Investment thesis

Microsoft (MSFT) continues to move forward, even if the market doesn’t appreciate it: Microsoft’s pace of innovation continues to amaze.

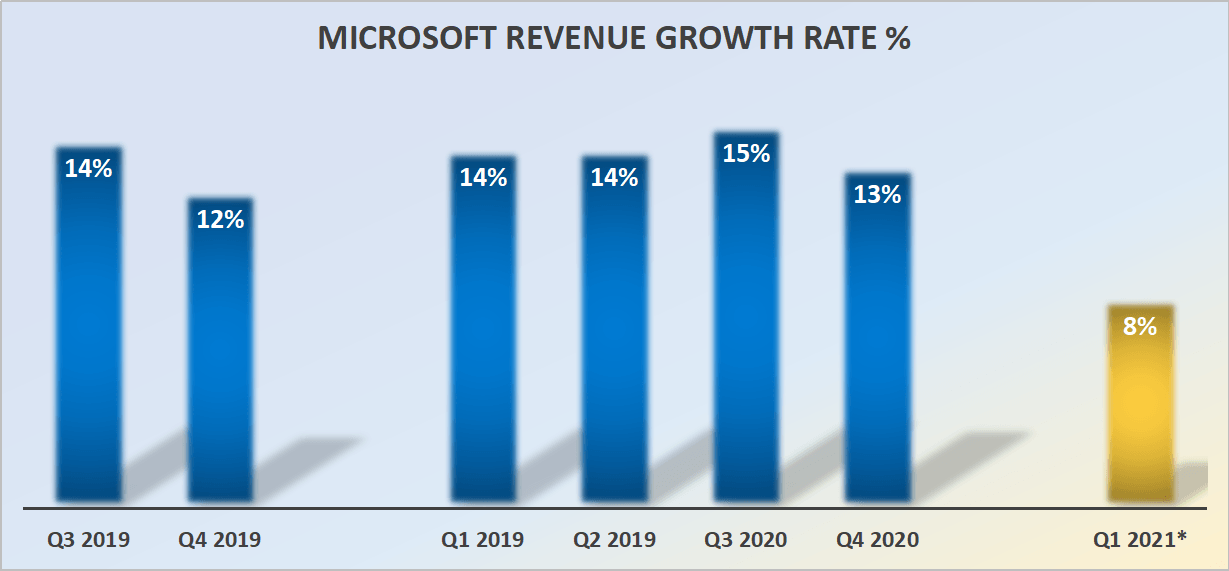

Microsoft at 33 times earnings is a much better investment opportunity than many stocks. Although its guidance for the first quarter of 2021 puts Microsoft increasing its revenue by less than 10%, there is still a great opportunity for Microsoft.

Investors would do well to consider this action. This is why:

Powerhouse continues with power ahead

Source: author’s calculations.

At a time when many companies have to pull out their guidance, Microsoft confidently pulls out its guidance for the next quarter at 8% (see above).

As you’ve no doubt already looked for (and probably immediately), Azure still increased 50% year-over-year, currency-adjusted in the fourth quarter of 2020.

Although Microsoft is much more than just Azure, investors have become obsessed with that revenue stream. Is it a problem that Microsoft’s smart cloud segment (which includes Azure) is guided at the high end to increase 18%?

Source: author’s calculations, company orientation at the top end.

In the short term, the market wanted plus. But short-term investing hardly ever offers a rewarding investment opportunity. Successful investing is about predicting future cash flows and buying them at a discount.

Microsoft is like a bonus in digitizing the future

Few companies can grow more predictably in the next 5 years. There is a lot of excitement on Wall Street. Right now, every company that facilitates the digitization of the modern workforce is getting a crazy multiple. Why?

Because the market is mostly correct. There is a great opportunity to assist companies in their digital migration, and not just in the US, but globally.

But ultimately, no matter how smart the workforce is, only companies with the best distribution systems and brands will be able to consistently gain market share.

That said, the problem for Microsoft is whether it can be nimble enough to specialize and meet the needs of an increasingly fragmented work environment. That is the question to which it is difficult to know the answer.

Microsoft CEO Satya Nadella believes that Microsoft can. During the earnings call, Nadella accuses Microsoft of continuing to accelerate the pace of ‘innovation to meet customer needs’.

Cash flow? Still To import?

For a long time, I have wondered if future cash flow really matters or if unprofitable income growth is the way to go. Realistically, I still don’t know the answer.

Right now, the marketplace essentially argues that only revenue growth matters and that having a path to profitability is ‘boring’. And I don’t know, maybe this is the new normal?

However, I am a value investor. For me, cash flows will always be important. And while I follow numerous companies (as you’ve probably already noticed!) I prefer to miss out on a lot of the favorites and position myself with companies with a clear path to free cash flow generation.

On this front, Microsoft does not disappoint.

Valuation: Strong stability trading at a discount

Source: author’s calculations.

The graphic above illustrates two different underlying themes. On the one hand, that multiple investors are willing to pay for Microsoft continues to expand slowly and steadily.

On the other hand, we can clearly appreciate that Microsoft trades at a significant discount for many of its peers.

For example, Slack (WORK), the crowd favorite, trades for approximately 25 times more sales; consider not earnings, but substantially unprofitable sales. The idea behind Slack is, of course, that its sleek communication platform is capable of consistently taking away market share from Microsoft teams. An idea that has a grain of truth, but has been massively exaggerated.

Ultimately, there are some companies that you just don’t try to beat, no matter how much fanfare there is on the sales side of Wall Street.

Microsoft’s ability to essentially outperform the Slack communication platform and redistribute it is almost too easy. In part, I’m kidding with this point, there is a lot I like about Slack, but if I was a gambling person, I think Microsoft teams will do well in the next 5 years.

Nadella notes that Microsoft Teams continues to innovate and go beyond the workforce, with its recent expansion to make it highly accessible to friends and family. In essence, Teams is much more than a working tool.

And that buying Microsoft at this point in the game with about 33 times more profit is a far superior idea than buying many other high-flying ‘new era’ stocks at 33 times sales.

The bottom line

Many readers would reply that they should have bought Microsoft earlier. That’s true, but I’m still struggling to invest in hindsight.

I explain why I state that Microsoft still has a promising future ahead of it. Even if it doesn’t generate very strong revenue growth, however, it oozes the growing free cash flow.

Finally, I argue that Microsoft is still undervalued.

Strong investment potential:

Investing is about increasing our savings and avoiding risky investments. Be highly selective when choosing a diversified portfolio of opportunities.

Invest very easy

I do the hard work of finding a select action group that increase your savings.

- Honest and trustworthy service.

- Hand service provided.

- Very simply it explains the stock selections. Helping you make the most of the investment.

- Useful tips along with videos.

Divulge: I / we do not have positions in any of the actions mentioned, but I can start a long position in MSFT for the next 72 hours. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.