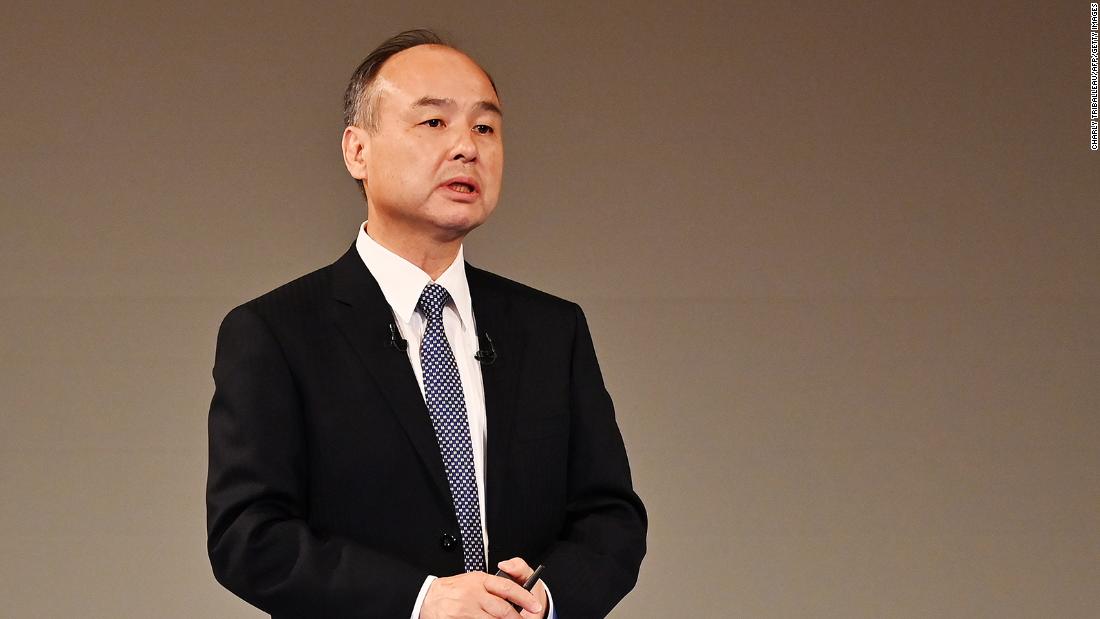

“A lot of people were concerned,” Son said Thursday, referring to how badly the Japanese conglomerate hit in the past fiscal year. SoftBank reported an annual operating loss of 1.36 trillion yen ($ 12.7 billion), the worst of all, due to a series of technology bets that went wrong and the coronavirus pandemic.

Son’s tone on Thursday during an online meeting of SoftBank shareholders was more optimistic than last month when he reported the company’s record losses. He added that people thought the company was “Softpunku”, using Japanese word games that can roughly translate to “SoftBankrupt” in English.

Son said Thursday things are getting better: SoftBank’s holding value rose to 30 trillion yen ($ 280 billion) this week, about 2 trillion yen ($ 18 billion) more than at the end of March. .

“However, I pushed and that is my responsibility. I should accept a cut,” Son said. “The judgment for my other executives must be comprehensive.” Son earned 209 million yen ($ 1.9 million) during the last fiscal year, a 9% pay cut compared to the previous year. He said he would take a 50% pay cut this year to 100 million yen.

“We will continue to be a long-term investor in Alibaba,” said Son.

The Chinese e-commerce company is the crown jewel of SoftBank’s investment portfolio, and Son con Ma’s rise has been legendary. Son invested $ 20 million in Alibaba 20 years ago, turning that bet into one that was worth $ 60 billion when Alibaba went public in 2014. Son referred to Ma as a “friend and partner,” and said last month that the two had dinner each month before the coronavirus pandemic to discuss life and business.

.