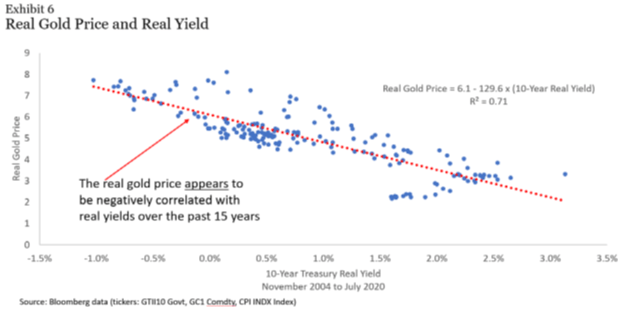

Fueled by concerns raised by the COVID-19 pandemic, the massive fiscal and monetary reactions to it, and negative real interest rates, we hear again and read stories about investors flocking to gold as a safe haven and / or inflation hedge. As of August 15, 2020, the SPDR Gold Shares (GLD) ETF had more than $ 78 billion in assets under management. Negative real rates are important because, as you can see in the following table, there has historically been a negative relationship between real interest rates and gold prices.

Given the current situation, it is no surprise that I, as Chief Investigating Officer of Buckingham Wealth Partners, have received many questions from both investors and advisers about investing in gold. As always, we look to the evidence to help us make decisions. Let’s just do it.

As you can see in the following table, the recent review in gold has traded at historically high levels in real terms.

How important is the real price of gold in terms of future returns? In their 2015 study “The Golden Dilemma,” Claude Erb and Campbell Harvey found that “the real price of gold was a more important driver of future nominal and real gold yields than the realized rate of inflation.” With that in mind, is now a good time to buy gold? Erb, Harvey and Tadas Viskanta, authors of the August 2020 paper “Gold, the Golden Constant, COVID-19, ‘Massive Passives’ and Déjà Vu,’ analyzed the historical evidence to help investors determine the answer to that question.

She began by noting, “Since 1975, periods of high real gold prices have occurred in periods of heightened concern about high future price inflation.” She added that the recent rally has led to the real (inflation-adjusted) price of gold currently being about twice as high as in January 1980 and August 2011 – two other periods when investors were worried about inflation risks . She also added that “five years after the peak of real prices in January 1980 and August 2011, the nominal (real) prices of gold fell by 55% (67%) and 28% (33%), respectively.” The final rule is that “high real gold prices are usually followed by low real gold yields.”

They also found that “on a five year time horizon the performance of gold is almost completely explained by variation in the real price of gold.”

Based on that finding, Erb, Harvey, and Viskanta hypothesized that “fluctuations in the nominal price of gold are likely to remain largely due to the real price of gold, not inflation, despite the time horizon.” Given the relationship, what is the market forecast of future inflation? We can see that in the burglary rate of burglary – the difference between the return on 10-year nominal treasuries and 10-year TIPS. As of August 15, 2020, it was about 1.7 percent.

These findings lead the authors to the conclusion: “The very real price of today suggests that gold is an expensive inflation hedge with a low prospect real return.” She added this caution: “If gold in 1980 and 2011 did not reward inflation for fear, why would it now be afraid of inflation?” However, they added this extra note of caution: “‘Massive passive’ ETF financing of gold holdings could introduce a period of ‘irrational prosperity’.” The authors showed that more than three years after Fed Chairman Alan Greenspan declared in 1996 that the market was irrationally exuberant, valuations were 40 percent higher. To emphasize this point, they have noted that the rise in the real price of gold is very correlated with the rise in demand from buyers of gold ETFs.

Finally, Erb, Harvey and Viskanta concluded: “Since the launch of gold futures trading, the real price of gold has averaged about 3.8.” It has been traded around 7.8 times since the publication of her paper. Since then, it has been going up. They noted that if gold returned to its ‘golden constant’, despite inflation, then reversal would have a dramatic negative impact on future returns. Assuming a 10-year horizon, the effect would be -6 percent per year. This is shown in the following table.

Summarizing their thoughts, Erb, Harvey and Viskanta stated: ‘Movement in the price of gold has been a useless prediction of future inflation. Both in 1980 and in 2011, high real gold prices coincided with general perceptions that future inflation would be significant. Those extensive views went wrong. Perhaps this time is different and one economic legacy of the COVID-19 will be a decade of high inflation. Just as in 1980 and 2011, an expectation of high future inflation has already been built into the price of gold. What happens to the price of gold in the coming decades will be largely determined by what happens to the real price of gold. They added these caveats: “If too much money chases too little gold, then the more the gold holdings of ‘massive liabilities’ grow, the higher the real price of gold could increase. Of course, gold holdings can trade through non-massive liabilities to to reduce the real price of gold. ”

Hopefully, the above evidence and analysis will help you make an informed decision if you want to include an allocation for gold in your portfolio.

Announcement: I / we have no positions in named shares, and no plans to initiate positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.