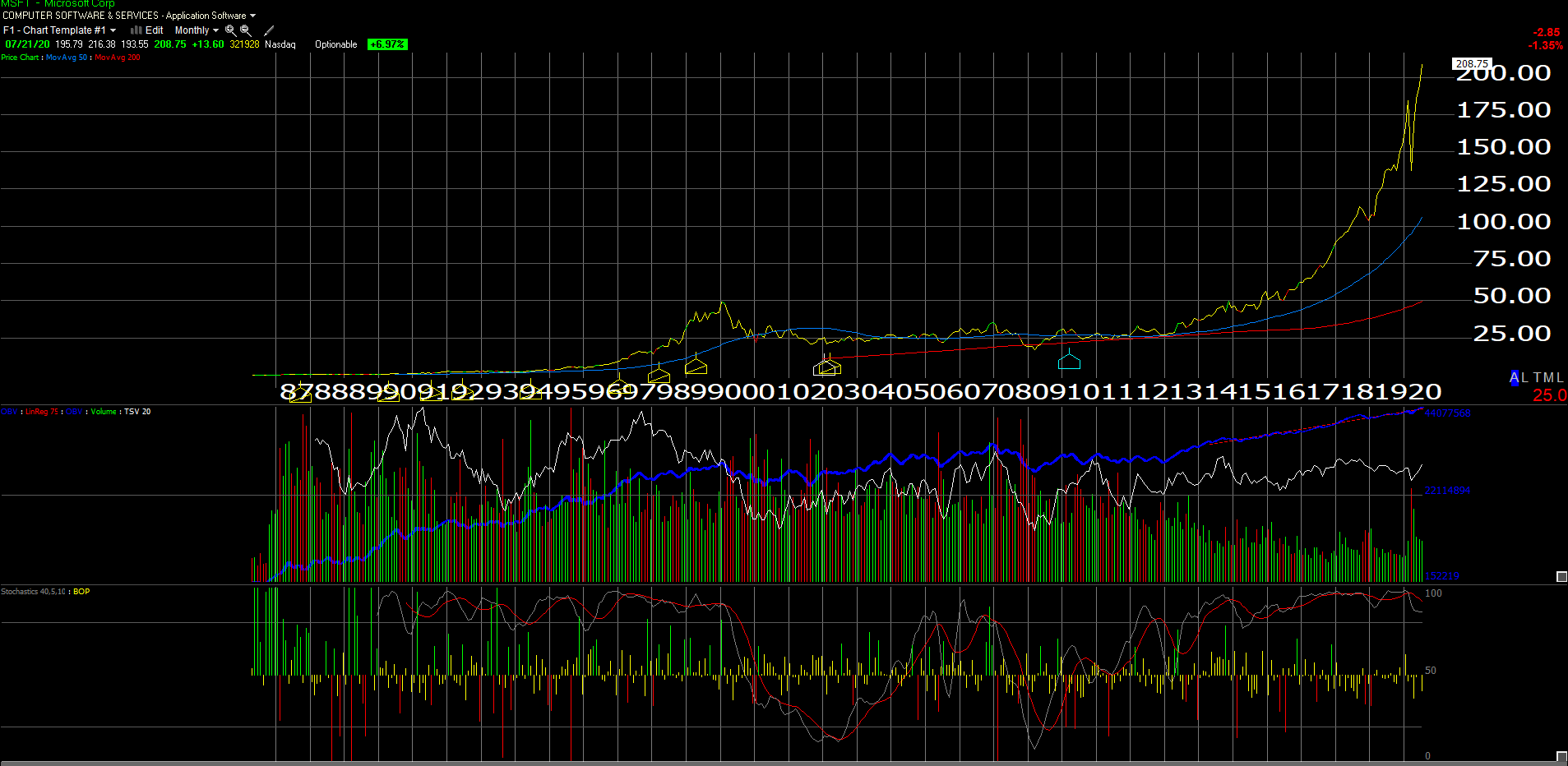

A earnings preview is generally not done with a chart, but in the case of Microsoft (MSFT), I think it’s warranted.

(Source: Worden Charts)

In Microsoft’s historic bull market from the mid-1980s to January 2000, where, according to the chart above, the stock price peaked at $ 53.81 in January 2000, with the catch that despite the rising earnings and earnings per share each year thereafter, Microsoft’s stock price did not permanently exceed the January 2000 high until mid-2016. And as readers can see, the last 4-5 years speak for themselves .

Microsoft is in a second historic bull market run, largely based on Azure and the turn to the cloud that Satya Nadella accomplished after ValueAct acquired a 1% stake in Microsoft in April 2013 and Satya was named CEO. in the next year.

The company has double the advantage of the installed base of the 1980s and 1990s, which is still 2/3 of the business and growing very well, and then adds the ‘Smart Cloud’, which is 1/3 of the revenue, but operating income The growth of the last 4 years has been stellar:

Table 1

(Source: internal valuation spreadsheet)

I would like readers to take note of the section “Operating Income Growth and / and” and then find the Smart Cloud line. Check that growth rate since March 2016.

Table 2

(Source: internal valuation spreadsheet)

As the Smart Cloud has taken off, it also (not so casually) has the operating margin.

EPS and income estimates

| Q4 ’20 Est. | Q3 ’20 | Q2 ’20 | Q1 ’20 | |

| FY ’23 EPS Est. | $ 7.74 | $ 7.45 | $ 7.76 | $ 7.62 |

| FY ’22 EPS Est. | $ 7.17 | $ 7.16 | $ 7.27 | $ 6.97 |

| FY ’21 EPS Est. | $ 6.24 | $ 6.21 | $ 6.31 | $ 5.93 |

| FY ’23 Est. EPS growth rate | 8% | 4% | 7% | 9% |

| FY ’22 Est. EPS growth rate | fifteen% | fifteen% | fifteen% | fifteen% |

| FY ’21 Est. EPS growth rate | 10% | 9% | eleven% | 12% |

| FY ’23 P / E | 27x | 24x | 22x | 18x |

| FY ’22 P / E | 29x | 25x | 24x | 20x |

| FY ’21 P / E | 33x | 29x | 27x | 23x |

| FY ’23 Rev. Est. ($ Billion) | $ 192.4 | $ 183.2 | $ 191.6 | 194.7 |

| FY ’22 Rev. Est. | $ 175.5 | $ 175.5 | $ 178.4 | $ 174.5 |

| FY ’21 Rev. Est. | $ 156.6 | $ 156.5 | $ 159.0 |

$ 156.2 |

| FY ’23 Est. Rev. growth rate | 10% | 4% | 7% | 12% |

| FY ’22 Est. Rev. growth rate | 12% | 12% | 12% | 12% |

| FY ’21 Est. Rev. growth rate | eleven% | eleven% | 12% | eleven% |

(Estimated source: IBES data by Refinitiv as of 07/21/20)

Looking at the last 4 quarters of estimate revisions, the first column being current estimates just before earnings release on Wednesday July 22, 2020, readers can clearly see the multiple expansion that has occurred at Microsoft as the P / E in the 2021 tax estimate it increased from 23x 3 quarters to 33x just before earnings release.

While that is a slight negative, the positive is that for fiscal year ’21 and ’22, revenue estimates have been fairly stable during the pandemic, which was somewhat surprising to see.

Conclusion summary

As of the last quarter, over 10% of MSFT’s market capitalization as of 03/31/20 was in cash and cash equivalents, and unlike banks, tech giants have no such restrictions on share buybacks.

There are many reasons to worry about Microsoft’s position as Stock 1 or 2 ranked by market capitalization in the S&P 500, as that group has been red hot all year and has captured much of the attention of the mainstream media. . The reversal on the Nasdaq 100 last week on Monday, July 13, 2020 caught the attention of many people, and the Nasdaq’s relative strength has since faded.

Apple (AAPL) is in a 20-year bull market, Facebook (FB) faces serious branding issues, and others, Google (GOOG, GOOGL) is receiving the attention of various state attorneys general, while Microsoft appears to be pushing less. the radar and avoiding the bad press.

The Street expects $ 1.34 in earnings per share on $ 36.5 billion in revenue for MSFT’s fourth fiscal quarter ended June 30 when the company reports its financial results after the close on Wednesday night, July 22, 2020. , for an expected annual growth of 11% and 8% respectively. The EPS number has dropped a few cents since the March quarter, but the consensus revenue estimate of $ 36.5 billion is actually slightly higher than it was 90 days ago, despite COVID-19.

How many companies do you know that report that both EPS and revenue growth remain positive at 11% and 8% respectively in a quarter in which the S&P 500 EPS is expected to drop 40%?

Fiscal fourth quarter ’20 and fiscal quarter ’21 (the next twelve months) still have to do with smart cloud and Azure. Microsoft remains at the sweet spot in the cloud market and at # 2 on Amazon Web Services (AWS).

Cloud adoption is only accelerating, thanks to COVID-19 and the pandemic.

Paying 33 times ’21 tax earnings for a stock expected to grow 10-15% always seems salty, but the estimated revisions have held up pretty well over the past 90-180 days.

MSFT reports on Wednesday 7/22, after closing.

Divulge: I am / we are long MSFT. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.