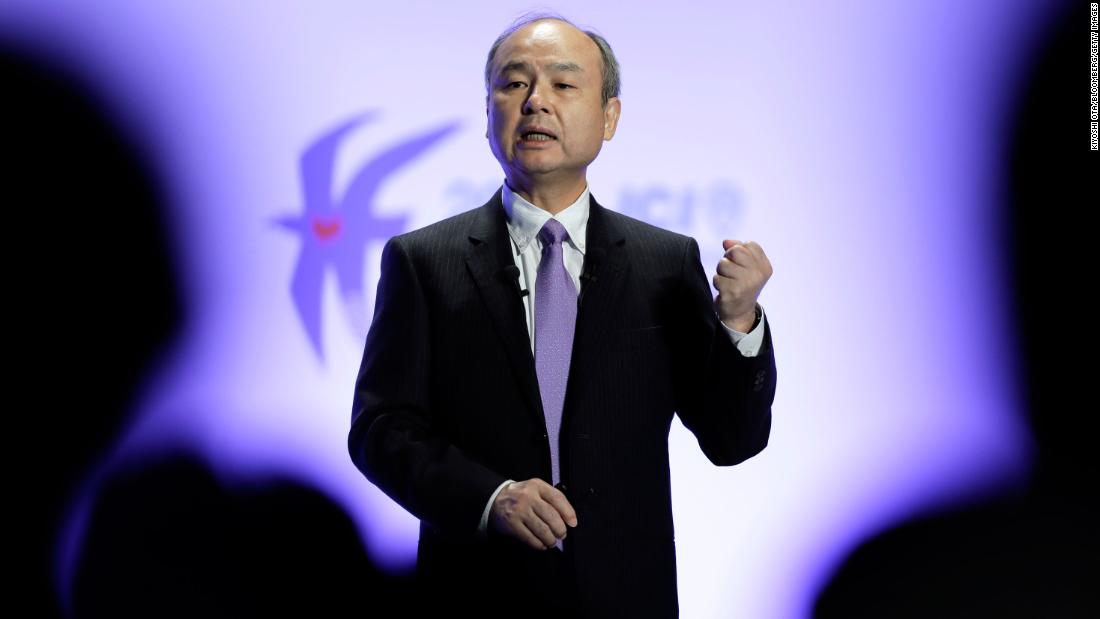

Effective vaccines and Covid-19 treatments could come soon, the CEO of Softbank said, adding that they are currently pessimistic about the second and third wave outbreaks worldwide.

“This is the first time in our history that so many assets have been liquidated as quickly as possible,” he said.

Before a coronavirus treatment or vaccine becomes available, “some big company may crash” and produce a “domino effect” in related industries, he said, clarifying the issue using the collapse of Lehman Brothers.

“I still want to be prepared for a bad situation, that’s why we have about $ 80 billion in cash today,” the son said.

The tech tycoon also invests in established tech companies, a move he insists is consistent with his long-term strategy of betting on the upcoming artificial intelligence revolution.

“Unicorn, public or private, [it] Never mind “I just want to bet on the AI revolution,” the son said.

Some bats have already gone sour. Softbank reported a loss of 131.7 billion yen ($ 1.3 billion) in the six months ended September last year on “investments in listed stocks and other instruments.” During the earnings presentation, Sone described his company’s latest strategy of investing in highly liquid, blue chip companies and derivatives products as a “pilot program.”

The founder of Softbank is known for investing heavily in private tech startups, a strategy that has garnered both huge rewards and confusion in public over the years.

The son said, “We’ve lost a lot of money, billions of dollars. And that’s my fault.”

“But luckily, we have a few other hits [investments]. Overall, we are still positive, “he said, adding that he hopes the Vision Fund will make Softbank even more money.

SoftBank said in a filing last week that the huge investment vehicle backed by Saudi Arabia had increased by 141.4 billion yen (4 1.4 billion) in the six months ended September, Softbank said in a filing last week. The filing did not disclose which company the funds came from.

.