[ad_1]

Next year, up to 4 billion will be opened between state revenues and expenditures. The hole in the euro is 3.3 times bigger than this year, which translates into a deficit of public administrations that we have not seen in a long time.

The state budget revenue projected for 2021 is 11,385 million. including 2,260 million euros. 15,499 million euros from the European Union and other international financial aid. euros.

Valdo Kopūstas / 15-minute photo / Vilius Šapoka

Finance Minister Vilius Šapoka, presenting the draft budget for 2021 to the Seimas on Tuesday, confirmed that next year’s Lithuanian budget indicators will be one of the best in the European Union (EU).

“We will be among the countries where both the budget deficit and the debt level will be the lowest,” emphasized V. Šapoka.

We will be among the countries where both the budget deficit and the level of debt will be the lowest, emphasized V. Šapoka.

Meanwhile, members of the Seimas made various comments and questions regarding next year’s draft budget: how to increase the volume of foreign investment, why is investment in municipalities decreasing, why is public spending increasing or why Revenue growth is so carefully projected for years to come.

Complained about this year’s unspecified budget

Conservative Jurgis Razma at the Seimas lamented that it would have been easier to estimate the budget for 2021 if the government had revised this year’s budget.

Photo by Rokas Lukoševičius / 15min / Jurgis Razma

“This is the only case where those discrepancies with the approved budget have not been adjusted. In addition to twists and turns, please answer if you could not do it, if you did not want to, if it was determined by political decisions, the instruction of the Prime Minister “J. Razma asked the Minister.

In response to the MP’s rebuke, V. Šapoka responded when he heard this question for the tenth time. According to him, the budget scheme does not foresee how to deal with such an emergency, but the situation and the forecasts have changed very quickly.

“We would have repaired it several times in a couple of months. We would not do anything else, we would only change the budget,” replied the minister.

Meanwhile, Algirdas Butkevičius was surprised that in 2021, he was forecasting 5 percent. from budget deficit to GDP, the Ministry of Finance has already planned less than 3% for 2022. of the GDP deficit.

Photo by Sigismund Gedvila / 15min / Algirdas Butkevičius

“List at least 2-3 measures to reduce the fiscal deficit by 2 percentage points in a year,” asked A. Butkevičius.

V.Šapoka expected that the increase in revenue collection due to economic growth would help reduce the deficit as early as 2022, but Social Democrat Rasa Budbergytė noted that extremely cautious revenue growth is forecast in the coming years.

Photo by Lukas Balandus / 15min / Rasa Budbergytė

The MEP wondered if there were no longer targets to get more income out of the shadows. In answering this question, V. Šapoka admitted that reducing the shadow is not realistic at this time.

“We need to be realistic. When the years are more difficult, especially after a year of crisis, the shadow tends to grow. We are not registering such signs at the moment, but for the shadow to reduce and we can calculate additional income, it is necessary make decisions that are sent to the Seimas: a constructor card or new measures, if the new majority will present them, ”suggested V.Šapoka.

Why will public spending increase?

According to the Finance Minister, the draft budget has been drawn up in the presence of great uncertainty due to the economic situation in the world and in Lithuania. According to him, given such uncertainty, it is necessary to comply with the commitments made, paying special attention to the most vulnerable groups.

“We must not only avoid long-term commitments that are not backed by sustainable finance, but also reduce cost growth. Only then can we reduce debt growth,” said V. Šapoka.

However, MP Ingrida Šimonytė pointed out that although the objective is to reduce expenses, next year the government’s consumption expenses will increase significantly, by 6%.

Sigismund Gedvila / 15 min photo / Gabrielius Landsbergis, Ingrida Šimonytė

V.Šapoka explained that some funds for economic transformation were included in government spending.

“For many ADN stocks, until the final projects are clear, the extent to which they will be a solid investment that would increase gross capital formation is included in other expenses and is therefore attributable to other government expenses but not to This will change drastically when specific projects are known, “the Minister explained.

Meanwhile, the conservative Mykolas Majauskas asked what was going to be done to attract more foreign investment to Lithuania, since this indicator is twice as high in Estonia and three times as high in the EU.

Valdo Kopūstas / 15min photo / Mykolas Majauskas

“The only way to have higher salaries, pensions, not to lend to Lithuania is to earn more money. We have a chronic problem in Lithuania: a low level of investment, ”said M. Majauskas.

V.Šapoka hopes that the funds provided for in the DNA plan will help Lithuania to stretch according to the foreign investment indicator. However, Aušrinė Armonaitė, leader of the Freedom Party, said that in the DNA plan he only sees infrastructure costs and lacks investments in the future, which would give a return to the budget.

The finance minister did not agree with this accusation, arguing that the € 1 invested in the DNA plan would yield a return of € 2, and in some cases up to € 10.

Meanwhile, Simon Gentvil, a member of the Liberal Movement, stressed that while this ruling majority was expected to pay more attention to regions and the environment, next year’s draft budget provides less funding for the environment and shrinks budgets. municipal.

No new taxes are planned

According to Prime Minister Saulius Skvernelis, the state budget for 2021 is sustainable. And Finance Minister V.Šapoka says that no fiscal changes will be made until the economy recovers. Meanwhile, the actual budget deficit will be determined by various circumstances, such as the pandemic situation, geopolitical tensions.

Photo by Luke April / 15 minutes / Vilius Šapoka

The country’s most important document, which will determine how we live next year, does not yet contain the thirteenth pension, which the “peasants” in power have not yet renounced. He claims that the current Seimas will still be able to pass the necessary law, and then the Finance Ministry will have to find funds for it.

The finance minister says that the budget, along with all European funds, is at a similar level to the current situation this year.

Pensions will grow, children’s money

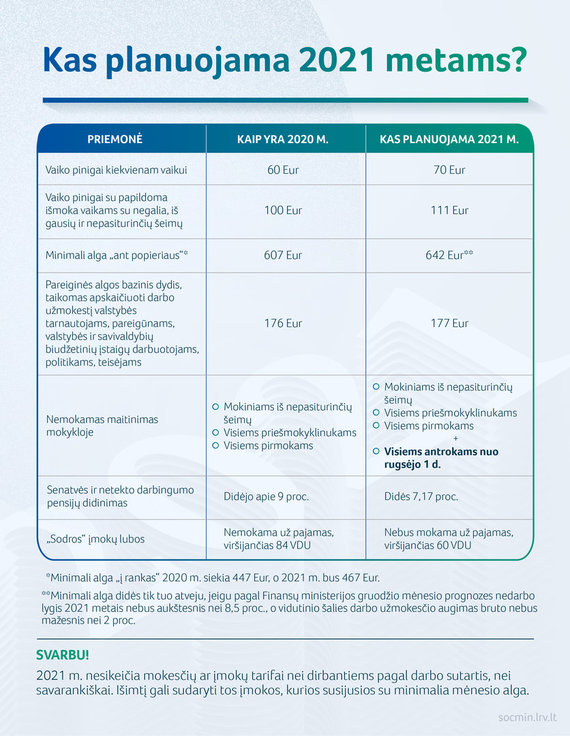

Although no new financial commitments are foreseen in the draft state budget, previous commitments to increase some benefits are maintained: from € 10 to € 70 for child money for all families and up to € 110 for older children and people with disabilities .

Changes for 2021

The monthly minimum wage “on paper” is 35 euros: from 607 euros to 642 euros. Due to indexation, the average old-age pension increases from 377 euros to 404 euros, and the old-age pension with the required time of service, from 399 to 429 euros.

Next year in euros – from 176 to 177 euros – the base salary should increase, which will lead to a slight increase in the salaries of civil servants, civil servants, employees of budgetary institutions, politicians and judges.

Expenditures on the economy and social security are increasing

Budget expenditures for 2021 are primarily for four whales, which are increasing compared to 2020 – social security expenditures are 783 million. 396 million euros for healthcare. 1,060 million euros for the economy. 683 million euros for education. euros. In economics, the focus is on the DNA plan.

Not only expenses but also revenue are expected to increase next year; Although the growth of the economy will also contribute, growth will be determined mainly by funds from the European Union Recovery and Resilience Fund. It is true that it is planned to collect less than all taxes, except the personal income tax, especially VAT.

In the 2021 budget, VAT revenue will represent 22%, personal income tax 19%, social security contributions 27% and EU money 12%.

Sodra’s budget will be positive (estimated surplus of 14 million euros), PSDF’s budget will be balanced.

The state budget for 2021 should already be approved by the Seimas of the new legislature.

[ad_2]