[ad_1]

“The entire retail and retail space sector in Lithuania is experiencing more or less challenges during this period, but for smaller merchants, this time is more difficult than ever. The rapidly changing pandemic situation in the country, constant adaptation to changing security requirements, and limited financial opportunities for small businesses make users of small retail stores extremely vulnerable during this period, says Raimondas Reginis, Ober-Haus Market Research Manager for the Baltic. State.

A survey conducted by Ober-Haus in mid-2020 and 2021 on Vilnius’ main shopping streets (Gedimino Avenue, Pilies Street, Didžioji Street, Vokiečių Street) shows that the situation remains tense. If in mid-2020 the vacancy rate on these streets was 11.0 percent, in mid-2021 it increased slightly and amounted to 11.9 percent.

During the summer of 2020, buyers returning to commercial streets gave optimism to merchants and especially to the largest group of tenants in the capital’s commercial premises: restaurants, cafes, bars and fast food restaurants, which occupy 38 %. of all the commercial premises in these streets of the capital ”, says R. Reginis.

Duomenys “Ober-Haus”

At the end of the first quarantine, people who craved entertainment settled in outdoor areas and improved the performance of these companies. According to data from the Lithuanian Department of Statistics, the turnover of food and beverage service companies in Lithuania in the second half of 2020, compared to the first half of 2020, increased by 27%. However, the general performance of this business sector in the second half of 2020 still remained at 19%. worse compared to the all-time highs of the second half of 2019.

The second wave of the virus substantially again closed the door to this business and, at the end of last year, performance again declined markedly. Food and beverage performance indicators for the first half of 2021 also remained modest at 9%. worse than in the same period last year and even 32 percent. lower than in the first half of 2019.

According to Ober-Haus calculations, in mid-2021 the highest level of vacant premises will be recorded on Pilies str. (18.5%), and the lowest – in Didžioji st. (9.1 percent). Avda Gedimino. The vacancy rate was 11.0% and Vokiečių st. – 10.2 percent.

During the year, the level of vacant premises increased more in Pilies str. (from 11.3% to 18.5%), which includes more than 50 rooms (on the first floor of the building, with at least one window to the street in question and suitable for commercial activities).

“As the number of venues here is not large, a few vacant venues can significantly change the relative vacancy rate. On the other hand, Pilies str. Vilnius street is probably the most visited by foreign tourists, and during the pandemic, the a sharp decrease in its flow significantly reduced the income of the business that works here, ”says R. Reginis.

Meanwhile, Vokiečių st. In mid-2021, there was one less vacancy than a year ago, and according to Ober-Haus, the vacancy rate fell from 12.5 percent. at 10.2 percent However, despite the relatively low level of vacancies, homeowners and renters on this street expect additional challenges.

This year, the renovation of the heating networks began on Vokiečių Street, and the cafes and restaurants had to adapt to the work being done and relocate or abandon the outdoor terraces. After the renovation of the heating networks, the reconstruction of the entire Vokiečių street should start, but the terms of the reconstruction are still unclear.

“Obviously, with this work, the flow of potential customers on this street will be significantly reduced and this will affect the entire business located here, which at the same time still has to deal with the challenges posed by the current pandemic. Therefore, Vokiečių st. Commercial property owners should agree that the number of vacant locations here may increase in the coming years and the stream of rental income may continue to decline, ”believes R. Reginis.

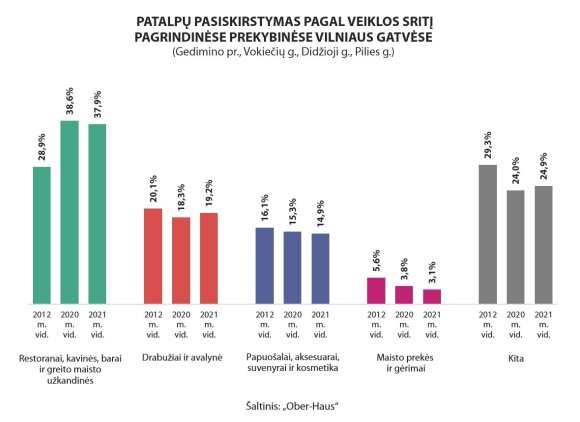

The tenant structure by activity areas on the main streets of the capital has not changed significantly over the years. According to Ober-Haus, by mid-2021, most of the facilities were operated by restaurants, cafes, bars and fast food restaurants, and their share decreased slightly over the year, from 38.6 percent. up to 37.9 percent. The share of tenants who trade clothes and footwear on these streets was 19.2%, jewelry, accessories, souvenirs and cosmetics, 14.9%, the share of food and beverage outlets accounted for 3, 1% and the remaining 24.9%. occupied by beauty salons, offices, pharmacies, banks, bookstores and other points of sale that provide various commercial and other services.

As the pandemic situation in the country is improving or deteriorating, homeowners’ expectations regarding rental prices also remain uncertain. According to R. Reginis, if some landlords tend to offer lower rents to prospective tenants than before, some of them are still waiting to sign long-term leases with pre-pandemic rents.

According to Ober-Haus calculations, in mid-2021, the rental prices of medium-sized business premises (around 100-300 m2) on the main shopping streets of Vilnius (Gedimino ave., Pilies st., Didžioji st., Vokiečių st. .) They amount to 15.0–40 .0 Eur / m2 and on average are 12 percent. lower than at the end of 2019. However, there are cases where landlords sign long-term leases with new tenants for 20-25%. at lower rental prices than they could have rented before the pandemic started.

The general indicators show that there is certainly not much optimism in Vilnius’ shopping streets, but the interest in empty premises has certainly not disappeared.

“Part of the business sees long-term prospects for these streets and the current market situation opens up much broader opportunities for them. If before the pandemic in general it was difficult to find suitable premises even at historically record rental prices, now the options here are wider and the rental prices more attractive. For this reason, the most daring entrepreneurs try not to miss their opportunity and are actively interested in their business development opportunities in prestigious places in the city, ”says R. Reginis.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]