Welcome to the lower edition of Natural Gas Daily!

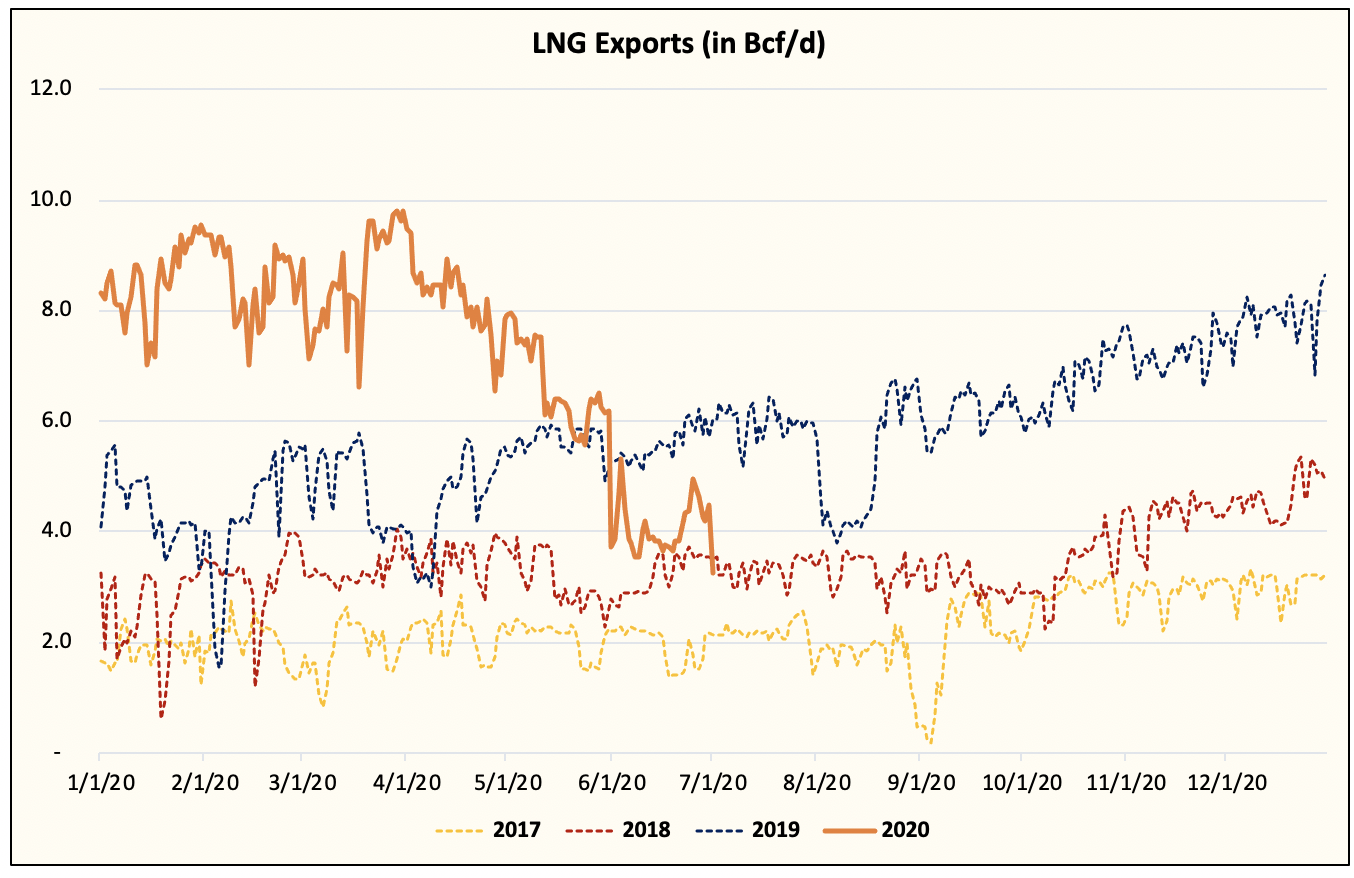

It’s a messy background and in early July we were able to take a look at the LNG export nominations. Right now, the LNG feed gas is operating at ~ 3.25 Bcf / d ~ 0.9 Bcf / d below the June average. The average for this month should be closer to ~ 3.6 to ~ 3.8 Bcf / d, but the lower figure is causing merchants to start worrying about the storage tank cap in the United States again.

When you’re worried, you don’t need a good reason to sell it. The difference between 3.8 Bcf / d and 3.25 Bcf / d is 0.55 Bcf / d. Over the course of nine weeks, this equals ~ 35 Bcf in storage. Again, this is really irrelevant in the grand scheme of things, but when you’re in a messy background, they sell you for no reason.

In our opinion, the weather side is largely moving in the right direction with much more heat than expected.

CDDs are expected to be materially higher than average with a very favorable 15-day outlook.

Source: WeatherModels.com

We really like the settings on the weather side.

So our focus is really on production right now.

Lower production of 48 has bottomed in the short term and has recovered to ~ 88.34 Bcf / d. If production remains at this level for the next week without moving to ~ 89 Bcf / d, then we can become “very” bullish. In early July, US oil production is expected to return, so if the volume for associated gas production does not rebound, July balances will at least be very tight.

The demand for energy consumption is also expected to move to a record high in the coming weeks.

We should eclipse ~ 45 Bcf / d by the second week of July.

All in all, NG is still in a messy bottom process, but with much warmer than normal weather, the key is to look at production figures. If we don’t see a big rebound, prices will rise very sharply. Once again, the limit is around the LNG economy for September, which is materially higher than today around ~ $ 2.35 / MMBtu.

Go long NG with a twist

We started a new long position in natural gas today through a long EQT. We write here why we like EQT.

Given that our analysis on the natural gas market points to a limited bullish scenario in the short term, while the medium-term outlook is much more favorable thanks to the decrease in production, we opted for a long EQT instead of UNG.

Furthermore, EQT demonstrated strong relative price action with a break of the downtrend today. We will be looking for a short-term hike of $ 17.

For readers interested in following the fundamentals of natural gas, HFI Research Natural Gas premium offers:

- Daily fundamental natural gas updates.

- Weather updates.

- Energy ideas.

- Natural gas trading in real time.

For more information, please look here.

Divulge: I am / we are long EQT. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.