[ad_1]

He presented the state of health of the economy and possible scenarios for future developments on Friday.

“The baseline scenario for the eurozone is almost 9%. Contraction of gross domestic product. We see that a contraction is also forecast for all the main economies. The environment is such that, under the influence of COVID-19, the economic recession of This year will be the largest in modern history, beating the shocks of 2008, ”he said.

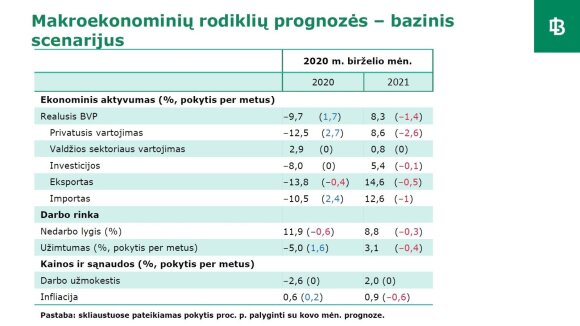

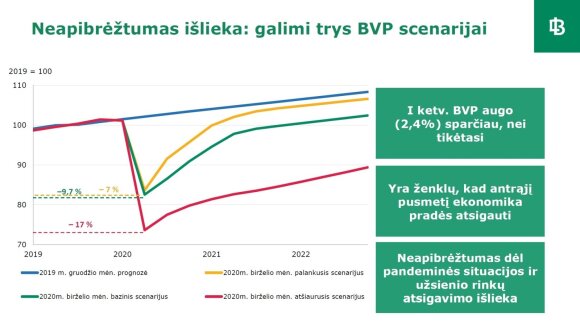

According to the updated database of the Bank of Lithuania, vol. and. The most likely scenario is that Lithuania’s GDP will fall 9.7 percent this year. At the end of March, GDP in the baseline scenario is forecast to decrease by -11.4% in 2020.

“The smallest decline is forecast for a relatively good first quarter GDP result (+ 2.4%), not as strong as the expected decline in trade (-14%) and industry (-12.5%) in April, which it will probably be the worst month for the country’s economy. “Recent economic indicators (decrease in employment since the beginning of May, recovery in population movement and domestic demand, decrease in electricity consumption) show that the economic situation has stabilized last month and will begin to recover in the second half of the year, “the central bank said in a statement.

The baseline scenario is based on the assumption that strict quarantine measures will be lifted in May and that demand and the economy will recover relatively slowly. Due to the impact of the pandemic, the unemployment rate is expected to rise this year to 11.9, the average wage will drop 2.6 percent, and inflation will hit 0.6 percent.

Previously, inflation was projected to hit 0.4% in 2020, wages would drop -2.6%, and the unemployment rate would hit 12.5%.

“Recent signs from the economy suggest that the darkest scenario will be avoided. However, uncertainty about the prospects for economic recovery remains high, and the consequences of the pandemic are the greatest risks to the stability of the financial system,” said the report.

Other scenarios

Under the favorable scenario of the Bank of Lithuania, GDP is projected to decrease by 7%, based on the assumption that the global outbreak of the virus will be controlled fairly quickly and that the global and Lithuanian economies will gradually return without significant negative consequences to long term. This scenario, although optimistic, is not very far from reality, which makes it close enough to the reference scenario.

“In the worst case, GDP would decline by 17%. It is assumed that the spread of the virus in the world cannot be controlled until medical means are invented to combat the virus. Therefore, the activity of global economies and Lithuanian remains moderate and, in the long run, the economic potential is more damaged, ”the report reads.

Finance system

According to the Bank of Lithuania, the consequences of the COVID-19 pandemic are currently the greatest risk to the country’s financial system.

“According to the economists of the Bank of Lithuania, the loan portfolio of the companies directly affected by COVID-19 amounts to around 4 billion LTL. EUR, that is, and around 40 percent. Corporate loan portfolio. Rapid response measures and accumulated corporate reserves helped companies resist the liquidity shock caused by the quarantine in Lithuania: the share of companies in financial difficulties increased relatively little in April, but did not change in early May, “he said The report.

However, the consequences of the pandemic worldwide will reduce the export opportunities of Lithuanian companies and may pose a risk to their solvency in the future. The announcement of the quarantine has had a significant impact on the Lithuanian credit market.

The flow of new loans decreased, the volume of loans with deferred payments increased. Within 10 weeks after quarantine was introduced, the flow of new home loans decreased by 30%, consumer and other loans by 37%, and business loans by 17%. However, the demand for loans is already returning to normal, with data showing an increase of around 18% in May compared to April.

“The decision of the Bank of Lithuania to reduce the countercyclical capital reserve ratio for banks by 1% also improves opportunities to lend to companies and individuals. up to 0 percent. The risk of the consequences of COVID-19 in the financial system will be limited by the improvement in the financial situation of companies and banks for a decade and responsible loans, which has prevented the formation of credit bubbles.

Banks have a strong capital buffer and companies have sufficient reserves to withstand a short-term liquidity shock. It is true that compared to the previous crisis, companies depend much more on indebtedness (commercial loans and corporate loans, totaling more than € 12 billion) than on bank financing (around € 9 billion). If the effects of the pandemic were to continue and the chain of agreements between them began to break, it would pose additional risks to corporate finances.

Recent stress test results suggest that banks are well prepared to withstand the economic shock. Even if the harsh scenario were to materialize, although the banking system’s capital adequacy ratio would drop by almost 10%. points, but would still have a margin above the minimum requirements. Banks could also support a third of deposit withdrawals, i. and. even five times more than the largest deposit decline in history during the previous crisis. At that time, deposits in the banking sector decreased more in October 2008, by 6.2 percent ”, announces the central bank.

It is strictly prohibited to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, DELFI must be cited as the source.

[ad_2]