[ad_1]

Thousands of employees and retirees will soon be able to check whether or not they get a backlash.

The tax return is sent in random order on different days.

– 4.9 million will receive the tax return between March 16 and April 7, but we will not send it on weekends or at Easter, explains Marta Johanne Gjengedal, division director in the Tax Administration.

Hundreds of thousands of people will receive their tax return on Tuesday, March 16.

With focus on for the time being

The tax ruling looming this spring has not been set in stone.

It is the preliminary calculation of the Tax Administration of whether you paid too much, too little or the correct tax in 2020.

Then it’s up to you to work through the tax return to see if you can get rid of the hangover or increase the amount you have on your credit.

Master of Business Administration Siw Slevigen recommends the deduction guide when verifying the tax return.

Photo: Private

– There are many who never review the tax return, and I think it is about the fear of being wrong. Taxes can be difficult and scary. I thought so too the first time I had to hand it over, admits MSc Siw Slevigen.

Now she knows better.

– The fear of doing something wrong in one’s finances is the biggest money thief. Then we do nothing and then we lose money, he emphasizes.

The sooner you open the tax return and verify that the numbers are correct, the faster you can get money into your account.

– I use the deduction guide. It is ingenious and simple. You don’t have to know everything about your finances and all the deductions you haven’t received. The deduction guide tells you which deductions are appropriate and only takes a minute, she says.

Is it about a better economy?

How to get a lower mortgage rate

Please wait for the email

You will receive an email when your tax return is ready. Then you can log in and check if you’ve received a backlash.

– Early tax settlement was available on April 2 of last year. On June 11, more than 1.9 million had received the amount they had to their credit, says Marta Johanne Gjengedal from the Tax Administration.

Photo: Karina Kaupang Jørgensen

– There really is no point in logging in before being informed that a tax return is available. If you try, you will get to a page that tells you that it is not available yet and that you should wait for a message, explains Gjengedal.

But it’s worth checking, checking, and delivering early. So the money also comes earlier.

Last year, almost 2 million received the tax assessment before June 11.

Then we too

a new tax return that is easier to complete.

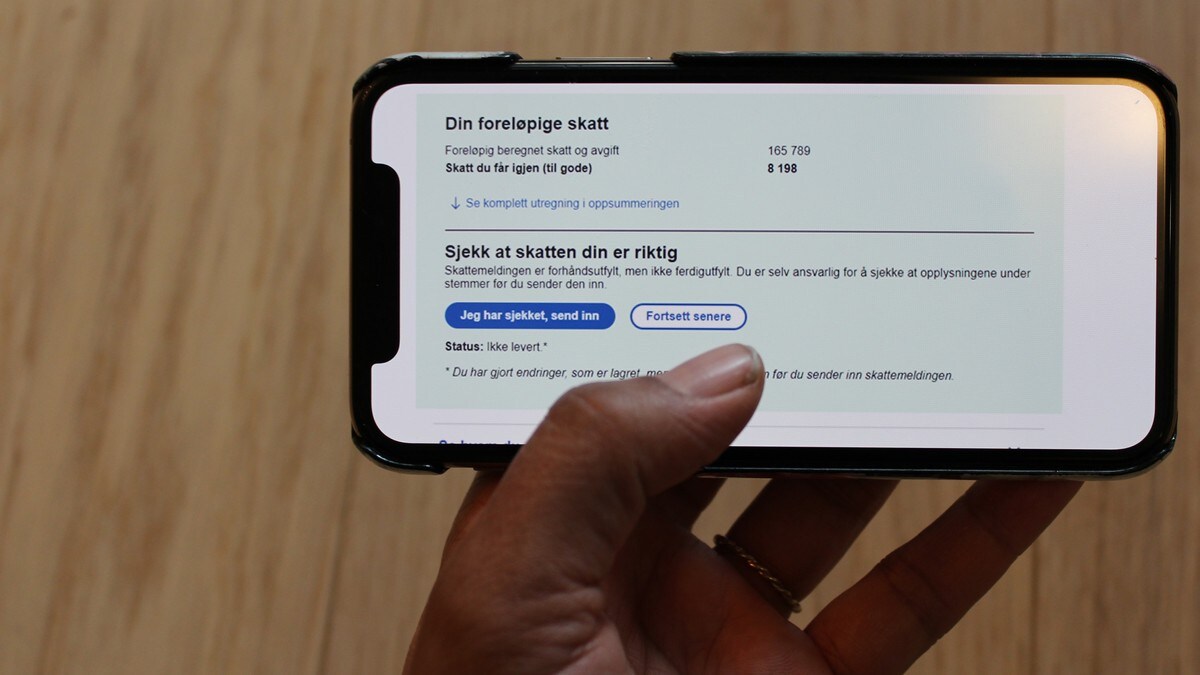

– You will see the preliminary tax calculation with income tax or residual tax at the top of the screen. If you change a number on the tax return, you will see an updated tax calculation on the tax return immediately, says Gjengedal.

The new tax return is interactive and

helps you do things right.

The sections of the tax return are:

- Work, social security and pension

- Banking, loans and insurance

- Housing and assets

- Family and health

- Finance

- Donation and inheritance

- Personal relationships

The tax authorities have done this to make verifying the tax return as easy as possible for you. If you need help, there are many good guides on these pages.