Welcome to the offer will not keep up with the edition of Natural Gas Daily!

EIA published its short-term energy shortage this week and one thing that is not surprising to anyone looking at the natural gas market is that EIA expects production to continue to fall.

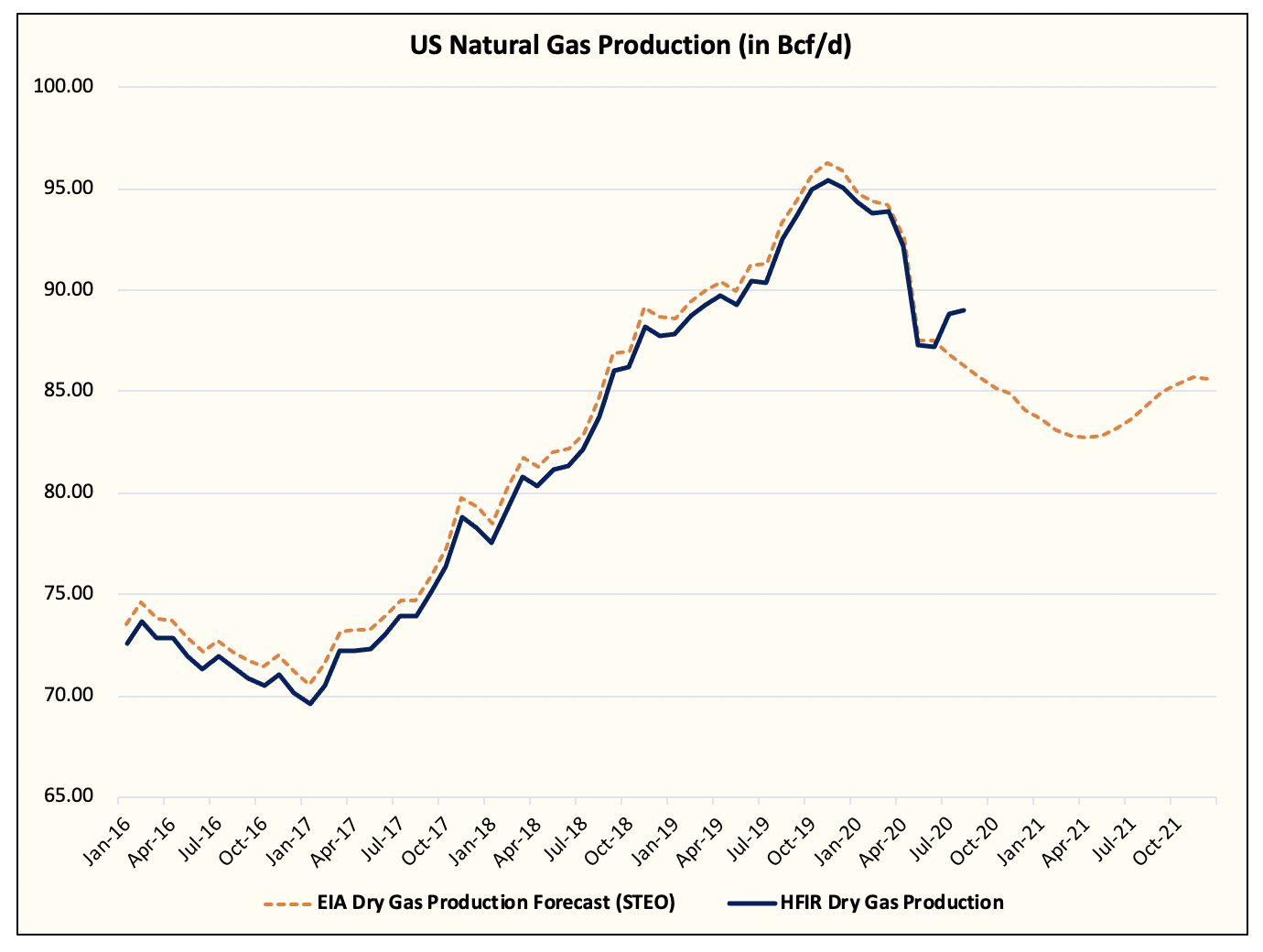

Source: EIA, HFI Research

Based on EIA’s latest estimate, lower 48 production has dropped to ~ 83 Bcf / d before returning to ~ 85 Bcf / d at the end of 2021.

While we are seeing a similar trajectory, one thing to note is that the recent projection of EIA pointing to a continuation in the decline in production for July and August has not come to fruition. As a result, EIA is likely to have to revise its estimates higher.

For us, we are still seeing a move to ~ 84 to ~ 85 Bcf / d by year, which is higher than our preliminary forecast for ~ 83 Bcf / d.

Although we can quip about the small movements in production figures, the end result is that lower 48 production will continue to trend lower. As a result, we see supply not kept up with a recovering demand base.

Based on our estimate, natural gas fundamentals in the US will be similar to those we saw in early 2019 when demand for heating materials was higher for Dec / Jan. Note that, even under a normal warming scenario, we should see the same deficit for the 2020/2021 winter season.

This means that anything we end up in storage by November will be irrelevant thanks to the material shortage we will see at the end of the year.

Intuitively, this also makes sense considering that LNG exports in Q4 are likely to average ~ 8 to ~ 9 Bcf / d while the production decline recedes.

At some point in the next two months, the market will have to start manufacturing in this outlook, assuming that production trend takes down. The STRIP for 2021 is likely to reflect closer to $ 3 to $ 3.5 to stimulate higher production, which the market will surely look to see how producers respond.

If fiscal discipline is the new name of the game, then we NG producers should see that production stays flat while we use too much FCF to pay debts. If not, the market will punish them by lowering prices for lower for 2022 and beyond.

First of all, there is a lot of skepticism that NG producers will do the “right” thing. NG producers worldwide have subsidized NG consumption through expenditure and cash burning at the expense of shareholders. Will this time be any different? We’ll have to wait and see. But for the duration of 2021, none of this will matter because it takes time to bring production online.

What is the point we get?

Keep long bias tactical for natural gas. Although the upside up close is tempered, the trajectory will remain biased towards the upside in the coming months. Water will play an important role, but given the fundamental dislocation, bias would have to be upside down, unlike the 2019/2020 weather which had a fundamental surplus.

We are now offering a free 2 week trial!

For readers interested in tracking natural gas facilities, HFI Research Natural Gas offers premium:

- Daily fundamental updates for natural gas.

- Weather updates.

- Energy ideas.

- Real-time natural gas trading.

For more info, please see here.

Announcement: I am / we are long PVAC. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.

Additional disclosure: We have long been PVAC in the NG trading portfolio.