(Bloomberg) – National Grid PLP PPL. Corp. agreed to buy the UK electricity distribution business for 8 7.8 billion (10. 10.9 billion), a move that would transform the company as it prepares for a low-carbon future.

How the UK’s largest utilities transaction in a decade, how to navigate a shift from fossil fuels to electricity, has become a crucial grid outside the nation.

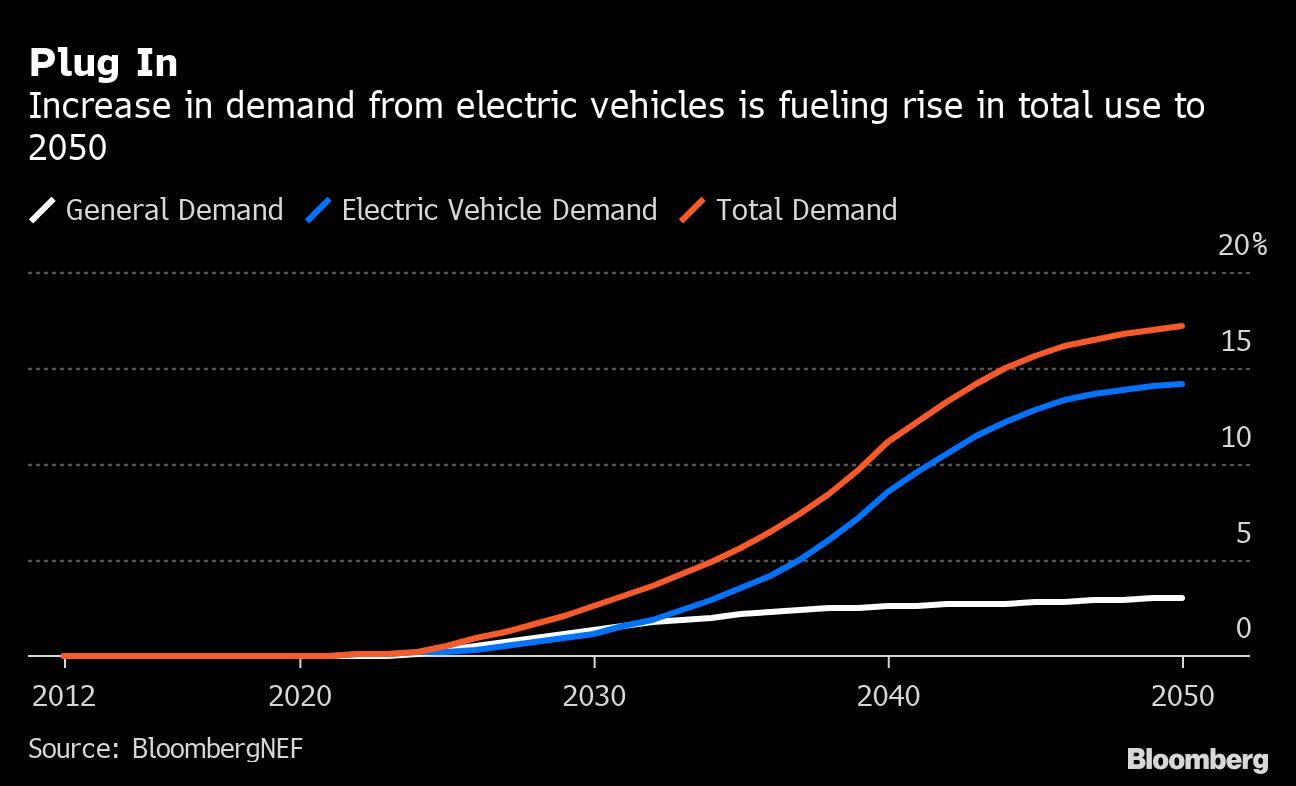

The distribution grid, the local networks that feed directly into homes and businesses, is at the heart of the energy transition. Smart homes with electric heating systems, as many as 30 million electric cars and a small-scale renewable generation, will be connected to local grids in the coming decades.

“This has dire implications for the UK and the national grid in terms of the transition,” Chief Executive Officer John Pettigrew said in an interview. “We believe that the growth we see in the distribution sector is likely to be stronger and more precise and longer than other elements in the energy sector.”

In a separate deal, the network manager agreed to sell Narganset Electric in the U.S. to PPL for an equity value of .8 PP.8 billion. National Grid also announced that it intends to sell its majority stake in its gas grid business by the end of this year.

WPD sales attracted the interest of various companies. According to Rand Rand Brazier, director of innovation and electricity systems at the Energy Networks Association, the government’s environmental pledges attract investors to the distribution grid.

“Ultimately, it runs from net zero,” he said. “Because people are connecting all these new technologies to the distribution grid.”

Local network businesses are about digitization, decarbonization and decentralization. They are all surrounded by a net zero, he said.

The completion of the WPD deal, which will be funded by debt financing through debt, is expected in the next four months and NECO sales are expected to be completed before the end of the first quarter of 2022. National Grid said it plans to start selling. Processing of its gas unit in the second half of this year.

Once the deal is completed the national grid portfolio is 70% electricity, 30% gas, Petigru said. Fossil fuels are fast becoming the next target of climate policies in the UK to effectively eliminate emissions by 2050

Western Power supplies electricity to more than 7.9 million UK customers in the Midlands, South West and Wales.

The national grid has a commitment to reach net zero for space one and two emissions. It plans to reduce space three emissions by 20% from the 2016 baseline to 2030 to reach customers through its network.

It is possible to reduce the carbon in the fuel stored in its gas network by hydrogen. The utility is currently looking at how it can replace burning hydrogen by piping natural gas through its network to domestic heating.

“We see this transaction as a positive step for the national grid,” John Musk, an analyst at RBC Europe Ltd., said in a note. In addition, the market will need time to “digest” the deal.

In London, the stock fell 1.9% to 815 pence by 9:25 p.m.

(Updates with full chart and context)

For more articles like this, please meet us at Bloomberg.com

Subscribe to stay ahead with the most trusted business news source.

21 2021 Bloomberg L.P.